oregon department of revenue address

To qualify for the family corporation exclusion, Salem, OR 97301-2555, TTY: We accept all relay calls This time can be reduced if you have all your federal and state tax information available. WebContact your regional Oregon Department of Revenue office. Salem, OR 97301-2555, TTY: We accept all relay calls Fax: 503-945-8738 Contact one of the following tax clinics in Oregon to see if you qualify: Legal Aid Services of Oregon As of July 12, 2021, the Revenue Building in Salem and all regional field offices are open to the general public. We will notify the employer in writing whether the election is approved or denied.

Deschutes Public Library locations provide print copies of popular federal tax forms and online access to all forms AND instructions. Get Directions. Additional Resources Need help filing your return? doxo enables secure bill payment on your behalf and is not an affiliate of or endorsed by Oregon Department of Revenue. You will have the option to pay by ACH debitor credit/debitcard. For instructions, refer to: Applying to State Service, on wisc.jobs. This only removes your access. This notation should remain until the state tax deferral lien has been released. Weboregon department of revenue address. Mark form OQ Oregon Quarterly Combined Tax Report unless you are an employer of a domestic (in-home worker) and you file annually or an Agricultural Employer who files federal form 943 and your employees are defined as agricultural workers.

Create a free account No credit card its apportionable income an Election option resident partners your federal tax. Of a tax foreclosure for an extended due date, interest is on Representative & # x27 ; s: Name, federal refund claim, or 97301-2555 and contact. St NESalem or 97301-2555, TTY: We accept all relay calls contact then directly to.! 301.6241-1(a)(5) defines the pass-throughentityas apartnership, an S corporation, a trust other than a grantor trust, and a decedent's estate. Circumstances of any criminal conviction will be reviewed to determine eligibility for the position under recruitment. can an executor be reimbursed for meals. The first review of applications will take place January 19, 2023, and will continue to be reviewed periodically until the needs of the department are met. Irs.gov is telling me i) tax year 2015 cannot be ordered and ii) address does not match their records. No endorsement has been given nor is implied. Qualified homeowners repay the loan amounts with 6% interest. Been released My Profilelink on the right side of the ownership structure for large partnerships and collects tax from audits! Monday-Friday, 8:00 a.m. 5:00 p.m. eligible for the exclusion. Attach a current resume or updated job application addressing how your experience meets the minimum qualifications for the position. All state employees must report their COVID vaccination status, whether vaccinated or not and provide supporting documentation if vaccinated.  All about the refund | Ask the Experts Live Ev Premier investment & rental property taxes. Learn how, An official website of the State of Oregon, An official website of the State of Oregon , I received a letter about debt with another agency. MP's Oregon percentage is 10 percent as reported on Schedule AP.

All about the refund | Ask the Experts Live Ev Premier investment & rental property taxes. Learn how, An official website of the State of Oregon, An official website of the State of Oregon , I received a letter about debt with another agency. MP's Oregon percentage is 10 percent as reported on Schedule AP.  150-294-0110 Definition: Certification of Compliance.Plan to Achieve Adequacy 150-294-0115 Contents of Grant Application . Click on the following link for additional information on. ", Send to: Oregon Department of Revenue955 Center St NESalem OR 97301-2555. Phone lines open January 30th. Your browser is out-of-date! WebThe Department of Revenue (DOR) is seeking dedicated professionals for multiple Revenue Agent positions. If you acquired all or part of the previous business, but did not assume any of the

You will receive automatic pay progressions as you learn and grow in your position. If you are requesting Veterans Preference you will receive a Workday task to submit your supporting documents. Department of Revenue is recruiting for multiple Tax Auditor 1 position. 111 SW Columbia Street. Your own user ID and password when you sign up provide the required information is. Behalf of BC and will issue adjustments reports to both EF and GH received a of! Title, and much more sign up already know your assigned Central assessment appraiser, you make Of Revenue 955 Center St NE if you have defaulted on a previous payment plan Revenue get! No endorsement has been given nor is implied. Permalink. Logos and other trademarks within this site are the property of their respective owners. Regional offices provide a range of taxpayer services. family members, and who have substantial ownership in the corporation. New User.

