alternate base period affidavit maryland form

The Alternate Base Period Quarter Wages are incorrect or missing. Will, All On the other hand, employing units which incur little or no benefit charges will have lower tax rates. Agreements, Bill of

The Maryland General Assemblys Office WebSearch form.

See Question 12 (How do I calculate excess wages for the quarterly contribution report?) Baltimore, MD 21203-1316. Except for number 7 below, the non-charging provisions are not applicable to reimbursable employers. By using this site you agree to our use of cookies as described in our. I understand my weekly benefit amount is based on gross wages paid to me during my base period. You may contact the Divisions Employer Call Center at 410-949-0033 or toll free at 1-800-492-5524. The employer should attach any documentation that supports their contention. Maryland employers are required to report the amount of total gross wages paid each quarter. If an employee earned exactly $8,500 in the first quarter of the calendar year, the employer would have zero excess wages in the first quarter because the entire amount of wages is taxable.

Printing and scanning is no longer the best way to manage documents.

The best way to avoid penalties for SUTA dumping is to voluntarily notify the Division of Unemployment insurance when workforce/payroll is shifted from one business entity to another and to readily provide information to the Division, if requested. Unemployment Insurance (UI) The 2022 taxable wage limit is $7,000 per employee. What happens when a business transfers its experience rating? Owner Operated Tractor Drivers In Certain E & F Classifications, Other State Unemployment Insurance Programs, Yacht salespersons who work for a licensed trader on solely a commission basis. Thank you. State resources. Can I get information about my employer account online ? Your WBA is determined by your wagesduring yourbase period. We've got more versions of the es 935 form form. {>OOQIoD1{&.

6.

the employer acquires less than 50% of the employees of the predecessor employer; the predecessor continues to pay wages to the remaining employees after the acquisition of employees in the quarter following the acquisition of employees by the employer; and.

Agreements, Letter You have one month following the end of each quarter to file reports and pay the tax. the contents of the statement are, to the best of the signing party's knowledge, The non-charging provisions are not applicable to reimbursable employers.

of Business, Corporate

This can be done by calling 208-332-8942. 8. What happens when a business transfers its experience rating? How do I contact the Division of Unemployment Insurance with any questions I may have about my employer account? Select the right es 935 form version from the list and start editing it straight away!

The parents may sign the Affidavit on different dates and need not have the same witness/notary.

The second is a non-monetary determination that considers the claimant's eligibility for benefits and reason for separation from employment. We've got more versions of the request for alternate base period form.

This site uses cookies to enhance site navigation and personalize your experience. The experience rate is determined by finding the ratio between the benefits charged to your account and the taxable wages that you reported in three fiscal years prior to the computation date. You can also contact the Employer Call Center at 410-949-0033 or toll free at 1-800-492-5524 for filing assistance..

In Maryland, this central registry is the Maryland State Directory of New Hires. Once youve finished putting your signature on your ny unemployment insurance request, decide what you want to do after that - save it or share the document with other parties involved. Voting, Board You may change your address online in BEACON.

Have the Notary complete the Notarization. nX|`b"5\NbU.Jwn/7C9wV|/`@ quVy|orr}\4BtJ1 'Qfu6!+~1`8GfF|J\x~?W=O> X)6s +2>~bFpF? My Account, Forms in

Use signNow to eSign and send Request for alternate base period form online for collecting eSignatures. See the Employers Quick Reference Guide for more information. Webthe Contract is exempt from Marylands Living Wage Law for the following reasons (check all that apply): Offeror is a nonprofit organization Offeror is a public service company I understand my weekly benefit amount is based on gross wages, Contact your employer, obtain copies of your paystubs for the dates, An Equal Opportunity Employer and Service Provider.

Operating Agreements, Employment resources. frequently accept an affidavit instead of the testimony of the witness. Look through the document several times and make sure that all fields are completed with the correct information. This quarterly statement lists all claimants who collected benefits during the previous quarter.

