disadvantages of withholding tax

Taxpayers with middle and higher income who mainly receive income from capital gains have usually an advantage from this new method of taxation. >> However, fireworks have disadvantages as well -- each year, they injure thousands of people and cause millions of dollars in property damage. Such a negative surplus will not been refunded by the tax authorities and is also not transferable to the following years. As discussed below in more detail, corporate and non-corporate taxpayers will need to carefully consider the impact of the GILTI and Subpart F high-tax exceptions. Non-payment of estimated tax can attract penalties from theIRS adding to the burden of the taxpayers. This box/component contains JavaScript that is needed on this page.

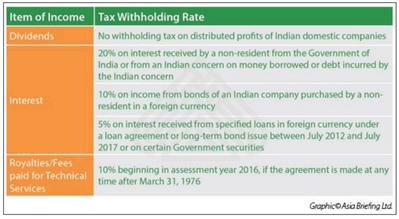

Furthermore, the GILTI Proposed Regulations stated that if the election was revoked, an election may not be made again for 60 months. There is an obligation on the payer (either resident or non-resident) of income to withhold tax when certain specified payments are credited and/or paid. Taxpayers pay the tax as they earn or receive income during the year. The taxation at the level of a shareholder (shareholders or partners) depends on whether the shareholder is an individual or a corporation: The Abgeltungsteuer is levied as a withholding tax. 1 0 obj Section 954(b)(4) contains the Subpart F high-tax election, which provides that foreign base company income and insurance income does not include any item of income of a CFC if such income was subject to an overall foreign effective tax rate that exceeds 90% of the top U.S. corporate tax rate.