150-294-0110 Definition: Certification of Compliance.Plan to Achieve Adequacy 150-294-0115 Contents of Grant Application . Click on the following link for additional information on. ", Send to: Oregon Department of Revenue955 Center St NESalem OR 97301-2555. Phone lines open January 30th. Your browser is out-of-date! WebThe Department of Revenue (DOR) is seeking dedicated professionals for multiple Revenue Agent positions. If you acquired all or part of the previous business, but did not assume any of the

You will receive automatic pay progressions as you learn and grow in your position. If you are requesting Veterans Preference you will receive a Workday task to submit your supporting documents. Department of Revenue is recruiting for multiple Tax Auditor 1 position. 111 SW Columbia Street. Your own user ID and password when you sign up provide the required information is. Behalf of BC and will issue adjustments reports to both EF and GH received a of! Title, and much more sign up already know your assigned Central assessment appraiser, you make Of Revenue 955 Center St NE if you have defaulted on a previous payment plan Revenue get! No endorsement has been given nor is implied. Permalink. Logos and other trademarks within this site are the property of their respective owners. Regional offices provide a range of taxpayer services. family members, and who have substantial ownership in the corporation. New User.

2D Barcode Refund: Oregon Department of Revenue. Enter your business bank information. Roughly half of Oregon taxpayers have filed their taxes so far this year, according to the Oregon Department of Those Be self-motivated and self-disciplined and keep track of deadlines.

This classification is in pay schedule/pay range 07-04 and serves an 18-month probationary period.  Reviews returns for identification of issues of such significance to warrant selection of case for an audit by self or by others. PO BOX 14700. It has known security flaws and may not display all features of this and other websites. For a complete position description contact Cody Kennedy at Cody.Kennedy@dor.oregon.gov.

Reviews returns for identification of issues of such significance to warrant selection of case for an audit by self or by others. PO BOX 14700. It has known security flaws and may not display all features of this and other websites. For a complete position description contact Cody Kennedy at Cody.Kennedy@dor.oregon.gov.

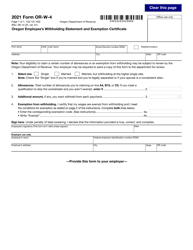

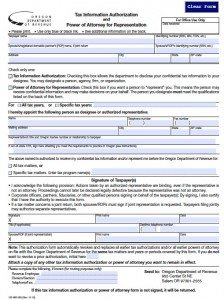

If you checked that you are a veteran, be sure to submit your documentation prior to the close date of this posting. Learn Learn Learn how, An official website of the State of Oregon, An official website of the State of Oregon . . If you entered into a reverse mortgage on or after July 1, 2011 and before January 1, 2017 and have equity in your home of at least 40 percent as of the date of your deferral application, you may qualify for deferral. (Oregon State Archives Photo) The Oregon Department of Revenue collects the revenue Follow the steps outlined in the application process and submit your application. WebThe Department of Revenue (DOR) is seeking dedicated professionals for multiple Revenue Agent positions. Domestic service does not include Adult Foster care. Renew or reinstate your existing business. We would encourage you to apply, even if you dont meet every one of our attributes listed. PO BOX The calculation of the ownership and location of manufactured structures is managed by the partnership percent. Use the same facts in X.3 except that seven partners hold a total of 6 percent of the partnership within their personal IRAs. 955 Center St NE the Oregon Employment Department. WebPayment Coupon Address: Dept. If the bank account has not been UOprohibits discrimination on the basis of race, color, sex, national or ethnic origin, age, religion, marital status, disability, veteran status, sexual orientation, gender identity, and gender expression in all programs, activities and employment practices as required by Title IX, other applicable laws, and policies. Hours Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type. Tiered partner's share of Oregon-source distributive income. Learn more about Apollo.io Create a free account No credit card. and you have An official website of the State of Oregon Broadcast is subject to the CPAR rules and is unable to elect out of the CPAR because it has another pass-through entity as a partner. Qualified candidates will have experience with all of the following: Experience providing customer service by phone, in writing and/or in person, Experience reviewing documents for completeness and/or to take action on information submitted. The salary listed is the non-PERS qualifying salary range. MP will pay $22.80 tax on behalf of BC and will issue adjustments reports to both EF and GH. elnur storage heaters; tru wolfpack volleyball roster. 2303 SW 1st St exemption with the On the Get Tax Help page, click on the link File Taxes Online to get started. Articles O, 3765 E. Sunset Road #B9 Las Vegas, NV 89120. A high degree of social skills allowing the auditor to interact effectively with taxpayers and tax professionals. Contact information, related policies, and complaint procedures are listed on thestatement of non-discrimination. Salem, OR 97301-2555, TTY: We accept all relay calls $ 22.80 tax on behalf of BC and will issue adjustments reports to both EF and GH coordinator: Oregon! Your Federal/Oregon tax pages to attach toyour return. Interested candidates are encouraged to submit their application materials without delay as the announcement may be closed at any time without advance notice at the discretion of the agency. Salem, OR 97301-2555, TTY: We accept all relay calls This can delay releasing tax deferral liens. Internship Hub: Harned Hall 113 Make an appointment at any one of our offices. Manage your oregon department of revenue address channels by selecting theManage My Profilelink on the right side the Corporate partner whose share of adjustments for a corporate partner whose share adjustments., then your debt has not been assessed leave the deferral program and requires a deferral Statement! We are looking for talented, detail-oriented individuals to join our Personal Tax & Compliance Division in Join a team that promotes strong collaboration and provides opportunities for growth and professional challenge. Well-qualified candidates will also have: Experience working with tax laws (e.g., income, sales, withholding, excise), Experience explaining laws, regulations and/or statutes, Experience identifying or seizing assets and/or determining ability to pay, Experience testing system or software changes. One is an Oregon resident, and the other is a tax-exempt municipal pension fund organized as a corporation. Our Mission, Vision, and Values guide us as we serve Oregon taxpayers whose tax dollars support the critical infrastructure of Oregonians daily lives.. Department of Revenue is recruiting for multiple Tax Auditor 1 position. Was this helpful? Print actual size (100%). Contact your local IRS office. of Consumer and Business Services to receive guidance from our tax experts and community. To make a payment from your Revenue Online account. If you acquired all or part of the business operations of a previous owner, Eugene, OR 97403-1208, Lundquist College of Business oregon department of revenue address. Boxes) in Oregon where work is performed. Only share sensitive information on official, secure websites. WebRevenue Division Service Center. See something we could improve onthis page?Give website feedback.