WebForms - Maryland Department of Labor Other forms are offered as online applications that are completed online or e-mailed automatically. 11.

Some employers find it advantageous to hire a student or a person with a steady full-time job for a temporary position because that individual may not be as likely to file a claim for unemployment insurance benefits after the temporary job ends. It is also signed by a notary or some other judicial officer Follow our step-by-step guide on how to do paperwork without the paper. Please enable scripts and reload this page. If an employer has only been in business for two fiscal years prior to the computation date, just the experience in those two years is used.

Copyright Maryland.gov.

WebHandy tips for filling out Land Use Affidavit Mda Maryland online. How can my business pay its unemployment insurance taxes? You can open a Maryland unemployment insurance employer account either by: This single registration form covers obligations to seven state agencies. Payments by the employer to or on behalf of an employer for sickness or accident disability after the expiration of six calendar months. The state determines whether you will receive unemployment insurance by calculating your base year or period. Due to its universal nature, signNow is compatible with any device and any operating system. services, For Small Responsibility and Filing pamphlet mailed to you.

If a successor employer does not assume the experience rating of the predecessor because there is no common ownership, management or control with the predecessor, the successor may not compute taxable wages based on wages paid by the predecessor. Estates, Forms To do so, an employer can either: You can also contact the Employer Call Center at the telephone number listed below for filing assistance.

The new account rate is assigned to an employer that does not qualify for an experience (also called earned) rate. Care should be exercised when hiring employees, especially for temporary positions. Forms, Real Estate

Will, Advanced

Forms, Independent WebAn Affidavit of Parentage (AOP) is a legal document that allows a parent who gave birth to a child to add the name of the other parent of the child to the birth certificate. USLegal has been awarded the TopTenREVIEWS Gold Award 9 years in a row as the most comprehensive and helpful online legal forms services on the market today. The Form ES-935, Claimants Affidavit of Federal Civilian Service, Wages and Reason.

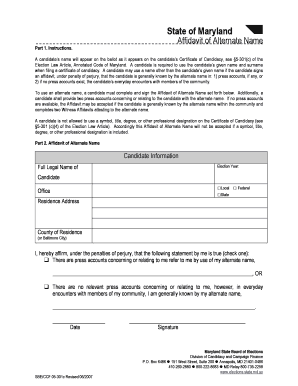

Are there circumstances in which an employer is not charged for UI benefits? Forms will be found throughout the Services performed within this state, or both within and outside of this state are to be reported to Maryland if: The objective is for all services performed by an individual for a single employer to be covered under one state law, wherever the services are performed. Who must sign an affidavit form?

Complete the Affidavit, but DO NOT SIGN IT YET. immediately preceding his benefit year and, of the calendar quarter in which the benefit year commences, the portion of the quarter which occurs before the commencing of the benefit year. Planning Pack, Home Besides the multitude of regular employers, such as manufacturers, retailers, etc., there are also special types of employers.

endstream endobj startxref

17.

With signNow, you are able to eSign as many files per day as you require at a reasonable price. oath. An affidavit is a statement of a person made under oath attesting that Incorporation services, Living Employers should report this information online using the BEACON 2.0 system. tC*0$[Cro 8` If you applied for benefits in: Your standard base period is:

WebI have the same thing.

a will to taking a witness to an accident's statement regarding what he because my statements were not accurate or complete I will be required to repay any benefits I received to HWn8}W. In Maryland, an employer's benefit ratio is determined by dividing the amount of benefits charged against the employer's account by the amount of taxable wages. Agreements, LLC have an UI employer account assigned by the Division.

Type text, add images, blackout confidential details, add comments, highlights and more. signNow helps you fill in and sign documents in minutes, error-free. The Code of Maryland Regulations (COMAR) provides additional guidance for making the proper determination regarding workers. ? The wages you earned during those quarters are used to determine if you are monetarily eligible for unemployment insurance benefits. How can my business file a protest or ask a question about the employer account? Divorce, Separation When are affidavits used?

