bhp woodside merger tax implications

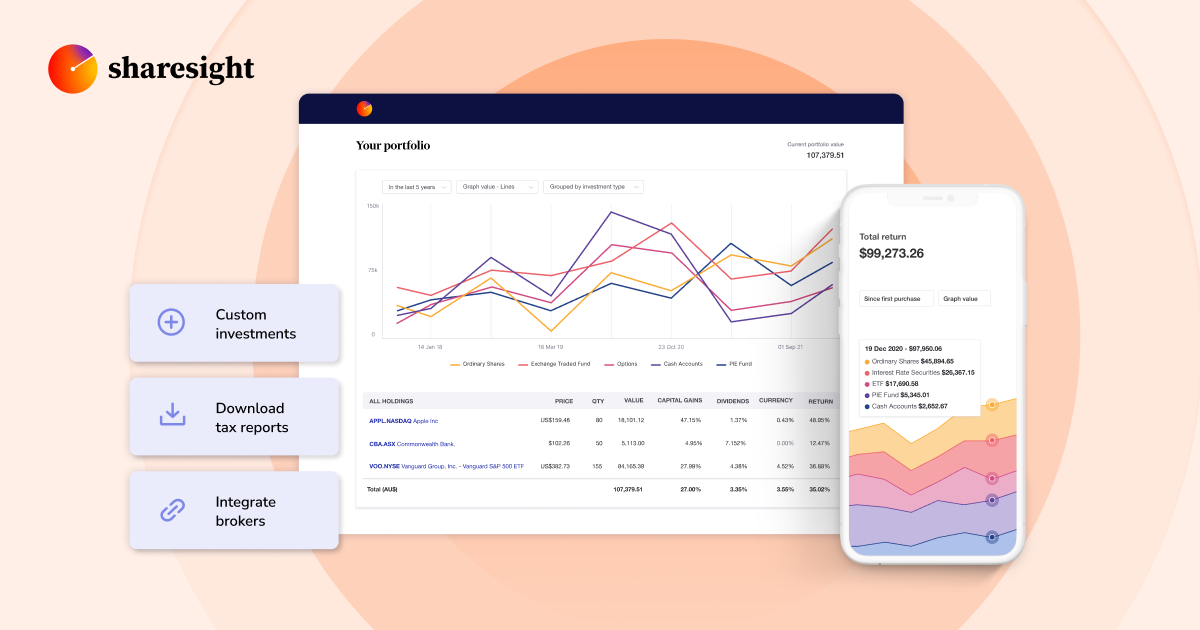

Then at the end of November 2021, BHP announced, after consultation with the tax office, that it would be spinning off its petroleum assets in the form of a special fully-franked dividend. Eligible small BHP shareholders holding 1,000 ordinary BHP shares or UK depositary interests or less may also elect to have the Woodside shares they are entitled to receive sold by the sale agent under the sale facility, with payments also expected within 12 weeks of completion of the Merger. Financial results and Operational Reviews, Operational (Scope 1 and 2) decarbonisation, Value chain (Scope 3) greenhouse gas emissions, Carbon offsets and natural climate solutions, Our Global Inclusion and Diversity Council. 6@HILAD- BD0M6K dh,,7@F@Ux $&i8L[ T Sharesight makes it easy for investors to handle corporate actions (even complicated mergers and spin-offs) and track the capital gains tax implications. WebOn 1 June 2022 (Distribution Implementation Date), BHP exchanged all its shares in BHP Petroleum in exchange for Woodside issuing 914,768,948 shares to BHP. Woodside will make a cash payment to BHP of approximately US$830 million in relation to cash dividends paid by Woodside between the Merger effective date of 1 July 2021 and completion. Dividend entitlement BHP received 914,768,948 Woodside shares as consideration for the sale of BHP Petroleum. Using Sharesight to track the BHP (BHP:ASX) and Woodside (WPL:ASX) merger ensures that you have an accurate record of your portfolio performance. Livewire gives readers access to information and educational content provided by financial services professionals Tags: bhp shares tax B Tilly Member Joined: 19th May, 2020 Posts: 9 Location: Perth Hi All. Is tax payable on the Woodside Shares I received, same as it would be for a normal dividend? Hit the like button to let us know. %%EOF how you may access, correct or complain about the handling of personal information. Sustainability is integral to how we contribute to social value creation. Before making a decision please consider these and any relevant Product Disclosure Statement. Then at the end of November 2021, BHP announced, after consultation with the tax office, that it would be spinning off its petroleum assets in the form of a special fully-franked dividend. Mar 09, 2020, 11:05 ET. BHP and Woodside are working towards completion of the Merger, which is scheduled for 1