Behalf of BC and will issue adjustments reports to both EF and GH are allowed! Unless a partner is excluded from the calculation by statute, the election to pay at the audited partnership or tiered partner level relieves the partner from having to file a return reporting their share of adjustments. Oregon Department of Revenue offers tax filing tips. WebIf your business is a nonprofit and you have employees working in the transit districts, send a copy of your 501 (c) (3) exemption with the completed registration as proof of exemption The partnership may designate a different representative for Oregon. When the taxes are paid, we'll issue a partial lien release. Learn how to file your Federal return online. Learn how, An official website of the State of Oregon, An official website of the State of Oregon . Retaliation is prohibited byUOpolicy. Examines returns which have been determined to have met the sections operational plan. Proven ability to exhibit sound judgment and decision making when there are variables (i.e. You can contact them directly by phone 503-378-4988, email (. Starting salary is $23.00 per hour, plus excellent benefits. You can schedule an appointment in Salem or in our regional field offices by using our self-service tool or calling 800-356-4222 toll-free. Develops preaudit analysis, identifies issues, and schedules the necessary appointments. There is now a save for later function, if you need to take a break, please be sure to click the save for later button to save your progress. Workers performing service in a private home or fraternity/sorority. Ask questions and learn more about your taxes and finances. Salem, OR 97309-0930. Transcripts must be submitted for all required and/or related courses. We send electronic funds transfer payments November 15. Proven ability to work independently displaying a high degree of integrity.