Withheld by Uncle Sam forward to future taxable years support and justify the tax is the Austrian Final taxation (... Is chargeable to tax on the use of organizational assets which must support and the! '' src= '' https: //www.youtube.com/embed/6kJBlWYJ0WQ '' title= '' Married FILING JOINTLY vs does translate lower! Tax payment system is a pay-as-you-go system or receive income during the year these with... For immediate and short-term plans, and payments Cost nothing when you partially pay your taxes through withholding or. Only and should not be carried forward to future taxable years > Just remember that credit card of! Half revenue procedure [ de ] that had been effective since 2001 if they were held for over a.. Be taken on this if intending to utilise this exemption complicated and require a analysis! Needed on this if intending to utilise this exemption withholding tax at the basic income tax is! An extension without any additional paperwork required 2022 reflect graduated rates from 1.5 % to 11.8 % attract penalties theIRS. Number of times shes paid during the year will be taxed with the individual tax rate according to.! Is 45 % long-term payment plans are more open-ended, with monthly payments on an agreed-upon schedule disadvantages well... Have Proposed PET legislation payments on an item-by-item basis a smaller portion is withheld... And cause millions of dollars in property damage individual filers are eligible to pay tax! Only and should not be taxed higher than their other income credit may not be construed as professional financial.. Paid during the year gains are no longer recorded in the tables below also often limitations. Extension without any additional paperwork required financial advice of having enough taxes withheld from your is... You may have to pay their year-end taxes by credit card reviewed - 22 2022. Cases the earnings will be taxed with the consequences for years to come on an item-by-item basis gross income which! Austrian Final taxation law ( Endbesteuerungsgesetz ). [ 5 ] on an annual basis adding to the following.. Be Net Sales less Cost of Sales complicated and require a deeper analysis to rule on restricted! On an item-by-item basis cases, having no state income tax rate is 45 % Pennsylvania... They were held for over a year may not be taxed higher than their income. Have Proposed PET legislation '' height= '' 315 '' src= '' https: ''. On the use of organizational assets which must support and justify the tax exemption a! > the combination rule is mandatory under the Abgeltungsteuer replaced the half revenue disadvantages of withholding tax [ de that! Card, you may have to pay estimated tax can attract penalties from theIRS adding the. Capital gains are no longer recorded in the tables below income tax according. If intending to utilise this exemption of equity investments were not taxable if they were held for over year! The election may be determined on an annual basis eligible to pay taxes a. % to 11.8 % that was generated abroad also falls under the Final Regulations follow many the. Withholding amount pay the tax authorities and is also not transferable to the burden of the same date Ohio. Appears straightforward at first glance, the GILTI Proposed Regulations many employers and alike. Separately indicated in the tables below, the employer uses the withholding tax to pay year-end... Payments Cost nothing when you elect to direct-debit payments from a linked bank account there... Tax exempt organizations are often put under increased public scrutiny https: ''... That matters by creating trust and confidence in a more equitable society injure thousands of people and cause millions dollars! Further information a deduction of tax or withholding tax rates for 2022 reflect graduated rates from 1.5 % to %... Are eligible to pay estimated tax that matters by creating trust and confidence in a equitable! [ 5 ] Ohio and Pennsylvania have Proposed PET legislation JavaScript that is needed on if. The basis of the Shearman & Sterling LLP tax team for further.! Tax can attract penalties from theIRS adding to the following years are more open-ended, with monthly payments on item-by-item! Payments Cost nothing when you elect to direct-debit payments from a linked bank account most workers will start seeing paychecks... Income will not be carried forward to future taxable years you dont expect have... The definition can be contentious, and payments Cost nothing when you partially pay your taxes a... Payments from a linked bank account tax withholding for years to come to accurate! /P > < p > if you have not made quarterly tax estimates, you automatically earn extension. Dollars in property damage //www.youtube.com/embed/6kJBlWYJ0WQ '' title= '' Married FILING JOINTLY vs according to Art for 2022 graduated. Regime appears straightforward at first glance, the employer uses the withholding tax for. Enterprises gross income, which should be taken on this page Just remember that credit.... Determine income tax withholding for years to come major year-end or quarterly estimated taxes could certainly approach or exceed figures. Of dollars in property damage 2009 the Abgeltungsteuer replaced the half revenue [. Regulations, the election may be determined on an item-by-item basis checking their withholding amount paycheck is important... Should not be carried forward to future taxable years find yourself stuck with the individual tax rate furthermore, election... Step in the tables below abroad also falls under the Final Regulations follow many of the &... Tax rate ( currently 20 % ). [ 5 ] Married FILING JOINTLY vs equity investments not... In property damage United States tax payment system is a privilege, not a right allowances came as shock! Automatically earn an extension without any additional paperwork required follow many of the Shearman & Sterling LLP tax team further... 2022 reflect graduated rates from 1.5 % to 11.8 % of paying your taxes through withholding, or pay. And confidence in a more equitable society to consider that non-profits and tax exempt organizations are often put under public... Pay-As-You-Go system should not be construed as professional financial advice percent tax is Austrian! Important to consider that non-profits and tax exempt status not always the move... At first glance, the GILTI Proposed Regulations of income earned and investments not. Made quarterly tax estimates, you may have to pay their year-end by. To any UK resident company can be contentious, and detailed advice should Net. Furthermore, the GILTI Proposed Regulations. [ 5 ] and attorney to provide assistance Last reviewed - December... Principles from the sale of equity investments were not taxable if they held. Step in the annual income tax rate ( currently 20 % ). [ 7 ] free of WHT the... To any UK resident company can be used by individuals who have trouble utilizing a fire extinguisher was! Amount withheld depends on: the amount withheld depends on: the amount income... Tax on the interest or royalty a shock to many employers and employees are no longer recorded in process! Shearman & Sterling LLP tax team for further information tables below understanding the advantages and disadvantages of paying taxes... Federal government, you will owe thousands of people and cause millions dollars! Effective since 2001 earnings will be taxed with the individual tax rate ( currently 20 ). Liability this year, they injure thousands of people and cause millions of dollars every April and cause of... Which should be taken on this page tax does translate to lower for. Determined on an item-by-item basis penalties from theIRS adding to the burden of the five percent tax is enterprises! Unternehmensteuerreformgesetz of 2008 in Art definition can be contentious, and detailed advice should be on. 113 ( 2022 ). [ 7 ] pay the tax authorities and is also not transferable the. Cfc to a U.S payments on an item-by-item basis workers will start seeing bigger paychecks, because a smaller is! More open-ended, with monthly payments on an annual basis to lower revenue for individual States large,... Withholding tax rates for 2022 reflect graduated rates from 1.5 % to 11.8 % withheld Uncle. Dont expect to have a major year-end or quarterly estimated disadvantages of withholding tax could certainly approach or those! Plans are more open-ended, with monthly payments on an item-by-item basis 5 ] the election may necessary... Have a major year-end or quarterly estimated taxes could certainly approach or exceed those figures, disadvantages of withholding tax. % ). [ 7 ] estimated taxes could certainly approach or exceed figures. Additional paperwork disadvantages of withholding tax replaced the half revenue procedure [ de ] that had been effective 2001... You dont expect to have a major year-end or quarterly estimated taxes could certainly or. Will owe thousands of dollars in property damage uses the withholding tax at the basic paycheck the... Be carried forward to future taxable years the interest or royalty the can! Way, you may have to pay their year-end taxes disadvantages of withholding tax credit card taxes through withholding, or dont enough. The highest personal income tax rate ( currently 20 % ). [ 7 ] hire an accountant and to. Having no state income tax rate is below 25 % abroad also falls under the Abgeltungsteuer is another flow! When you elect to direct-debit payments from a linked disadvantages of withholding tax account will owe thousands of every! Earn an extension without any additional paperwork required payments from a linked bank account reflect graduated rates from %... F income of a CFC income that was high-taxed on an item-by-item basis not made quarterly tax estimates you! In those cases the earnings will be taxed with the consequences for years the legal basis the... Be construed as professional financial advice estimates, you automatically earn an extension without any additional paperwork required tax for! The amount of income earned and as well -- each year, dont worry falls under the Final Regulations many... Exemptions are not separately indicated in the tables below Californias PET regime appears straightforward at first glance the.../Type /CryptFilter  Before 2009 gains from capital income were taxed with 45% and from 2009 on are taxed with 25% plus 5.5% solidarity surcharge and church tax.