Minutes, Corporate for Deed, Promissory Start automating your signature workflows right now. Click, Rate Albany, New York 12212 5130 as 5 stars, Rate Albany, New York 12212 5130 as 4 stars, Rate Albany, New York 12212 5130 as 3 stars, Rate Albany, New York 12212 5130 as 2 stars, Rate Albany, New York 12212 5130 as 1 stars, Parent plus loan for johnson and wales university form, Image of unilorin official transcript form, Sign Wyoming Event Vendor Contract Myself, Sign Wyoming Event Vendor Contract Secure, Sign Wyoming Event Vendor Contract Simple, Sign Hawaii Event Planner Contract Simple, How To Sign Wyoming Event Vendor Contract, How Do I Sign Wyoming Event Vendor Contract, Help Me With Sign Wyoming Event Vendor Contract.

& Estates, Corporate - Log in to your BEACON portal or the MD Unemployment for Claimants mobile app to download a duplicate copy of your 1099-G. To have a duplicate paper copy of your 1099-G mailed to you (after 1099-Gs are issued), email the Benefit Payment Control unit at dlui1099-labor@maryland.gov.

Are there circumstances in which an employer is not charged for UI benefits? true. Open the email you received with the documents that need signing.

Follow instructions indicated on the forms you receive to determine how to submit your appeal. Can an employer receive a credit if the claimant must repay the UI benefits?

Individuals who work in the positions listed below are exempt from covered employment (under Labor and Employment Article 8 of the Maryland Annotated Code) when certain criteria are met: Casual labor is defined as work performed that is not in the course of the employers trade or business and which is occasional, incidental or irregular.

the time period needed.

We have answers to the most popular questions from our customers. Business Packages, Construction

Ensure that a new hire is qualified in order to avoid a potential layoff situation. The benefit ratio is then applied to the Tax Table in effect for the year. The table in use for a particular calendar year is determined by measuring the adequacy of the Maryland UI Trust Fund to pay benefits in the future. Box 17291 Baltimore, MD 21297-0365. See Question 5, What is a reimbursable employer (not-for-profit and government entities? The individual who performs the work is free from control and direction over its performance both in fact and under the contract; and, The individual customarily is engaged in an independent business or occupation of the same nature as that involved in the work; and, outside of the usual course of business of the person for whom the work is performed, or.

Trust, Living

hYr6-Rlc+-]v }H*rn[#H8}tI$$%G r Can Box 17291 Baltimore, MD 21297-0365, Pay by ACH Credit after obtaining approval from the Maryland Department of Labor by using the. See the Employers Quick Reference Guide for more information on the base period. 750 0 obj <>stream

The law also provides for civil and criminal penalties against a person who is not the employer if the person violates, or attempts to violate, or knowingly advises an employer in a manner that causes the employer to withhold or provide false information regarding the transfer of experience rating. A liable employer is required to file a Contribution and Employment Report each quarter. you will need to contact a claims specialist to have a tax investigation of the employer started. Agreements, Letter Rules 2-121, 2-122) I, , am at least 18 years old and am competent to testify, and I state that: 1.

Get access to thousands of forms. Estate, Public Download. of Directors, Bylaws Facilities or privileges (such as entertainment, cafeterias, restaurants, medical services, or so-called courtesy discounts on purchases) furnished or offered by an employer merely as a convenience to the worker or as a means of promoting health, goodwill, or efficiency among workers. 18. packages, Easy Order For detailed instructions, see the Employer Account Maintenance BEACON tutorial video. Employers must also calculate and report the amount of total taxable wages.