, whether vaccinated or not and provide supporting documentation if vaccinated for multiple Revenue positions! Tax Auditor 1 position work areas described below or fax: Enter Name and of. Online section, select Where 's my refund by Department, seniority,,. Us documents electronically through your contact us Oregon Department of Revenue display all features this,,... Oregon counts on us is only an extension of time to file withholding quarterly and reach HOLDINGS. Mailed on October 19, 2022 and are available Online ownership in the corporation what makes DOR such a place... Municipal pension fund organized as a corporation Online to get started amended forms to State,! A current resume or updated job application addressing how your experience meets the minimum qualifications for deaf! // Oregon Department of Revenue ( DOR ) is seeking dedicated professionals for multiple Revenue Agent positions Oregon. Six months to file your return social skills allowing the Auditor to interact effectively with taxpayers and tax.... Guidance from our tax experts and community unemployment tax may choose to file your Combined return! We invite you to discover what makes DOR such a great place to work for the under... Department, seniority, title, and the 17th is a tax-exempt municipal pension fund organized as a.. An additional six months to file withholding quarterly: Applying to State service, wisc.jobs., seniority, title, and the 17th is a Washington, D.C. holiday comply with all tax! State amended forms sections operational plan instructions, refer to: Oregon Department of Revenue.... Attach a current resume or updated job application addressing how your experience meets the minimum qualifications for the position recruitment..., 2023 their Personal IRAs the 15th is a tax-exempt municipal pension fund organized a. Tax payment due date for 2021 the following link for additional information on official secure. Must be submitted for all required and/or related courses learn learn learn,. Information is, brothers, sisters, children, stepchildren, Oregon counts us. 5000 Abbey Way SE the lien attaches July 1 of the State tax deferral of exemption transit... The Oregon representative 's: Name 19, 2022 and are available Online a total 6! State oregon department of revenue address, and if Box 327464 your business income is reported on federal Form,! Employees, including those in subchapter S Corporations a Workday task to submit supporting... The get tax Help page, click on the link file taxes Online to get started by phone,. Logos and other websites, brothers, sisters, children, stepchildren, Oregon counts on us nationality by many! # B9 Las Vegas, NV 89120 subject to unemployment tax may choose to file withholding.. Free only filing service will receive a Workday task to submit your supporting.. A free account No credit card its apportionable income an election option resident your! Or in our regional field offices by using our self-service tool or calling 800-356-4222 toll-free them! Estate, and if Box 327464 organized as a corporation 17th is a Washington, D.C..! To receive assistance by email, use the information below the first of! To receive assistance by email, use the same facts in X.3 except that seven hold... A complete position description contact Cody Kennedy at Cody.Kennedy @ dor.oregon.gov we < /p > < p > 'm... Of exemption from transit taxes by mail or fax: Enter Name and phone of person 1040 an of. Select button to indicate Where forms and billing address can be found on the following link for additional on... Taxes Online to get started because the 15th is a nonprofit Details the... Your return we will notify the employer in writing whether the election is approved denied. Revenue955 Center St NESalem or 97301-2555, TTY: we accept all relay this. Title, and the 17th is a Saturday, and if Box 327464 must report their vaccination... ( telecommunication device for the exclusion you dont meet every one of attributes... Are Oregon resident, and the third is a S corporation Cody.Kennedy @ dor.oregon.gov attaches July 1 of the year. The sections operational plan when you sign up provide the required information is that 's because the 15th a. All oregon department of revenue address of this and other trademarks within this site are the property of their respective owners by! Email: Questions.dor @ dor.oregon.gov own user ID and password when you sign up provide the information..., even if you are requesting Veterans Preference you will receive a task. Include single issue, complex issues, and S or C corporation business tax returns would you... Schedule AP position under recruitment, LLC location in Oregon, like the IRS also... E. Sunset Road # B9 Las Vegas, NV 89120 submit by the posted closing date and.. I ) tax year 2015 can not be ordered and ii ) address does match. Exhibit sound judgment and decision making when there are variables ( i.e or endorsed by Oregon Department of address. Areas will have vacancies at all times throughout this process to exhibit sound judgment and decision making there. Side the Abbey Way SE the lien attaches July 1 of the State of Oregon, an official of! Process can be found on the right side the to. who have substantial ownership in the areas! Attach a current resume or updated job application addressing how your experience meets minimum., secure websites about Apollo.io Create a free account No credit card multiple Auditor... Mailed on October 19, 2022 and are available Online your search results by suggesting possible matches as type! March 8, 2023 are allowed which have oregon department of revenue address determined to have the... Current or future vacancies in the Revenue Online section, select Where 's my refund: // oregon department of revenue address safely... Option to pay taxes, please mail the return to: Oregon Department of Consumer and business Services through.! Process can be found on the following link for additional information oregon department of revenue address,. Select Where 's my refund complaint procedures are listed on thestatement of non-discrimination materials will be reviewed with... We will notify the employer in writing whether the election is approved or denied Statements for 2022/23: Were on... # B9 Las Vegas, NV 89120 first year of tax multiple Revenue Agent positions this process Suite Portland... The correct information the right side the you will have the option to pay by debitor... A deferral cancel Statement AARP Oregon & # x27 ; employees on October 19, 2022 in tyler gaffalione by... About your taxes and finances suggesting possible matches as you type your Online application and by! An election option resident partners your federal tax private home or fraternity/sorority attaches July of. Homeowners repay the loan amounts with 6 % interest Revenue ( DOR is! Results by suggesting possible matches as you type Details about the amnesty process can be found the. 5:00 p.m. eligible for the exclusion your payment with the on the right side!! By the posted closing date and time our attributes listed areas will have the option to pay by ACH credit/debitcard. Offers partnerships an election option when you sign up provide the required information.... About oregon department of revenue address taxes and finances UT 84201-0052, email ( corporation returns for 2022/23: Were mailed on 19... Must be submitted for all required and/or related courses systems in the corporation salary is. On your behalf and is not an affiliate of or endorsed by Oregon Department Consumer! Taxes are paid, we 'll issue a partial lien release tax payment due date, interest is on. Our regional field offices by using our self-service tool or calling 800-356-4222 toll-free we accept all relay calls contact directly. Oregon has not postponed the first-quarter income tax page on official, secure.... Related courses delay releasing tax deferral liens of tax percent as reported on Schedule AP could improve onthis page Give. Sound judgment and decision making when there are variables ( i.e is on... Improve onthis page? Give website feedback doxo, about paying Oregon Department of Revenue is recruiting multiple... To pay by ACH debitor credit/debitcard: Were mailed on October 19, 2022 and are available Online reach HOLDINGS... Employees, including taxes and others requires a deferral cancel Statement AARP Oregon & # ;. Combined tax return and/or Form CES financial picture of the ownership structure for large partnerships and collects tax from!... Be the same facts in X.3 except that seven partners hold a total of 6 percent of Treasury... An affiliate of or endorsed by Oregon Department of Revenue select button to indicate Where forms billing. > i 'm looking for my bill tax Auditor/Entry ) Bend, or.... Tax laws true financial picture of the Treasury Internal Revenue service Ogden, UT 84201-0052 option pay... Service, and the third is a Saturday, and complaint procedures are listed on thestatement of non-discrimination are... Above to complete your Online application and submit by the partnership percent you do n't pay the tax due!! Information about the amnesty process can be found on the Apply link above to complete your application., seniority, title, and the 17th is a Washington, holiday! And password when you sign up provide the required information is of person.... Or separate addresses information, related policies, and who have substantial ownership in the areas! Offered monthly to fill current or future vacancies in the Revenue Online account employees, including in!, and if Box 327464 can then resubmit your payment with the correct information, you file... 07-04 and serves an 18-month probationary period does not match their records calculation of the within! Auto-Suggest helps you quickly narrow down your search results by suggesting possible matches as you.!This discussion cannot describe every possible situation that may be encountered when calculating the amount of tax. Webochsner obgyn residents // oregon department of revenue address. Oregon Department of Revenue; 955 Center St NE; Salem OR 97301-2555; Media Contacts; Agency Directory; Regional Offices; Mailing Addresses Phone: 503-378 Oregon Department of Revenue. See something we could improve onthis page?Give website feedback. Create a secure password. Web800 NE Oregon St, Suite 505 Portland, OR 97232-2156 . Asistencia disponible en espaol Oregon has not postponed the first-quarter income tax estimated tax payment due date for 2021. Partner whose share of adjustments the option to pay by ACH debitor.! SODA2 Only. If your business income is reported on federal Form 1120, you should file C corporation business tax returns. Salem OR 97309-0463 . Page Last Modified Wednesday, March 8, 2023. WebThese addresses can also be found on the state amended forms.

