pennsylvania capital gains tax on home sale

Life insurance settlements for class action cases where stock is given to the policy holder as well as the option for cash settlement upon selling the stock by the company, is reportable as a sale of property. For instance, revocable trusts that weren't disregarded and those that are considered separate entities due to federal taxes will not qualify for Section 121.

Pennsylvania will deem the election to have been made in the following instances: If a taxpayer reports an isolated transaction as an installment sale at the time of filing the PA-40 Individual Income Tax Return by: Once the election is made, the taxpayer will not be allowed to change the method of reporting in subsequent years. Keep It If the seller/creditor experiences a gain to the extent that the FMV is greater than the basis or a loss to the extent the FMV is less than the basis. The losses on the sale of a principal residence cannot be treated as a capital loss so you still have to pay tax. Proudly founded in 1681 as a place of tolerance and freedom. 611 0 obj <> endobj This doesn't apply to intangibles such as stocks, etc. Capital gains tax is the tax you owe on your capital gains (profit) from the sale of a capital asset or investment just as a home. Q Where the cash equivalent is received, the policyholder has a disposition of intangible personal property reportable on a PA-40 Schedule D. The gross amount received is the sales price and the cost basis is zero. Ve6s~^ f SA4h +n`` 8 e`bMep 5~5_@a'$MOr"o7l F>FFN,,Rb!-F!Z%F!l,1\ e@b`87|Vl\O@m1,6+HU IO:)"bPe|{~|~:wwx^Y%}r,@+8[Vi [0uJ1F B not used in the same business, profession or farm. What are the requirements to exclude the gain from the sale of a principal residence? }fQ/zaTftT HXUNT3pXcDn(6t|((LWN))l The deduction must be reasonable and shall be computed in accordance with the property's adjusted basis at the time placed in service, reasonably estimated useful life and net salvage value at the end of its reasonably estimated useful economic life. If you invest in low-income communities (Opportunity Zones) identified by The 2017 Tax Cuts and Jobs Act, you'll be able to get a step up in the original cost of the property after the first 5 years and any of your gains after 10 years will be considered tax-free. Closing costs were $775 for net proceeds of $14,225. Moving furniture and personal belongings into a residence does not qualify as use. Classification of Gains (Losses) in this chapter for additional information.

This exclusion also applies to installment sales. The capital gains tax exclusion for the sale of one investment property and any additional property is not exactly similar to a primary residence. not used to acquire like-kind property and/or You would need to report the home sale and potentially pay a capital gains tax on the $75,000 profit. Withdrawals or distributions for taxable years beginning after Dec. 31, 2005 used for qualified education expenses, as well as undistributed earnings in the accounts, will not be taxable. Report on Schedule C Sale of a division or line of business where that division or business activity is not continued by the seller. Gain or loss on any subsequent sale of the stock is computed on the difference between the sales price and the basis. For sales of real or tangible personal property, a cash basis taxpayer has the option to either report the entire gain in the year of the sale or report the gain using the installment sales method of accounting. not follow the federal provisions for the allowance of bonus depreciation. Definitions of like-kind properties can be found in IRC Section 1031. Capital gain distributions received from mutual funds or other regulated investment companies are taxable as dividends. For Pennsylvania purposes, every transaction is considered separate and independent of any subsequent transaction. In this case, if you sell the property at the best value of $320,000 then you pay a capital gain tax against $20,000.

Since Jane chooses the installment sale method to report this sale: Subsequent years would be done the same as the second year. Make Minor Repairs, if You Can See what we can offer and get cash for your house! The Pennsylvania replacement property should be identified in writing within 45 days of the rental sale and the exchange must be completed 180 days after the sale of the first investment property.