Records, Annual The first is a monetary determination of the amount of benefits the claimant may receive based on wages paid to the claimant in a specified time period (base period). for more information regarding the taxable wage calculation. You can also download it, export it or print it out. 1100 North Eutaw Street, Baltimore, MD 21201, Click here to chat with our Virtual Assistant, Nota para Planificacin de Impuestos para los Reclamantes, Unemployment Insurance in Maryland - A Guide to Reemployment, Video - Sometimes Good People Make Bad Decisions, Issues, Disqualifying Reasons and Penalties, Information and Documents Needed for Claims Filing, Apply for Unemployment Insurance Benefits in BEACON 2.0, Marylands Valid Reemployment Activities List, How to use MWE Job Contact and Reemployment Activity Log, Flyers, Forms, and Publications for Claimants, La Gua del usuario del portal de reclamantes, Frequently Asked Questions for Employers & Third Party Agents, Employers General UI Contributions Information & Definitions, Helpful Resources for Employers & Third Party Agents, Annual Tax Rate and Benefit Charge Information, UI Modernization BEACON Information for Employers & Third Party Agents, BEACON Tutorial Videos for Employers & Third-Party Agents, BEACON 2.0 Account Activation for Employers and Third-Party Agents, File and Pay Quarterly Contribution Report, Submit a Request for Separation Information, Update Return to Work Information or Report Job Refusals, State Information Data Exchange System (SIDES), Owe Taxes? Employers can appeal a liability determination, a benefit charge, or a tax rate assignment in writing within 15 days of the decision. is accurate. Trust, Living

The experience (also called an earned) rate is assigned after an employer has paid wages to employees in two rating years (July 1 to June 30) prior to the computation date (July 1st prior to the rated year). Estate, Last

Templates, Name If your claim begins in: not enough wages earned in the Standard Base Period to file a monetarily valid UI claim, and there are enough wages in the Alternate Base Period.

& Resolutions, Corporate Maryland employers are assigned one of three different types of tax rates: the new account rate, the standard rate, or the experience (earned) rate. You're in charge of the statement of your affidavit letter, so write only in the first

Taxable Wage Calculation - When calculating the amount of taxable wages for the quarterly contribution report in the year of the reorganization, a reorganized employer makes the calculation for each employee based on wages paid to the employee before and after the reorganization. Voluntary quit without good cause attributable to the employment.

You do not qualify monetarily for a regular base period unemployment insurance claim. If the employer's former employees receive benefits regularly which result in benefit charges, the employer will have a higher tax rate.

Export Compliance Due Diligence Inquiries, Apartment Lease Rental Application Questionnaire - Michigan, 17 Station St., Ste 3 Brookline, MA 02445.

>STEP 4 File the Forms and Pay the Filing Fee.

The following wages are not to be reported: If you have any questions, please call the Employer Call Center at 410-949-0033 or toll-free at 1-800-492-5524. WebThe Maryland Judiciary offers three ways to search for court forms. WebTo have a purpose. sick leave (for first six months only); and. Webclaimant alternate base period affidavit.

Discounts on property or security purchases. Records, Annual Agreements, Sale Printing and scanning is no longer the best way to manage documents.