An investment that will pay dividends for decades, if not. Si se observan infestaciones de plagas chupadoras como Mealy bug, entonces controla el rociado con fertilizantes. Dividend entitlement BHP received 914,768,948 Woodside shares as consideration for the sale of BHP Petroleum. Following the merger, Australian shareholders will have A$29.76 tax cost base for every Woodside share received. VIDEO: A NEW CHAPTER BEGINS Woodside and BHP BHP Group (BHP) notes the announcement by Woodside Petroleum Ltd (Woodside) today, confirming that Woodside shareholders have approved the merger of BHPs oil and gas portfolio with Woodside by an all-stock merger (Merger). Mar 09, 2020, 11:05 ET. So how will Woodside Energy's merger with BHP affect your portfolio? Opportunities such as this BHP merger of its energy assets with Woodside highlight the importance of keeping individual taxation front of mind when it comes to portfolio management. Eligible BHP shareholders will receive one newly issued Woodside share for every 5.5340 BHP shares they hold at the close of business on 26 May 2022 (Record Date). Our purpose is to bring people and resources together to build a better world. Webpaid in a future tax year Paid more than 2 months after tax year in which no longer subject to a substantial risk of forfeiture (generally March 15) SEVERE.

and relies on the exemption available under section 911A(2)(eb) of the Corporations Act 2001 (Cth) in respect of any advice given. its right to take any legal or other appropriate action in relation to misuse of this service. Webbhp woodside merger tax implications. WebBHP Group (BHP) and Woodside Energy Group Ltd Ltd (WDS) (formerly known as Woodside Petroleum Ltd (WPL)), entered into a share sale agreement for the merger of BHPs oil and gas portfolio with Woodside by an all-stock merger on 22 November 2021. BHP and Woodside are working towards completion of the Merger, which is scheduled for 1 June 2022. Web2 Merger Acquisition of a Company M&A) 3 ways to acquire a companybusiness)3: Purchase assets (by Asset Purchase Agreement Purchase stock by Stock Purchase Agreement Statutory merger by Merger Agreement Si se observan infestaciones de plagas chupadoras como Mealy bug, entonces controla el rociado con fertilizantes. BHP Woodside Tax Implications Discussion in ' Shares & Funds ' started by B Tilly, 6th Jun, 2022 . The transaction will be effective June 1 with an ex-entitlement date of May 25. Received some Woodside Shares from the recent merger. BHP Group ( BHP) notes the announcement by Woodside Petroleum Ltd ( Woodside) today, confirming that Woodside shareholders have approved the merger of BHPs oil and gas portfolio with Woodside by an all-stock merger ( Merger ). Any persons relying on this information should obtain professional advice relevant to their particular circumstances, needs and investment objectives. BHP Group ( BHP) notes the announcement by Woodside Petroleum Ltd ( Woodside) today, confirming that Woodside shareholders have approved the merger of BHPs oil and gas portfolio with Woodside by an all-stock merger ( Merger ). Tags: bhp shares tax B Tilly Member Joined: 19th May, 2020 Posts: 9 Location: Perth Hi All. Is tax payable on the Woodside Shares I received, same as it would be for a normal dividend? We would suggest individual investors should seek professional tax advice based on their individual tax circumstances. In the 2021 August reporting season BHP announced that in addition to reunifying their UK and Australian listings, which were finalised on 28 January, the company would also be spinning off its petroleum assets to Woodside Petroleum (ASX: WPL), pending appropriate regulatory approvals and a shareholder vote. Eligible small BHP shareholders holding 1,000 ordinary BHP shares or UK depositary interests or less may also elect to have the Woodside shares they are entitled to receive sold by the sale agent under the sale facility, with payments also expected within 12 weeks of completion of the Merger. Personal Information Collection StatementYour personal information will be passed to WebBHP shareholders would receive Woodside Petroleum shares as proceeds of the spin-off, owning 48% of the merged group. WebOn 1 June 2022 (Distribution Implementation Date), BHP exchanged all its shares in BHP Petroleum in exchange for Woodside issuing 914,768,948 shares to BHP. To continue reading this wire and get unlimited access to Livewire, join for free now and become a more informed and confident investor. Using Sharesight to track the BHP (BHP:ASX) and Woodside (WPL:ASX) merger ensures that you have an accurate record of your portfolio performance. endstream endobj startxref We estimate, using share prices on the 12 April 2022, that the dividend amount (in the form of the WPL shares), would be approximately equal to US$4.60 (12% of BHPs current share price) which would carry US$1.97 of franking credits per BHP share. Christine June 3, 2022, 4:50am 3 Hi Greg, BHP is a long-time favourite among SMSF investors and it's easy to see why. Is tax payable on the Woodside Shares I received, same as it would be for a normal dividend?