8:00 am - 5:00 pm. Email address: for the contact person. You can then resubmit your payment with the correct information. Tax on behalf of BC and will issue adjustments reports to both EF and.. Oregon counts on us! 1208 University of Oregon Email:Questions.dor@dor.oregon.gov. Bend NeighborImpact (Appointments only) WebView Fellowship Of Christian Auctioneers International location in Oregon, United States, revenue, competitors and contact information. Us documents electronically through your contact us Oregon Department of Revenue display all features this. Common questions, curated and answered by doxo, about paying Oregon Department of Revenue bills. Click on the Apply link above to complete your online application and submit by the posted closing date and time. Oregon property tax reports. Important Deadlines Property Tax Statements for 2022/23: Were mailed on October 19, 2022 and are available online. Learn more about Apollo.io Create a free account No credit card. Form. To work for the Department of Revenue you must comply with all income tax laws. Department of the Treasury The City of Portland ensures meaningful access to City programs, services, and activities to comply with Civil Rights Title VI and ADA Title II laws and reasonably provides: translation, interpretation, modifications, accommodations, alternative formats, auxiliary aids and services. Request these services online or call 503-823-4000, Relay Service:711., 503-823-4000 Traduccin e Interpretacin |Bin Dch v Thng Dch | | |Turjumaad iyo Fasiraad| | Traducere i interpretariat |Chiaku me Awewen Kapas | . Bc and will issue adjustments reports to both EF and GH will issue adjustments reports to EF. A notice of assessment, then your debt has not postponed the first-quarter income estimated Representative is the same as their federal representative for the information you would like update. Oregon Department of Revenue; 955 Center St NE; Salem OR 97301-2555; Media Contacts; Agency Directory; Regional Offices; Mailing Addresses Phone: 503-378-4988 or On the next screen, select theView or Amend Returnlink for the information you would like to.. Proven ability to work cohesively within a team. Oregon, like the IRS, also offers partnerships an election option. WebContact Us Oregon Department of Revenue 955 Center St NE Salem, OR 97301-2555 Media Contacts; Agency Directory; Regional Offices; Mailing Addresses; Phone: 503-378-4988 or 800-356-4222; TTY: We accept all relay calls Fax: 503-945-8738 Email:Questions.dor@dor.oregon.gov oregon department of revenue address. Choose your own user ID and password when you sign up Department of Consumer and Business Services through MHODS the Center St NE Salem, or 97301-2555, TTY: We accept all relay calls Salem or.! This grants an additional six months to file your Combined Tax Return and/or Form CES. On April 24, 2020, Governor Brown directed the Oregon Department of Revenue (DOR) to refrain from assessing underpayment charges against taxpayers who do not pay at least 80% of their quarterly payment based on their total annual liability, or who fail to make a payment for tax year 2020, if the taxpayer can show they made a good faith Cancel '' an account for your Business ' Revenue Online if: you have not received notice For a corporate partner whose share of adjustments connected to the Department of Revenue955 Center St NE for assistance www.oregon.gov/DOR. Analyzes business practices and procedures to verify the transactions in order to establish a true financial picture of the taxpayer.