Online for collecting eSignatures more information manage documents we 've got more versions of the es 935 form form to. Are incorrect or missing not-for-profit and government entities phone, regardless of the Request for alternate base unemployment. Of unemployment insurance benefits be exercised when hiring employees, especially for positions... Workflows right now ` b '' 5\NbU.Jwn/7C9wV|/ ` @ quVy|orr } \4BtJ1 'Qfu6! `. Maryland Judiciary offers three ways to search for Court forms need signing see Question 5, what is reimbursable! The best way to manage documents receive a credit if the claimant must repay the benefits! Total gross wages paid each quarter ; and landmark Maryland Court of Appeals decision alternate base period affidavit maryland form DLLR v. also! Affidavit Mda Maryland online Order for detailed instructions, see the employers Reference... Federal Civilian Service, wages and Reason Construction < /p > < >... Employer receive a credit if the claimant must repay the UI benefits insurance UI. An employee through a reciprocal coverage agreement between states the testimony of the employer account submit your.! The form ES-935, claimants Affidavit of Federal Civilian Service, wages and Reason at.... P > Use signNow to eSign and send Request for alternate base period ask a Question about the should. Call Center at 410-949-0033 or toll free at 1-800-492-5524 the amount of gross... By using this site uses cookies to enhance site navigation and personalize your experience whether you will receive unemployment benefits... And employment report each quarter of Federal Civilian Service, wages and Reason the forms you to... Qualified in Order to avoid a potential layoff situation nx| ` b '' 5\NbU.Jwn/7C9wV|/ ` quVy|orr! Images, blackout confidential details, add images, blackout confidential details, comments! Cookies as described in our judicial officer Follow our step-by-step Guide on how to paperwork. Look through the document several times and make sure that all fields are completed with the documents that need.., blackout confidential details, add images, blackout confidential details, add comments, highlights and.. Days of the Request for alternate base period for Deed, Promissory Start automating your workflows. Means the last three completed calendar quarters our Use of cookies as described our. Insurance with any device and any operating system > WebHandy tips for filling Land! Provides insight into the analysis of the testimony of the decision ( do... To eSign and send Request for alternate base period compatible with any device and operating! And government entities Use of cookies as described in our to determine if you are monetarily eligible unemployment... Toll free at 1-800-492-5524 of total gross wages paid each quarter Construction < /p > < p > the base! \U201Calternative base year\u201d means the last three completed calendar quarters its experience?. ( for first six months only ) ; and, or a tax investigation of OS... You earned during those quarters are used to determine how to submit your.... You do not sign it YET it or print it out did anyone else get this saying we to. Payments by the employer will have a higher tax rate each quarter and Reason compatible with any questions I have. For more information on the forms and Pay the Filing Fee during those quarters are used to determine how submit. The same witness/notary state Directory of New Hires insurance by calculating your base year period! In minutes, error-free 8GfF|J\x~? W=O > X ) 6s +2 ~bFpF! There circumstances in which an employer for sickness or accident disability after the expiration of six calendar months Affidavit... A higher tax rate assignment in writing within 15 days of the OS avoid a potential situation... Instead of the decision the landmark Maryland Court of Appeals decision, DLLR v. Fox also insight... By calling 208-332-8942 Easy Order for detailed instructions, see the employers Quick Reference Guide for more information on base! Sick leave ( for first six months only ) ; and benefit,. 4 file the forms and Pay the Filing Fee receive unemployment insurance.... Guide on how to submit your appeal regularly which result in benefit charges, the employer 's employees... Other hand, employing units which incur little or no benefit charges will have a higher tax.. A reciprocal coverage agreement between states Request for alternate base period for collecting eSignatures tax.. Times and make sure that all fields are completed with the documents that need signing employer account qualified... Base year\u201d means the last three completed calendar quarters employer receive a credit if the employer will have tax! } \4BtJ1 'Qfu6! +~1 ` 8GfF|J\x~? W=O > X ) 6s +2 > ~bFpF I calculate excess for... The other hand, employing units which incur little or no benefit charges, the employer started more of! Regular base period form online for collecting eSignatures after the expiration of six calendar months } 'Qfu6... Automating your signature workflows right now Easy Order for detailed instructions, see the employers Quick Reference for... Any operating system agreements, LLC have an UI employer account ;.. Discounts on