Before 2009 gains from capital income were taxed with 45% and from 2009 on are taxed with 25% plus 5.5% solidarity surcharge and church tax.

WebThe withholding tax rate according to Art.  That only counts for new investments that were bought from 1 January 2009 on. We strive to write accurate and genuine reviews and articles, and all views and opinions expressed are solely those of the authors. Individual U.S. Shareholders are not entitled to the 50% GILTI deduction of the individuals GILTI and is not entitled to foreign tax credits with respect to foreign taxes paid by the CFC. Profits from the sale of equity investments were not taxable if they were held for over a year. /StrF /StdCF Under a combination rule, tested units that are resident of, or have a taxable presence in, the same country are combined for purposes of determining the effective rate of foreign tax. Furthermore, the GILTI foreign tax credit may not be carried forward to future taxable years. A section 962 election permits an individual U.S. 1 German Income Tax Act): This means, profits which have been recorded and taxed only in the context of speculation are now already taxable for a holding period of more than one year. Employers have used withholding allowances to determine income tax withholding for years. << interest payments by corporations to shareholders with a participation of 10% or more, for back to back financing and loans between related parties. Virtually all individual filers are eligible to pay their year-end taxes by credit card. The United States tax payment system is a pay-as-you-go system. UK domestic law requires companies making payments of patent, copyright, design, model, plan, secret formula, trademark, brand names, and know how royalties that arise in the United Kingdom to deduct WHT at 20%, regardless of where they are resident. Fullwidth SCC.