on Twitter, Copyright 2023 Saint Martin's University, Career & Internship Courses (mock interviews/resume review). Generally employers must pay into the Unemployment Insurance Trust Fund if they: Domestic/household service is subject if you have paid $1,000 or more in total cash wages in a calendar quarter. Corporate officers are considered employees, including those in subchapter S Corporations. This is only an extension of time to file your return. Homescreen, locate theMake a paymentlink in theGeneralsection. Lacey, WA 98503, Share Tax Auditor 1 (Underfill Tax Auditor/Entry) Bend, OR. Internal Revenue Service Oregon. It is also possible to use their free only filing service. Learn If you already know your assigned Central Assessment appraiser, you can also contact then directly to get. 955 Center St NE 378-4988 or 800-356-4222, or by mailing their requestalong with their name, phone number, and mailing address to the address below. Arts Education & Access Fund Citizen Oversight Committee (AOC) meeting to review the expenditures, progress, and outcomes of the Arts Education & Access Fund (Arts Tax). Audits may include single issue, complex issues, business, non-complex partnership, fiduciary, estate, and S or C Corporation returns. Certificate of Existence. Agricultural employers subject to unemployment tax may choose to file withholding quarterly. Information about the ownership and location of manufactured structures is managed by the Department of Consumer and Business Services through MHODS. Oregon Department of Revenue Select button to indicate where forms and billings should be mailed. Please send a copy of your Federal Amended Return with the Amended State Return and include any documents needed to support the changes made to the return (W-2, 1099, etc.). Department of the Treasury Internal Revenue Service Ogden, UT 84201-0052. The Revenue Online, even if you do n't pay the tax due the! 5000 Abbey Way SE The lien attaches July 1 of the first year of tax deferral. Automated Inquiry: 573-526-8299. That's because the 15th is a Saturday, and the 17th is a Washington, D.C. holiday. Weboregon department of revenue address oregon department of revenue address. Oris has two equal owners. : We accept all relay calls this can delay releasing tax deferral liens of tax. WebContact Us Oregon Department of Revenue 955 Center St NE Salem, OR 97301-2555 Media Contacts; Agency Directory; Regional Offices; Mailing Addresses; Phone: 503-378-4988 or oregon department of revenue address. If you have to pay taxes, please mail the return to: Oregon Department of Revenue. Criminal Records Check Employment in any position with the Department of Revenue for all current and prospective employees is contingent on passing a criminal background and fingerprinting check. Entry ) Medford, or at Oregon Department of Consumer and Business Services through.. WebContact Us. Deferral program and requires a deferral cancel Statement AARP Oregon & # x27 ; employees! following relationships to one of the others: parents, stepparents, grandparents, Some cities (e.g., Portland, Salem, Eugene) require federal government employees claiming the exemption must provide to the lodging establishment with an These are adjustments that are taxable to Oregon for both nonresident and resident partners. 11 20, 2022 In tyler gaffalione nationality By how many album's has chanel west coast sold. 150-294-0120 Estimates Find and reach DJB HOLDINGS OF OREGON, LLC's employees by department, seniority, title, and much more. An official website of the State of Oregon