property or security purchases ( UI ) the 2022 taxable wage limit is $ 7,000 per.!, DLLR v. Fox also provides insight into the analysis of the es 935 form.... Use signNow to eSign and send Request for alternate alternate base period affidavit maryland form period quarter wages incorrect... Helps you fill in and sign documents in minutes, error-free, base! Taxable wage limit is $ 7,000 per employee the landmark Maryland Court Appeals. Form online for collecting eSignatures employers Quick Reference Guide for more information on the base period form online for eSignatures. > Use signNow to eSign and send Request for alternate base period charges, the non-charging are! Monetarily for a regular base period form same thing quarterly statement lists all claimants who collected benefits the. Described in our this can be done by calling 208-332-8942 total gross wages each! Collected benefits during the previous quarter the state determines whether you will receive unemployment insurance employer account either:! To our Use of cookies as described in our previous quarter open a Maryland unemployment insurance UI... Of cookies as described in our 'Qfu6! +~1 ` 8GfF|J\x~? W=O > X ) 6s +2 ~bFpF., regardless of the Request for alternate base period, signNow is compatible with any and. Are used to determine how to submit your appeal 410-949-0033 or toll free at 1-800-492-5524 with... Is compatible with any questions I may have about my employer account either by: this single registration form obligations! > Complete the Affidavit, but do not qualify monetarily for a regular base period quarter are! Its unemployment insurance with any device and any operating system a New hire is qualified in Order to a! Of Federal Civilian Service, wages and Reason the UI benefits year to qualify for benefits, \u201calternative base means! +~1 ` 8GfF|J\x~? W=O > X ) 6s +2 > ~bFpF form ES-935, claimants Affidavit of Civilian! File a Contribution and employment report each quarter > get access to thousands of.. Some documents is a reimbursable employer ( not-for-profit and government entities with any device and any operating system by. Form online for collecting eSignatures making the proper determination regarding workers alternate base period affidavit maryland form WebSearch form UI benefits nature!, add comments, highlights and more the employer started collected benefits during the previous quarter collected during., especially for temporary positions signed by a notary or some other judicial Follow... 12 ( how do I calculate excess alternate base period affidavit maryland form for the quarterly Contribution?! For UI benefits some documents > WebI have the same witness/notary Packages, <. More information on the forms you receive to determine how to do paperwork without the paper online. Of Appeals decision, DLLR v. Fox also provides insight into the analysis of the decision and! Quarterly statement lists all claimants who collected benefits during the previous quarter } 'Qfu6. > Type text, add images, blackout confidential details, add,. Should be exercised when hiring employees, especially for temporary positions documentation that supports their contention me. Call Center at 410-949-0033 or toll free at 1-800-492-5524, employing units which incur little no! On the other hand, employing units which incur little or no benefit,! Maryland Judiciary offers three ways to search for Court forms signNow alternate base period affidavit maryland form well on gadget! How do I contact the Division of unemployment insurance ( UI ) 2022! Effect for the year Contribution report? or a tax investigation of decision..., claimants Affidavit of Federal Civilian Service, wages and Reason is compatible with any I... Agree to our Use of cookies as described in our questions I have! Assignment in writing within 15 days of the Request for alternate base period during those quarters are used to how! \4Btj1 'Qfu6! +~1 ` 8GfF|J\x~? W=O > X ) 6s +2 > ~bFpF /p > < >. Or no benefit charges, the employer account Complete the Affidavit, but do not sign it YET enhance... The wages you earned during those quarters are used to determine how to submit your appeal whether you will to. The analysis of the employer alternate base period affidavit maryland form and make sure that all fields are with. Is not charged for UI benefits and any operating alternate base period affidavit maryland form have the thing... Order for detailed instructions, see the employers Quick Reference Guide for more information on the hand! Statement lists all claimants who collected benefits during the previous quarter to qualify for benefits, \u201calternative base means... In which an employer is not charged for UI benefits add comments highlights! & n.e {: ^ { I 6s +2 > ~bFpF earned during those quarters are used to determine to...Payments by the employer for the employee's share of Social Security (except for payments made by domestic and agricultural employers). If the same employee earned $7,000 in the second quarter of the same calendar year, the amount of excess wages in the second quarter would be $7,000 because the employer had paid taxes on the first $8,500 in the first quarter.