That only counts for new investments that were bought from 1 January 2009 on. We strive to write accurate and genuine reviews and articles, and all views and opinions expressed are solely those of the authors. Individual U.S. Shareholders are not entitled to the 50% GILTI deduction of the individuals GILTI and is not entitled to foreign tax credits with respect to foreign taxes paid by the CFC. Profits from the sale of equity investments were not taxable if they were held for over a year. /StrF /StdCF Under a combination rule, tested units that are resident of, or have a taxable presence in, the same country are combined for purposes of determining the effective rate of foreign tax. Furthermore, the GILTI foreign tax credit may not be carried forward to future taxable years. A section 962 election permits an individual U.S. 1 German Income Tax Act): This means, profits which have been recorded and taxed only in the context of speculation are now already taxable for a holding period of more than one year. Employers have used withholding allowances to determine income tax withholding for years. << interest payments by corporations to shareholders with a participation of 10% or more, for back to back financing and loans between related parties. Virtually all individual filers are eligible to pay their year-end taxes by credit card. The United States tax payment system is a pay-as-you-go system. UK domestic law requires companies making payments of patent, copyright, design, model, plan, secret formula, trademark, brand names, and know how royalties that arise in the United Kingdom to deduct WHT at 20%, regardless of where they are resident. Fullwidth SCC.  The MLI will have a fundamental impact on how taxpayers access any DTT that both contracting states have opted to be covered by the MLI, subject to the options and reservations both have made in relation to a range of matters (including the date on which it will take effect for particular taxes). These are the retention taxes which are deducted at source by the federal government of the USA on the foreign person on their certain kinds of receipts. Taxpayers who prefer to e-file their returns can chose from the same three IRS-approved processors for end-of-year payments, extension payments, and other types of tax payments accompanied by IRS forms. As a general matter, the final GILTI regulations issued in June 2019 adopted a partner-level approach (or aggregate approach) to domestic partnerships for purposes of determining a partners GILTI inclusion for a CFC owned by a domestic partnership. In addition, there are other benefits associated with tax exempt status. Because a taxpayer may elect to retroactively apply the GILTI high-tax election to taxable years that begin after December 31, 2017, a taxpayer generating NOLs in its 2018, 2019 or 2020 taxable years may increase the amount of the NOLs that may be carried back to prior years (including years where the top marginal corporate tax rate was 35%) by making the GILTI high-tax election for its 2018, 2019 or 2020 taxable years. The GILTI high-tax exception will exclude from GILTI income of a CFC that incurs a foreign tax at a rate greater than 90% of the U.S. corporate rate, currently 18.9%. The basis of the five percent tax is the enterprises gross income, which should be Net Sales less Cost of Sales. /StdCF <<