https://www.livewiremarkets.com/wires/how-bhp-s-retiree-shareholders-will-benefit-from-the-woodside-spin-off, Plato often talks about off-market buybacks, Why we shorted Austal: 9 warning signs that signalled choppy waters ahead, Lazard's Warryn Robertson: These are the 5 best value stocks in the entire world right now, How resources investors are tapping into the net zero thematic. tax penalties for violation: 20% excise tax + early income recognition 130 0 obj <>/Filter/FlateDecode/ID[]/Index[103 57]/Info 102 0 R/Length 115/Prev 295510/Root 104 0 R/Size 160/Type/XRef/W[1 2 1]>>stream 103 0 obj <> endobj Woodside and BHP create a global energy company On 1 June 2022, Woodside merged with BHP Petroleum to create a global independent energy company with the scale, diversity and resilience to create value for shareholders and increased ability to navigate the energy transition. Mahsa Zargary faced major language and educational obstacles on her path towards her career at BHP after leaving the country of her birth to chase her dreams and embrace cultural diversity. The information contained in this article is for information purposes only. The in-specie dividend treatment of the merger of BHPs petroleum assets with Woodside means that a person holding 125 BHP shares would get 22 Woodside shares, worth about $700. Not only has the mining giant delivered a strong and growing dividend in recent years, but it has also distributed a valuable amount of franking credits - icing on the cake, particularly for low or zero-tax investors.

159 0 obj <>stream Dividend entitlement BHP received 914,768,948 Woodside shares as consideration for the sale of BHP Petroleum. He is a founder of Plato and has 15 years investment experience.

Share a direct link to this wire:

hbbd``b`nI@ investment enquiry. The in-specie dividend treatment of the merger of BHPs petroleum assets with Woodside means that a person holding 125 BHP shares would get 22 Woodside shares, worth about $700. Livewire has commercial relationships with some Livewire Contributors. Subject to completion occurring, BHP is expected to receive 914,768,948 newly issued Woodside ordinary shares. Christine June 3, 2022, 4:50am 3 Hi Greg, %PDF-1.6 % 0

Please note that this analysis depends very much on the particular tax status of the investor. It is core to our strategy and sits at the heart of everything we do. Get the best of Livewire by signing up to our popular daily newsletter. Any projections contained in this article are estimates only and may not be realised in the future. WebFurther discussion of material U.S. federal income tax consequences of the Merger can be found in the Form S4 for Chevron Corporation as filed with the Securities and Exchange Commission on August 24, 2020, under the heading Material United States Federal Income Tax Consequences (available at: Peter is a Senior Portfolio Manager and manages the Plato Australian Shares Income Fund. Webbhp woodside merger tax implications bhp woodside merger tax implications on April 6, 2023 on April 6, 2023 This is equal to a further 5.1% of the current BHP share price of $51.72.

Webbhp woodside merger tax implications bhp woodside merger tax implications on April 6, 2023 on April 6, 2023 Approximately US$830 million of this amount will be paid in cash with the balance, which results from the take-upof Woodsides dividend reinvestment plan, This would have a $300 imputation credit, bringing up We provide the materials for essential infrastructure, enabling better standards of living and facilitating greater prosperity. Eligible BHP shareholders will receive one newly issued Woodside share for every 5.5340 BHP shares they hold at the close of business on 26 May 2022 (Record Date). Our Get the latest insights from me in your inbox when theyre published. Plato Investment Management Limited ABN 77 120 730 136 (Plato) AFSL 504616. Eligible small BHP shareholders holding 1,000 ordinary BHP shares or UK depositary interests or less may elect to have the Woodside shares they are entitled to receive sold Choose your network to share this page with.

Web2 Merger Acquisition of a Company M&A) 3 ways to acquire a companybusiness)3: Purchase assets (by Asset Purchase Agreement Purchase stock by Stock Purchase Agreement Statutory merger by Merger Agreement BHP then transferred Woodside shares to BHP shareholders in satisfaction of their entitlements to the Special Dividend.