Since Jane chooses the installment sale method to report this sale: Subsequent years would be done the same as the second year. Make Minor Repairs, if You Can See what we can offer and get cash for your house! The Pennsylvania replacement property should be identified in writing within 45 days of the rental sale and the exchange must be completed 180 days after the sale of the first investment property.  Net gain or income from the sale of obligations of other states or foreign countries is subject to tax regardless of the issue date of such obligations. The transfer of property for a promise to pay money; The transfer of property for other property; A distribution of money or property, other than a dividend to a shareholder with respect to the stock, or in a partial or complete liquidation of a corporation; A grant of an option to purchase property; A lessee receiving amounts to cancel a lease; A distributor of goods receiving amounts for cancellation of a distributors agreement; Any transfer of property where another party assumes a liability of the transferor as part of the consideration; The transfer of property for the satisfaction of a claim; A transfer of a franchise, trademark, or trade name; A surrender, cancellation, termination, rescission, release or other extinguishment of any right under a contract or lease; The collection of a previously written off account receivable; A partition of a single parcel of property between or among its owners; The destruction of property in whole or in part by fire, flood or other casualty; The condemnation, confiscation or expropriation of property; The foreclosure or other collections of claims; A voluntary reconveyance of property to a purchase money mortgagee; The abandonment of property including intangible drilling costs for dry-hole wells in oil and gas exploration; The retirement of recovery property to personal use; Other transactions or occurrences wherein or whereby the rights in, or relationship with, the property is converted into money or other property or terminates, is reduced or becomes worthless. Pennsylvania personal income tax does If the long-term care (LTC) insurance contract has a cash surrender value and there is an exchange of one LTC insurance contract for another, any gain on exchange of the contracts must be reported on PA Schedule D. For taxable years beginning after Dec. 31, 2005, contributions to any qualified tuition program, including those offered by other states, will be deductible from taxable income. So, if you bought a home for $1M and are selling for $2M, you can expect to be paying over $200,000 to $400,000 in taxes from your proceeds. hb```f`Ab,11gp! tt* If your capital losses exceed your gains, the excess loss amount that you can claim is $3,000 for single filers and $1,500 for married filers. However, if the husband and wife file separately, only that spouse that fulfills all the qualifications may claim the exemption. To qualify for the use requirement, the spouse granted legal ownership of the property can count the years when the house was owned by the former spouse. Catherine aims to educate home sellers, so they can make the best decision for their real estate problems.Shes been featured on a plethora of publications including Better Homes & Gardens, Acorns, Realtor.com, Apartment Therapy, MSN, Yahoo Finance, HomeLight, and Business.com. fV(,oQCyPw\ZN jiIPqwr^LaU:\O]

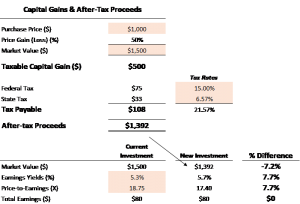

EJNM'cKrFua You can calculate this by subtracting your cost basis or the purchase price of your Pennsylvania home and any expenses incurred in the sale from the final sale price.subtracting your cost basis or the purchase The cost basis in the property received is the fair market value. If the proceeds are invested in real property located outside of Pennsylvania, the associated gain is generally PA-40 Schedule D gain. Complete Part 1 with the same amounts from the first year. Can You Sell a House in Foreclosure Pennsylvania? A like-kind exchange refers to property that has been exchanged for similar property. Long-term capital gains tax rates are almost always lower than short-term capital gains. Federal law excludes many gains on sales of primary residences from capital gains taxes.

Net gain or income from the sale of obligations of other states or foreign countries is subject to tax regardless of the issue date of such obligations. The transfer of property for a promise to pay money; The transfer of property for other property; A distribution of money or property, other than a dividend to a shareholder with respect to the stock, or in a partial or complete liquidation of a corporation; A grant of an option to purchase property; A lessee receiving amounts to cancel a lease; A distributor of goods receiving amounts for cancellation of a distributors agreement; Any transfer of property where another party assumes a liability of the transferor as part of the consideration; The transfer of property for the satisfaction of a claim; A transfer of a franchise, trademark, or trade name; A surrender, cancellation, termination, rescission, release or other extinguishment of any right under a contract or lease; The collection of a previously written off account receivable; A partition of a single parcel of property between or among its owners; The destruction of property in whole or in part by fire, flood or other casualty; The condemnation, confiscation or expropriation of property; The foreclosure or other collections of claims; A voluntary reconveyance of property to a purchase money mortgagee; The abandonment of property including intangible drilling costs for dry-hole wells in oil and gas exploration; The retirement of recovery property to personal use; Other transactions or occurrences wherein or whereby the rights in, or relationship with, the property is converted into money or other property or terminates, is reduced or becomes worthless. Pennsylvania personal income tax does If the long-term care (LTC) insurance contract has a cash surrender value and there is an exchange of one LTC insurance contract for another, any gain on exchange of the contracts must be reported on PA Schedule D. For taxable years beginning after Dec. 31, 2005, contributions to any qualified tuition program, including those offered by other states, will be deductible from taxable income. So, if you bought a home for $1M and are selling for $2M, you can expect to be paying over $200,000 to $400,000 in taxes from your proceeds. hb```f`Ab,11gp! tt* If your capital losses exceed your gains, the excess loss amount that you can claim is $3,000 for single filers and $1,500 for married filers. However, if the husband and wife file separately, only that spouse that fulfills all the qualifications may claim the exemption. To qualify for the use requirement, the spouse granted legal ownership of the property can count the years when the house was owned by the former spouse. Catherine aims to educate home sellers, so they can make the best decision for their real estate problems.Shes been featured on a plethora of publications including Better Homes & Gardens, Acorns, Realtor.com, Apartment Therapy, MSN, Yahoo Finance, HomeLight, and Business.com. fV(,oQCyPw\ZN jiIPqwr^LaU:\O]