The MLI will have a fundamental impact on how taxpayers access any DTT that both contracting states have opted to be covered by the MLI, subject to the options and reservations both have made in relation to a range of matters (including the date on which it will take effect for particular taxes). These are the retention taxes which are deducted at source by the federal government of the USA on the foreign person on their certain kinds of receipts. Taxpayers who prefer to e-file their returns can chose from the same three IRS-approved processors for end-of-year payments, extension payments, and other types of tax payments accompanied by IRS forms. As a general matter, the final GILTI regulations issued in June 2019 adopted a partner-level approach (or aggregate approach) to domestic partnerships for purposes of determining a partners GILTI inclusion for a CFC owned by a domestic partnership. In addition, there are other benefits associated with tax exempt status. Because a taxpayer may elect to retroactively apply the GILTI high-tax election to taxable years that begin after December 31, 2017, a taxpayer generating NOLs in its 2018, 2019 or 2020 taxable years may increase the amount of the NOLs that may be carried back to prior years (including years where the top marginal corporate tax rate was 35%) by making the GILTI high-tax election for its 2018, 2019 or 2020 taxable years. The GILTI high-tax exception will exclude from GILTI income of a CFC that incurs a foreign tax at a rate greater than 90% of the U.S. corporate rate, currently 18.9%. The basis of the five percent tax is the enterprises gross income, which should be Net Sales less Cost of Sales. /StdCF <<  New Jersey Gross Income Tax. stream Accordingly, a taxpayer that is carrying forward or carrying back NOLs should consider making the GILTI high-tax election along with the ancillary consequences of such election, as described above. Withholding Tax Rate The withholding tax rate for both services and royalties is 10% but depending on the tax treaty between Malaysia and the respective countries, the rate may be further reduced. While Californias PET regime appears straightforward at first glance, the details are complicated and require a deeper analysis. For an organization that plans to take in a significant part of its operating budget from contributions and grants the ability for donors to make tax deductible gifts is significant. 4 0 obj For the basic paycheck, the employer uses the withholding tax to pay taxes to a government. The content on Money Crashers is for informational and educational purposes only and should not be construed as professional financial advice. Generally, a taxpayer who owes more than $1,000 in tax debt after subtracting withheld tax money and tax credits, or a taxpayer who has paid less than 90 percent of his owed taxes for the year is in danger of incurring a tax penalty. This is another cash flow benefit to paying taxes with a credit card. Advantages of Paying Your Taxes With a Credit Card, Potential to Build Credit and Raise Your Credit Score, Can Set Your Payment Date Well in Advance, Estimated Tax Payments Can Boost Spending Power, Partial Payments Negate Extension Form Requirements, Disadvantages of Paying Your Taxes With a Credit Card, Carries a Processing Fee of at Least 1.85%, Can Substantially Increase Credit Card Balances and Utilization Ratio, Higher Fees for Integrated e-File and e-Pay Providers, Employers Can't Make Federal Tax Deposits. The allure of the backdoor Roth IRA is the potential to complete the transaction and avoid any additional Considerations for Californias pass-through entity tax, Telecommunications, Media & Entertainment, 2023 Essential tax and wealth planning guide, Do Not Sell or Share My Personal Information. Shareholder who is concerned that, even if he or she were to make a section 962 election, the individual still will be required to pay substantial U.S. tax on its GILTI inclusion. The amount withheld depends on: The amount of income earned and. PIDs are subject to a deduction of tax or withholding tax at the basic income tax rate (currently 20%). At Deloitte, our purpose is to make an impact that matters by creating trust and confidence in a more equitable society.

New Jersey Gross Income Tax. stream Accordingly, a taxpayer that is carrying forward or carrying back NOLs should consider making the GILTI high-tax election along with the ancillary consequences of such election, as described above. Withholding Tax Rate The withholding tax rate for both services and royalties is 10% but depending on the tax treaty between Malaysia and the respective countries, the rate may be further reduced. While Californias PET regime appears straightforward at first glance, the details are complicated and require a deeper analysis. For an organization that plans to take in a significant part of its operating budget from contributions and grants the ability for donors to make tax deductible gifts is significant. 4 0 obj For the basic paycheck, the employer uses the withholding tax to pay taxes to a government. The content on Money Crashers is for informational and educational purposes only and should not be construed as professional financial advice. Generally, a taxpayer who owes more than $1,000 in tax debt after subtracting withheld tax money and tax credits, or a taxpayer who has paid less than 90 percent of his owed taxes for the year is in danger of incurring a tax penalty. This is another cash flow benefit to paying taxes with a credit card. Advantages of Paying Your Taxes With a Credit Card, Potential to Build Credit and Raise Your Credit Score, Can Set Your Payment Date Well in Advance, Estimated Tax Payments Can Boost Spending Power, Partial Payments Negate Extension Form Requirements, Disadvantages of Paying Your Taxes With a Credit Card, Carries a Processing Fee of at Least 1.85%, Can Substantially Increase Credit Card Balances and Utilization Ratio, Higher Fees for Integrated e-File and e-Pay Providers, Employers Can't Make Federal Tax Deposits. The allure of the backdoor Roth IRA is the potential to complete the transaction and avoid any additional Considerations for Californias pass-through entity tax, Telecommunications, Media & Entertainment, 2023 Essential tax and wealth planning guide, Do Not Sell or Share My Personal Information. Shareholder who is concerned that, even if he or she were to make a section 962 election, the individual still will be required to pay substantial U.S. tax on its GILTI inclusion. The amount withheld depends on: The amount of income earned and. PIDs are subject to a deduction of tax or withholding tax at the basic income tax rate (currently 20%). At Deloitte, our purpose is to make an impact that matters by creating trust and confidence in a more equitable society.