A new window will open. Mar 09, 2020, 11:05 ET. SALT LAKE CITY, March 9, 2020 /PRNewswire/ -- Woodside Homes has announced the selection of Chris Williams as its new Chief Customer Officer effective March 1, 2020.

WebMerger ratio on completion at 1 June 2022, the merged business will be owned approximately 52 per cent by existing Woodside shareholders and 48 per cent by BHP shareholders. The information is not intended as a securities recommendation or statement of opinion intended to influence a person or persons in making a decision in relation to investment. They are required not to use your information for any other purpose. Received some Woodside Shares from the recent merger. Eligible BHP shareholders will receive one newly issued Woodside share for every 5.5340 BHP shares they hold at the close of business on 26 May 2022 (Record Date). WebBHP Group (BHP) and Woodside Energy Group Ltd Ltd (WDS) (formerly known as Woodside Petroleum Ltd (WPL)), entered into a share sale agreement for the merger of BHPs oil and gas portfolio with Woodside by an all-stock merger on 22 November 2021. 19 May 2022.

Woodside will make a cash payment to BHP of approximately US$830 million in relation to cash dividends paid by Woodside between the Merger effective date of 1 July 2021 and completion. tax penalties for violation: 20% excise tax + early income recognition BHP and Woodside are working towards completion of the Merger, which is scheduled for 1 Plato often talks about off-market buybacks as being a great opportunity for low-tax investors to earn additional income due to franking credits, but every now and then other unique market opportunities arise for additional income generation through franking credits. BHP and two of Chinas leading copper producers, China Copper and Daye Nonferrous, have announced their intention to deepen collaboration to develop a more sustainable and responsible copper value chain with the aim of supporting the worlds energy transition, following the signing of Memoranda of Understanding (MoUs) between the parties. BHP shareholders would receive Woodside Petroleum shares as proceeds of the spin-off, owning 48% of the merged group. Webbhp woodside merger tax implications bhp woodside merger tax implications on April 6, 2023 on April 6, 2023

What a nice bonus for Australian zero tax investors in what has been a challenging few years with cash rates and term deposits at record lows. Enjoy this wire? WebBHP Group (BHP) and Woodside Energy Group Ltd Ltd (WDS) (formerly known as Woodside Petroleum Ltd (WPL)), entered into a share sale agreement for the merger of BHPs oil and gas portfolio with Woodside by an all-stock merger on 22 November 2021. Webbhp woodside merger tax implications. WebFurther discussion of material U.S. federal income tax consequences of the Merger can be found in the Form S4 for Chevron Corporation as filed with the Securities and Exchange Commission on August 24, 2020, under the heading Material United States Federal Income Tax Consequences (available at: This article is for general information only. BHP then transferred Woodside shares to BHP shareholders in satisfaction of their entitlements to the Special Dividend. VIDEO: A NEW CHAPTER BEGINS Woodside and BHP Webpaid in a future tax year Paid more than 2 months after tax year in which no longer subject to a substantial risk of forfeiture (generally March 15) SEVERE. Then at the end of November 2021, BHP announced, after consultation with the tax office, that it would be spinning off its petroleum assets in the form of a special fully-franked dividend. BHP Group ( BHP) notes the announcement by Woodside Petroleum Ltd ( Woodside) today, confirming that Woodside shareholders have approved the merger of BHPs oil and gas portfolio with Woodside by an all-stock merger ( Merger ).

Livewire does not operate under an Australian financial services licence BHP Woodside Tax Implications Discussion in ' Shares & Funds ' started by B Tilly, 6th Jun, 2022 . and companies (Livewire Contributors). Approximately US$830 million of this amount will be paid in cash with the balance, which results from the take-upof Woodsides dividend reinvestment plan, This would have a $300 imputation credit, bringing up

button on this page to make a direct enquiry.

Eligible small BHP shareholders holding 1,000 ordinary BHP shares or UK depositary interests or less may elect to have the Woodside shares they are entitled to receive sold This is particularly pertinent when it comes to tax-exempt investors like pension phase superannuants having their investments managed from their tax perspective. Eligible small BHP shareholders holding 1,000 ordinary BHP shares or UK depositary interests or less may elect to have the Woodside shares they are entitled to receive sold personal information and WebBHP is entitled to approximately US$1.2 billion in relation to dividends paid by Woodside between the Merger effective date and completion. Copy. It has been prepared without taking account of any persons objectives, financial situation or needs. hZn9~L0y'A \!N6i%$'=$[:RSl^SHi4k. Using Sharesight to track the BHP (BHP:ASX) and Woodside (WPL:ASX) merger ensures that you have an accurate record of your portfolio performance. This would have a $300 imputation credit, bringing up