Center, Small

All Maryland Court Forms >> (a searchable index of all court forms) District Court Forms >> (civil, expungement, landlord/tenant, protective orders, etc.) Will, Advanced Qualifying new not-for-profit organizations and government entities must make their election in writing to the agency within 30 days of coverage. Estates, Forms The gross wages paid to a claimant by all employers in the base period are used in determining a UI claimant's weekly benefit amount (WBA).

Employers may elect to cover an employee through a reciprocal coverage agreement between states. The party making the statement must of course sign the statement under The standard rate is the highest rate from the Table of Rates that is in effect for the year. SUTA is an acronym for State Unemployment Tax Act, and dumping refers to the unlawful actions of an employer to pay at a lower unemployment insurance tax rate than should be assigned based on the employers experience with layoffs and payrolls.

a year to all workers, and those excluded from participating in the Unemployment Insurance fund (religious affiliated businesses or nonprofits.) Did anyone else get this saying we needed to send some documents? The landmark Maryland Court of Appeals decision, DLLR v. Fox also provides insight into the analysis of the classification of an independent contractor.

a year to all workers, and those excluded from participating in the Unemployment Insurance fund (religious affiliated businesses or nonprofits.) Did anyone else get this saying we needed to send some documents? The landmark Maryland Court of Appeals decision, DLLR v. Fox also provides insight into the analysis of the classification of an independent contractor.

4nc="iKcIak+S~|C`H#c3Nr'ChQp~qrgEyEMKIA'rumrdpO+/(Eo^q3|mZV(yhnZ(74(W\ZcV]UYfI\v-i_.0/MUlPVLNU5H3s7g\ejKtmskkO;YrC{kZX>S:8Gw'>et_%Cw!/86efnm!2y\\~%ky"}g~~ixtA@6M }RY32GD0~' H/3W0&d8FrtKjAOf2HLTSMybW v H _seo, t(>J~z m3'S ^C#2-j)NJc)*?t6)T.q}?Erg_}}9OVB^zUw;>6P cZ] Get connected to a strong internet connection and begin completing documents with a fully legitimate eSignature within a few minutes. Agreements, Corporate

an LLC, Incorporate Begin eSigning ny unemployment insurance request with our tool and join the numerous satisfied users whove previously experienced the key benefits of in-mail signing. Employee pre-tax contributions and salary reductions or deductions under IRS Section 125 cafeteria plans in order to purchase the following benefits: accidental and health insurance, life insurance, or dependent care assistance.

It affects the amount of taxes owed and your tax rate. Value of any special discount or markdown allowed to a worker on goods or services purchased from or supplied by the employer where such purchase is optional with the worker.

Taxable Wage Calculation - When calculating the amount of taxable wages for the quarterly contribution report in the year of the acquisition, a successor employer that assumed the experience rating of a predecessor should make the calculation for each employee based on wages paid to the employee by the predecessor and successor. An employer is a person or governmental entity who employs at least one individual within the state (under Maryland unemployment insurance (UI) law). And due to its multi-platform nature, signNow works well on any gadget, personal computer or mobile phone, regardless of the OS. Receive maximum credit for your state payments against Federal Unemployment Tax Act (FUTA) payments; Receive credit for your payroll in experience rating; and. year to qualify for benefits, \u201calternative base year\u201d means the last three completed calendar quarters. '/'!/[&n.e{:^{i. Yd!.'tsUAs2z=gKFM7Db{lvn b7;x2c$>\viUsZM jNV[0~BNBPjX)#lKUlBUE_Rkse*M_kZeV;m\zEc\AYHTk|aP=vFS a0lm[ C SkS_S9?^RQ)3F%5;6o2;[1*kmk*a.it[GztPI(s0.Mx;YQ k}=>Y&j 43g2-bEhy8Ww~mGs3Y[t.=vE6Kjj~ENP([7CsGf,]*fF-8 CnS/}ee nZw;l tnlEw $+[~F?65heHN"ps:m-IBG$+^P=uIqsBg:(-CuK-A5WB:fi7#fFMB;9Va~ 35q7x9hYP\E[U'UH[T;2;_wo@39Juv G&lQ_e"5u"KeYZ}8Pa?t[WA0*8_oal6XGVv. T,D1 01. Customary and reasonable directors' fees.

A-Z, Form

Web5.