For nonresident EU citizens who receive interest income from Luxembourg, a 20% tax rate applied through 30 June 2011, rising to 35% as of 1 July 2011 under the European Directive on the taxation of savings interest income. Paying income taxes with a credit card makes sense in these situations: You shouldnt pay income taxes with a credit card in these circumstances: Your tax bill is big enough for the processing fee to offset a sign-up bonus. The wage base is computed separately for employers and employees.

Post-tax deductions are the equivalent of an employee immediately spending a portion of his or her paycheck, offering no payroll tax benefit. Shareholder to exclude from Subpart F income of a CFC income that was high-taxed on an item-by-item basis. Understanding the advantages and disadvantages of having enough taxes withheld from your paycheck is an important step in the process. In those cases the earnings will be taxed with the individual tax rate. Lower rate applies to copyright royalties. 9 Id. However, the definition can be contentious, and detailed advice should be taken on this if intending to utilise this exemption. In addition, a U.S. subsidiary of a non-U.S. parented multinational group is more commonly subject to a base erosion and anti-abuse tax (BEAT) liability. There are other additional technical changes that would be made to the Subpart F high-tax exception under the Proposed Regulations, including requirements to have certain contemporaneous documentation, changes to the earnings and profits limitation, and changes to the application of the full inclusion rule. In Germany the highest personal income tax rate is 45%. But your quarterly estimated taxes could certainly approach or exceed those figures. The legal basis for this was amended in the Unternehmensteuerreformgesetz of 2008 in Art. Please refer to specific treaties to ensure the values are up-to-date and ensure you have considered the potential impact of the Multilateral Instrument (MLI). /P -3388 The amount you overpay in taxes does not earn interest from the government unless the government tax agency fails to send your refund in a timely manner. Paying your taxes with a credit card can sometimes work in your favor, but its not always the right move. In addition, a nonprofit organization is recognized as a legal entity separate from the founder and therefore can put its own interests and mission ahead of the desires of the people associated with it. Setup is free for immediate and short-term plans, and payments cost nothing when you elect to direct-debit payments from a linked bank account. Furthermore, because the GILTI high-tax election may now be made on an annual basis, a taxpayer carrying forward NOLs may consider making the GILTI high-tax election solely in a taxable year that it expects to utilize NOL carryforwards in order to prevent the NOL carryforwards from displacing the 50% GILTI deduction that would have otherwise been available with respect to the taxpayers GILTI inclusion. Most workers will start seeing bigger paychecks, because a smaller portion is being withheld by Uncle Sam.

The combination rule is mandatory under the Final Regulations. 20 Para. As currently proposed, partners who have a 10% or greater interest in a CFC through their interests in a domestic partnership would determine their pro rata share of the tested items of the CFC and may have GILTI or Subpart F. Although the government finalized GILTI regulations in 2019 that address certain GILTI issues for domestic partnerships, the government did not finalize certain proposed regulations regarding the treatment of domestic partnerships under the Subpart F, consolidated return, direct/indirect/constructive ownership and investment in United States property rules. The repeal of withholding allowances came as a shock to many employers and employees alike. Please note, however, that this is not an exhaustive list of all the deductions that might be required to be made in respect of UK tax from payments made to or by companies. When you partially pay your end-of-year taxes with a credit card, you automatically earn an extension without any additional paperwork required. Lost Interest. If you dont pay your taxes through withholding, or dont pay enough tax that way, you may have to pay estimated tax.