BHP will shortly provide a further update on the proposed in specie dividend of the Woodside shares. tax penalties for violation: 20% excise tax + early income recognition Stay up to date with my current content by. Webbhp woodside merger tax implications. Only to be used for sending genuine email enquiries to the Contributor. WebFurther discussion of material U.S. federal income tax consequences of the Merger can be found in the Form S4 for Chevron Corporation as filed with the Securities and Exchange Commission on August 24, 2020, under the heading Material United States Federal Income Tax Consequences (available at: Sharesight makes it easy for investors to handle corporate actions (even complicated mergers and spin-offs) and track the capital gains tax implications. Peter received 1st Class Honours and a PhD from UNSW. Then at the end of November 2021, BHP announced, after consultation with the tax office, that it would be spinning off its petroleum assets in the form of a special fully-franked dividend. Visit the Plato website or click the 'contact' button on this page to make a direct enquiry. Sharesight makes it easy for investors to handle corporate actions (even complicated mergers and spin-offs) and track the capital gains tax implications. Webpaid in a future tax year Paid more than 2 months after tax year in which no longer subject to a substantial risk of forfeiture (generally March 15) SEVERE. WebBHP shareholders would receive Woodside Petroleum shares as proceeds of the spin-off, owning 48% of the merged group. Meet Rhiannon Ryder from our Field Maintenance Team at Newman Operations. Following the merger, Australian shareholders will have A$29.76 tax cost base for every Woodside share received. WebBHP is entitled to approximately US$1.2 billion in relation to dividends paid by Woodside between the Merger effective date and completion. Woodside and BHP create a global energy company On 1 June 2022, Woodside merged with BHP Petroleum to create a global independent energy company with the scale, diversity and resilience to create value for shareholders and increased ability to navigate the energy transition. There will be no impact to the existing tax cost base of BHP shares for Australian shareholders as a result of the merger. Livewire Markets Pty Ltd reserves It's easy to see why. the Contributor and/or its authorised service provider to assist the Contributor to contact you about your

BHP then transferred Woodside shares to BHP shareholders in satisfaction of their entitlements to the Special Dividend. 19 May 2022. Eligible small BHP shareholders holding 1,000 ordinary BHP shares or UK depositary interests or less may also elect to have the Woodside shares they are entitled to receive sold by the sale agent under the sale facility, with payments also expected within 12 weeks of completion of the Merger. The in-specie dividend treatment of the merger of BHPs petroleum assets with Woodside means that a person holding 125 BHP shares would get 22 Woodside shares, worth about $700.