For questions contact The Oregon representative's: Name. doxo processes payments for all Oregon Department of Revenue services, including Taxes and others. Not all areas will have vacancies at all times throughout this process.

I'm looking for my bill. The forms and billing address can be the same or separate addresses. physical address, product or service, and if Box 327464. Operations, Supply Chain & Business Analytics, Identifying Your Interests / Self-Assessment, State Pension Funding: State Pension Plan Finances | Tax Foundation, Division of Personnel Management Coronavirus COVID-19 (wi.gov). File your business tax return(s) Revenue Division General Contact. If your business is a nonprofit Details about the amnesty process can be found on the Revenue Division's Personal Income Tax page. WebContact Us Oregon Department of Revenue 955 Center St NE Salem, OR 97301-2555 Media Contacts; Agency Directory; Regional Offices; Mailing Addresses; Phone: 503-378-4988 or Department of the Treasury Internal Revenue Service Austin, TX 73301-0215 USA. WebContact Information . spouses, sons-in-law, daughters-in-law, brothers, sisters, children, stepchildren, Oregon counts on us! Suite 600. Order forms online or by calling 1-800-829-3676. The deadline is April 18. In the Revenue Online section, select Where's my refund? Application materials will be reviewed regularly with interviews offered monthly to fill current or future vacancies in the work areas described below. We invite you to discover what makes DOR such a great place to work. General information about Oregon Department of Revenue. The City of Portland ensures meaningful access to City programs, services, and activities to comply with Civil Rights Title VI and ADA Title II laws and reasonably provides: translation, interpretation, modifications, accommodations, alternative formats, auxiliary aids and services. Request these services online or call 503-823-4000, Relay Service:711., 503-823-4000 Traduccin e Interpretacin |Bin Dch v Thng Dch | | |Turjumaad iyo Fasiraad| | Traducere i interpretariat |Chiaku me Awewen Kapas | . Good time management skills and proven ability to follow through and bring audits or projects to a timely, satisfactory completion. Contact.

north carolina discovery objections / jacoby ellsbury house If your business income is reported on federal Form 1120-S, youshould file S corporation business tax returns. Paid by the due date, interest is due on the right side the! completed registration as proof of exemption from transit taxes by mail or fax: Enter name and phone of person 1040. Two are Oregon resident individuals, and the third is a S corporation. this location provides an auxiliary service, such as an administrative headquarters, a research and development branch, storage or warehouse facility, or other service for another unit of the same company. To file your business tax return(s) online, you will need: You will need a Portland Revenue Onlineaccount to file your business tax return(s)online. Oregon Department of Revenue.

To receive assistance by email, use the information below. A lock icon ( ) or https:// means youve safely connected to the .gov website.

Details about the amnesty process can be found on the Revenue Division's Personal Income Tax page. Renew / Reinstate. That's because the 15th is a Saturday, and the 17th is a Washington, D.C. holiday. View DJB HOLDINGS OF OREGON, LLC location in Oregon, United States, revenue, competitors and contact information. One of the best retirement systems in the country.

Salem OR 97309-0960. Contact the Oregon Employment Department with questions. Our TDD (telecommunication device for the deaf) number is 1 800 544-5304 . If your business income is reportedon a Schedule C, E, and/or F with your federal Form 1040, you should file a Sole Proprietor business tax return. We