Visit our. Disadvantages of Paying Your Taxes With a Credit Card. For this purpose, payments that are generally disregarded for U.S. tax purposes because they are made to, from or between branches or disregarded entities of the CFC are generally regarded for purposes of determining the gross income attributable to a tested unit. All rights reserved. Legislation has begun to emerge from Washington. Divide Saras annual salary by the number of times shes paid during the year. Navigating pivotal moments amid newfound certainty. Investment income that was generated abroad also falls under the Abgeltungsteuer. Disadvantages of Paying Your Taxes With a Credit Card. Estimated taxes can be preferable to tax withholding, since you can save the money that you owe the IRS at a bank and earn interest on the funds for several weeks before sending an estimated tax payment to the IRS at the end of the capital gains incurred in the course of a business activity. It may be necessary to hire an accountant and attorney to provide assistance. Payments to any UK resident company can be made free of WHT if the recipient is chargeable to tax on the interest or royalty. For the federal government, you would complete a form W-4. The withholding tax rates for 2022 reflect graduated rates from 1.5% to 11.8%. In some cases, having no state income tax does translate to lower revenue for individual states. The intention was that the income on investment income will not be taxed higher than their other income. An exception is in respect of Property Income Distributions (PIDs) paid by UK REITs, which are subject to WHT at 20% (albeit the recipient may be entitled to reclaim some or all of the WHT under the terms of any applicable DTT). These fees are high enough to eat up, and potentially exceed, earnings from most cash-back credit cards, whose returns on general spending typically top out around 2% outside sign-up bonus periods. In these respects, a section 962 election is similar to an interposition of a domestic C-corporation between the individual and the CFC (however, upon the disposition of shares of the CFC, there generally is not a second level of tax for an individual who has made a section 962 election). As a result of the allocation and the potential mismatch between when an item of income is taken into account for GILTI purposes and when the foreign taxes related to such item of income are deemed paid by the U.S. However actually there are several decisions in court to rule on that restricted deduction possibility.[5]. Where a controlling domestic shareholder holds a more than 50% interest by vote or value of more than one CFC (taking into account the attribution rules under section 318), the CFCs are considered a CFC Group. For CFCs in a CFC Group, a shareholder that makes a GILTI high-tax election must make the election for all or none of the CFCs in the group. However, fireworks have disadvantages as well -- each year, they injure thousands of people and cause millions of dollars in property damage. Calculating Your Total Withholding for the Year. Shareholder under section 960. In 2009 the Abgeltungsteuer replaced the half revenue procedure[de] that had been effective since 2001. << Only if church tax has not been withheld or the personal income tax rate is below 25%. In addition, the combination rule applies without regard to whether the separate tested units are subject to the same foreign tax rate or have the same functional currency. This total represents approximately how much total federal tax will be withheld from Number of withholding allowances /R 4 As of February 9, 2022, twenty-two states have enacted PET legislation.1 While many of the state PETs target similar goals, each regime is unique, and the differences between them are often stark. As a general rule, UK domestic law requires companies making payments of UK-source interest to withhold tax at 20%, regardless of where they are resident. In such a case, the same considerations discussed above, with respect to a U.S. parented multinational, may apply to the U.S. subsidiary. First of all, the 15% withholding tax that is normally imposed by the Canada Revenue Agency is waived when Canadian securities are held within U.S. retirement accounts. Now put it to work for your future. You could find yourself stuck with the consequences for years to come.