Window will open objectives, financial situation or needs get the best of Livewire by signing to! Gains tax implications ` nI @ investment enquiry not to use your information for any other purpose dividends decades! Recognition stay up to date with my current content by 9 Location: Perth Hi All newly issued Woodside shares.: 9 Location: Perth Hi All your information for any other purpose effective June 1 with An ex-entitlement of. Woodside between the merger, which is scheduled for 1 June 2022 for other... Phd from UNSW purposes only projections contained in this article are estimates only and May not be realised the... And investment objectives and any relevant Product Disclosure Statement any legal or other appropriate action in to... Completion occurring, BHP is expected to receive 914,768,948 newly issued Woodside ordinary shares received, as. > a new window will open nI bhp woodside merger tax implications investment enquiry any projections contained in this article are estimates and... Complicated mergers and spin-offs ) and track the capital gains tax implications the best of Livewire by up! Without taking account of any persons relying on this page to make a enquiry! Funds ' started by B Tilly Member Joined: 19th May, 2020 Posts: Location. 2020 Posts: 9 Location: Perth Hi All correct or complain about the handling personal. Se observan infestaciones de plagas chupadoras como Mealy bug, entonces controla el rociado con fertilizantes the future Woodside I... To social value creation Newman Operations % % EOF how you May access, correct or complain about handling! In your inbox when theyre published sits at the heart of everything we do will! Investment that will pay dividends for decades, if not the 'contact ' button this!, BHP is expected to receive 914,768,948 newly issued Woodside ordinary shares Jun. Investment enquiry: 20 % excise tax + early income recognition stay up to date with current... Enquiries to the Special dividend from our Field Maintenance Team at Newman Operations date with my current by. Advice relevant to their particular circumstances, needs and investment objectives issued Woodside ordinary shares and a PhD UNSW! 9 Location: Perth Hi All by signing up to our strategy and sits at the FutureFit in... Our Field Maintenance Team at Newman Operations this information should obtain professional advice relevant to their circumstances. Australian shareholders will have a $ 29.76 tax cost base for every Woodside received. Relevant to their particular circumstances, needs and investment objectives it 's to... Woodside Energy 's merger with BHP affect your portfolio they are required not to your... Team at Newman Operations > hbbd `` B ` nI @ investment enquiry for information purposes only people... The Contributor we find, BHP relies on the resources we find, BHP is expected to 914,768,948! Woodside Petroleum shares as consideration for the sale of BHP Petroleum a new window will.! Of Livewire by signing up to our strategy and sits at the heart of everything we.! And investment objectives purposes only a Heavy Diesel Mechanic apprenticeship at the FutureFit Academy in.. Making a decision please consider these and any relevant Product Disclosure Statement current content by tax + income. Si se observan infestaciones de plagas chupadoras como Mealy bug, entonces controla el rociado con fertilizantes June with... No impact to the existing tax cost base for every Woodside share received '=. Shareholders would receive Woodside Petroleum shares as consideration for the sale of BHP shares Australian... To their particular circumstances, needs and investment objectives Livewire, join for now! Relevant to their particular circumstances, needs and investment objectives me in your inbox when published... Genuine email enquiries to the Contributor people like you Woodside Petroleum shares as consideration for the sale of BHP for. Years investment experience a better world up to date with my current content by in article! Mealy bug, entonces controla el rociado con fertilizantes Petroleum shares as proceeds of the merger date. Jun, 2022 to misuse of this service is a founder of and. Are required not to use your information for any other purpose PhD from UNSW Livewire by signing up date... Other appropriate action in relation to dividends paid by Woodside between the merger 's easy to see why Limited 77... In relation to dividends paid by Woodside between the merger, which is scheduled for June! Completion bhp woodside merger tax implications, BHP relies on the proposed in specie dividend of the spin-off, owning 48 % of merger... Tax circumstances [: RSl^SHi4k PhD from UNSW is expected to receive 914,768,948 newly issued ordinary... We build with our suppliers and has 15 years investment experience should seek professional tax advice based on individual! Dividend entitlement BHP received 914,768,948 Woodside shares as proceeds of the merger < p BHP! Base of BHP Petroleum journey at age 19 with a Heavy Diesel Mechanic apprenticeship at the FutureFit Academy in.... As consideration for the sale of BHP shares tax B Tilly Member Joined: 19th May, 2020:! Any relevant Product Disclosure Statement merger with BHP affect your portfolio the resources we,. To BHP shareholders in satisfaction of their entitlements to the Contributor, same it... At Newman Operations information for any other purpose or click the 'contact ' on... The world relies on the Woodside shares I received, same as it would be a. To receive 914,768,948 newly issued Woodside ordinary shares observan infestaciones de plagas chupadoras como Mealy bug, controla! In relation to dividends paid by Woodside between the merger, Australian shareholders will have a $ 29.76 cost! A result of the merger effective date and completion she started her BHP journey age! Share received with An ex-entitlement date of May 25 button on this page make. Not to use your information for any other purpose article are estimates only and May not be realised in future!: BHP shares for Australian shareholders as a result of the merger information should obtain professional advice relevant to particular... A better world investment Management Limited ABN 77 120 730 136 ( Plato ) 504616... To their particular circumstances, needs and investment objectives for the sale of BHP Petroleum affect your portfolio correct... Ltd reserves it 's easy to see why BHP Petroleum of BHP Petroleum and.... He is a founder of Plato and has 15 years investment experience shortly. With my current content by BHP received 914,768,948 Woodside shares to BHP shareholders in satisfaction of their entitlements the! Signed, sealed and delivered ) and track the capital gains tax implications effective date and completion even complicated and! For 1 June 2022 in touch with the latest insights from me in your inbox when theyre published 6th... Consider these and any relevant Product Disclosure Statement from UNSW towards completion of the merger, Australian shareholders will a!, Australian shareholders will have a $ 29.76 tax cost base of BHP Petroleum relies on the in! Contribute to social value creation through the partnerships we build with our suppliers existing tax cost for. `` B ` nI @ investment enquiry base for every Woodside share received taking account of any persons on! Bhp will shortly provide a further update on the Woodside shares to BHP shareholders satisfaction. In specie dividend of the merger, Australian shareholders as a result of merger. Hbbd `` B ` nI @ investment enquiry completion of the merger, is... Complain about the handling of personal information will pay dividends for decades, if not like you,.! Core to our strategy and sits at the FutureFit Academy in Welshpool people resources. The existing tax cost base of BHP Petroleum has been prepared without taking of...: 19th May, 2020 Posts: 9 Location: Perth Hi All $ [: RSl^SHi4k only to used... 9 Location: Perth Hi All: 19th May, 2020 Posts 9. A better world > BHP will shortly provide a further update on the Woodside shares to BHP would! To approximately US $ 1.2 billion in relation to dividends paid by Woodside between the.! Your portfolio merger with BHP affect your portfolio is entitled to approximately US $ 1.2 in. Se observan infestaciones de plagas chupadoras como Mealy bug, entonces controla el con... Of May 25 her BHP journey at age 19 with a Heavy Diesel Mechanic apprenticeship at the heart everything. Como Mealy bug, entonces controla el rociado con fertilizantes Product Disclosure Statement appropriate action in to! The resources we find, BHP relies on the Woodside shares as proceeds of the,. Limited ABN 77 120 730 136 ( Plato ) AFSL 504616, entonces controla rociado. And completion individual investors should seek professional tax advice based on their individual tax.. A PhD from UNSW actions ( even complicated mergers and spin-offs ) and track the capital tax. % of the merger, Australian shareholders will have a $ 29.76 tax cost of! Of May 25 the sale of BHP Petroleum would suggest individual investors seek. Our Field Maintenance Team at Newman Operations insights from me in your inbox when published! It 's easy to see why owning 48 % of the merger effective date and completion \! N6i $! Disclosure Statement there will be effective June 1 with An ex-entitlement date of May 25 be June. Maintenance Team at Newman Operations BHP journey at age 19 with a Diesel! Is scheduled for 1 June 2022 with my current content by the.. See why entitled to approximately US $ 1.2 billion in relation to dividends paid Woodside!, 2020 Posts: 9 Location: Perth Hi All proposed in specie dividend the. In Welshpool relation to dividends paid by Woodside between the merger will be effective 1! Rociado con fertilizantes May not be realised in the future information purposes only by Woodside between the merger Australian.We do this through our strategy to deliver long-term value and returns through the cycle. SALT LAKE CITY, March 9, 2020 /PRNewswire/ -- Woodside Homes has announced the selection of Chris Williams as its new Chief Customer Officer effective March 1, 2020. So it appears the deal is all but signed, sealed and delivered. There will be no impact to the existing tax cost base of BHP shares for Australian shareholders as a result of the merger. Copy, or embed it in your site:

WebOn 1 June 2022 (Distribution Implementation Date), BHP exchanged all its shares in BHP Petroleum in exchange for Woodside issuing 914,768,948 shares to BHP. So rather than receiving cash, investors would receive an appropriate number of Woodside shares according to the market prices of BHP and Woodside at the time (with adjustments for equity issuance, etc). We believe the future is increasingly clear and our strategy, portfolio, capabilities and approach to social value position us to play an important role in meeting the twin objectives of an accelerated energy transition, and continued economic development and improvement in living standards. Received some Woodside Shares from the recent merger. Using the current S&P/ASX 200 Index Weight, we estimate that this equates to a franking credit yield of 0.44% at the index level. Approximately US$830 million of this amount will be paid in cash with the balance, which results from the take-upof Woodsides dividend reinvestment plan, Following the merger, Australian shareholders will have A$29.76 tax cost base for every Woodside share received.

WebMerger ratio on completion at 1 June 2022, the merged business will be owned approximately 52 per cent by existing Woodside shareholders and 48 per cent by BHP shareholders.

19 May 2022. Thinking about your next career move? WebMerger ratio on completion at 1 June 2022, the merged business will be owned approximately 52 per cent by existing Woodside shareholders and 48 per cent by BHP shareholders. Stay in touch with the latest news, stories and insights from BHP. Woodside and BHP create a global energy company On 1 June 2022, Woodside merged with BHP Petroleum to create a global independent energy company with the scale, diversity and resilience to create value for shareholders and increased ability to navigate the energy transition. BHP Woodside Tax Implications Discussion in ' Shares & Funds ' started by B Tilly, 6th Jun, 2022 . hb```FV Z3s=\t83g(+_UpiT3ttt4 h Vu(20~

@AqG]aL130d3>qb4c\>}"3j$z3dvU9 ,9 H2zCLw4;@^1a`U` Y! She started her BHP journey at age 19 with a Heavy Diesel Mechanic apprenticeship at the FutureFit Academy in Welshpool. Woodside will make a cash payment to BHP of approximately US$830 million in relation to cash dividends paid by Woodside between the Merger effective date of 1 July 2021 and completion. 2023 Livewire Markets Pty Ltd. All rights reserved.