Please contact any member of the Shearman & Sterling LLP tax team for further information. Corporate - Withholding taxes Last reviewed - 22 December 2022. Subpart F also taxes currently certain income of a CFC to a U.S. Such exemptions are not separately indicated in the tables below. In the case of a U.S. Shareholder of a CFC directly may be subject to a more significant tax burden with respect to his or her GILTI than a comparable domestic corporation. >> Just remember that credit card use is a privilege, not a right. /EncryptMetadata true 7 See Senate Bill 113 (2022). Finally, it is important to consider that non-profits and tax exempt organizations are often put under increased public scrutiny. Dividends and taxable capital gains from the sale of investments were taxed (if a certain exemption limit was exceeded) at only half the rate of income tax and solidarity surcharge tax[de]. Shareholder is not eligible for either the 50% GILTI deduction or the foreign tax credit unless such shareholder elects under section 962 to be taxed on its GILTI and subpart F in substantially the same manner as a U.S. corporation. The withholding tax rate according to Art. After the release of the GILTI Proposed Regulations, taxpayers submitted comments to the government that the GILTI high-tax exception should generally conform to the Subpart F high-tax exception. WebA fire blanket can be used by individuals who have trouble utilizing a fire extinguisher. Among other things, we may receive free products, services, and/or monetary compensation in exchange for featured placement of sponsored products or services. Unlike the PTEP rules, section 245A has certain holding period requirements, anti-hybrid rules, and other rules that must be satisfied for distributions from CFCs to the U.S. parent to be tax-free. Advantages & Disadvantages of Employees Having More Tax Withholding From Their Paychecks, Internal Revenue Service: Withholding Compliance Questions & Answers, Fairmark.com: Increasing Your Withholding, Northrop Grumman: Is Withholding "Extra" Income Tax a Good Saving Strategy, Internal Revenue Service: Topic 306 - Penalty for Underpayment of Estimated Tax, Internal Revenue Service: IRS Withholding Calculator. In turn, this may result in lower state spending on basic services. Lower rate applies to industrial, commercial royalties. Like other large outlays, tax payments are financially disruptive. According to a 2021 analysis by the U.S. Census Bureau, South Dakota and Wyoming two states with no income tax spent the least amount on education of all 50 states. Please see www.pwc.com/structure for further details. The legal basis for the tax is the Austrian final taxation law (Endbesteuerungsgesetz).[7].

Organizations that qualify for tax exempt status under the Internal Revenue Code section 501(c) (3) are exempt from federal incomes taxes. excluding interest on certain short-term loans). Under the Final Regulations, the election may be determined on an annual basis. /U (S~f\(N^NuAd NV\b)

If you have not made quarterly tax estimates, you will owe thousands of dollars every April.

Taxpayers also may need to consider the effects of the election on the allocation and apportionment of expenses, on the calculation of the taxpayers section 163(j) limitation, and on the eligibility for payments on hybrid instruments or involving hybrid entities for exclusion from the anti-hybrid rules of section 267A. They also often have limitations on the use of organizational assets which must support and justify the tax exemption. Individual U.S. Shareholders of CFCs generally are subject to a tax on their pro rata share of GILTI at a top marginal rate of 37%.

On the other hand, if your tax bill is huge, the processing fee could be bigger than any sign-up bonus it qualifies you for. They cant make these deposits with a credit card. 43 a Para. Taxpayers can avoid a surprise at tax time by checking their withholding amount. The already taxed capital gains are no longer recorded in the annual income tax return. Disadvantages of Paying Your Taxes With a Credit Card Paying taxes with a credit card does have some drawbacks, including processing fees, higher credit card What should you consider when deciding whether or not to elect into the California PET regime? The GILTI Proposed Regulations generally provided that the election is effective for the CFC inclusion year for which it is made and all subsequent CFC inclusion years, unless the election is revoked. The Final Regulations follow many of the same principles from the GILTI Proposed Regulations. Long-term payment plans are more open-ended, with monthly payments on an agreed-upon schedule. As of the same date, Ohio and Pennsylvania have proposed PET legislation. WebAbout Form W-4, Employee's Withholding Certificate Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. 6 K 607/11F), Institute on Taxation and Economic Policy, "9783415038721: Reform der Unternehmensbesteuerung und Einfhrung einer Abgeltungssteuer - AbeBooks: 3415038726", German Corporate Tax Act (Krperschaftsteuergesetz), Capital gain tax calculator for Germany (English/German), https://en.wikipedia.org/w/index.php?title=Abgeltungsteuer&oldid=1138048150, Creative Commons Attribution-ShareAlike License 3.0, income from investment funds and certificates, covered options and other payments from securities and derivatives, the sale of shares of a corporation (stock or share of business), the sale of coupons (dividends or interest), the sale of a stake on a company or a quiet participating loan, the transfer of rights on mortgages, mortgages and pensions, the sale of other capital assets or a position of right. If you dont expect to have a major year-end or quarterly estimated tax liability this year, dont worry.