19 May 2022. Thinking about your next career move? WebMerger ratio on completion at 1 June 2022, the merged business will be owned approximately 52 per cent by existing Woodside shareholders and 48 per cent by BHP shareholders. Stay in touch with the latest news, stories and insights from BHP. Woodside and BHP create a global energy company On 1 June 2022, Woodside merged with BHP Petroleum to create a global independent energy company with the scale, diversity and resilience to create value for shareholders and increased ability to navigate the energy transition. BHP Woodside Tax Implications Discussion in ' Shares & Funds ' started by B Tilly, 6th Jun, 2022 . hb```FV Z3s=\t83g(+_UpiT3ttt4 h Vu(20~

@AqG]aL130d3>qb4c\>}"3j$z3dvU9 ,9 H2zCLw4;@^1a`U` Y! She started her BHP journey at age 19 with a Heavy Diesel Mechanic apprenticeship at the FutureFit Academy in Welshpool. Woodside will make a cash payment to BHP of approximately US$830 million in relation to cash dividends paid by Woodside between the Merger effective date of 1 July 2021 and completion. 2023 Livewire Markets Pty Ltd. All rights reserved.

This month, Woodside has published an explanatory memorandum and an independent report recommending that shareholders vote in favour of the merger at a meeting scheduled for 19 May. BHP Group (ASX: BHP) is one of the traditional Australian income stocks favoured by a large number of SMSFs, retirees and other low-tax investors. Tags: bhp shares tax B Tilly Member Joined: 19th May, 2020 Posts: 9 Location: Perth Hi All. VIDEO: A NEW CHAPTER BEGINS Woodside and BHP

This month, Woodside has published an explanatory memorandum and an independent report recommending that shareholders vote in favour of the merger at a meeting scheduled for 19 May. BHP Group (ASX: BHP) is one of the traditional Australian income stocks favoured by a large number of SMSFs, retirees and other low-tax investors. Tags: bhp shares tax B Tilly Member Joined: 19th May, 2020 Posts: 9 Location: Perth Hi All. VIDEO: A NEW CHAPTER BEGINS Woodside and BHP  Any advice on this site is general in nature and does not take into consideration your objectives, financial situation or needs. endstream

endobj

104 0 obj

<>

endobj

105 0 obj

<>/Font<>/ProcSet[/PDF/Text]>>/Rotate 0/TrimBox[0.012 0.016 611.988 791.984]/Type/Page>>

endobj

106 0 obj

<>stream

Any advice on this site is general in nature and does not take into consideration your objectives, financial situation or needs. endstream

endobj

104 0 obj

<>

endobj

105 0 obj

<>/Font<>/ProcSet[/PDF/Text]>>/Rotate 0/TrimBox[0.012 0.016 611.988 791.984]/Type/Page>>

endobj

106 0 obj

<>stream

privacy policy explains how we store Si se observan infestaciones de plagas chupadoras como Mealy bug, entonces controla el rociado con fertilizantes. The mining giant delivered a strong and growing dividend and distributes a valuable amount of franking credits - icing on the cake, particularly for low or zero-tax investors. Then think big. We succeed through the partnerships we build with our suppliers. SALT LAKE CITY, March 9, 2020 /PRNewswire/ -- Woodside Homes has announced the selection of Chris Williams as its new Chief Customer Officer effective March 1, 2020. Web2 Merger Acquisition of a Company M&A) 3 ways to acquire a companybusiness)3: Purchase assets (by Asset Purchase Agreement Purchase stock by Stock Purchase Agreement Statutory merger by Merger Agreement There will be no impact to the existing tax cost base of BHP shares for Australian shareholders as a result of the merger. BHP and Woodside are working towards completion of the Merger, which is scheduled for 1 WebBHP shareholders would receive Woodside Petroleum shares as proceeds of the spin-off, owning 48% of the merged group. Because while the world relies on the resources we find, BHP relies on people like you. WebBHP is entitled to approximately US$1.2 billion in relation to dividends paid by Woodside between the Merger effective date and completion. Christine June 3, 2022, 4:50am 3 Hi Greg, Any opinions or forecasts reflect the judgment and assumptions of Plato and its representatives on the basis of information at the date of publication and may later change without notice.