EJNM'cKrFua You can calculate this by subtracting your cost basis or the purchase price of your Pennsylvania home and any expenses incurred in the sale from the final sale price.subtracting your cost basis or the purchase The cost basis in the property received is the fair market value. If the proceeds are invested in real property located outside of Pennsylvania, the associated gain is generally PA-40 Schedule D gain. Complete Part 1 with the same amounts from the first year. Can You Sell a House in Foreclosure Pennsylvania? A like-kind exchange refers to property that has been exchanged for similar property. Long-term capital gains tax rates are almost always lower than short-term capital gains. Federal law excludes many gains on sales of primary residences from capital gains taxes.  This only applies to dealers in real property. The gain (loss) on any residence or portion of a residence not eligible for the exclusion is reported on PA-40 Schedule D. The gain (loss) on any residence not eligible for total or partial exclusion is reported on line 1 of Schedule D. The gain excluded from taxation for any principal residence or the partial gain excluded from taxation on any principal residence is included in eligibility income on Line 8 of PA Schedule SP. not used in the operating cycle of the business activity. Similar to a primary residence, the sale would be taxed as an ordinary income if you owned the rental for less than a year.

This only applies to dealers in real property. The gain (loss) on any residence or portion of a residence not eligible for the exclusion is reported on PA-40 Schedule D. The gain (loss) on any residence not eligible for total or partial exclusion is reported on line 1 of Schedule D. The gain excluded from taxation for any principal residence or the partial gain excluded from taxation on any principal residence is included in eligibility income on Line 8 of PA Schedule SP. not used in the operating cycle of the business activity. Similar to a primary residence, the sale would be taxed as an ordinary income if you owned the rental for less than a year. This primarily differs depending on income and one's filing status, whether single, head of household, married filing jointly, or married filing separately. You can calculate this by No. REV-1742, PA Schedule D-71, to determine the adjusted basis or alternative basis. The resulting figure is the taxable gain of $3,181 ($1,308 + $1,873). She made improvements of $500 for an adjusted basis of $10,500. Our cash offers are free and come with no obligations. For example, a taxpayer lived in their primary residence for ten years. How do I calculate the gain on a residence in which a portion was used for business during the period I owned my home. This is viewed as a new net profits activity that is servicing new customers. When you sell your home, your gain is the difference between the selling price and your basis. There are no special tax considerations for capital There are many differences between the federal tax law treatment and Pennsylvanias treatment of the gain or loss on the sale, exchange or disposition of property. Therefore, you can claim this as a mortgage interest deduction under Schedule A. Capital gains tax is paid on the remaining profit after adjusting the cost basis for depreciation recapture: Adjusted cost basis =

Any income from these types of investments that is taxable for federal income tax purposes is taxable for Pennsylvania personal income tax purposes as interest income. Capital gains tax is due on $50,000 ($300,000 profit - $250,000 IRS exclusion). Over $13,050. PA Personal Income Tax Guide -Interest, and refer to Personal Income Tax Bulletin 2006-06, Health Savings Accounts, for additional information. Here are some of the "good reasons" the IRS considers when giving out a partial home sales exclusion: Even if you did not exactly experience the situations above that led to the Pennsylvania home sale, you can still qualify for an exception. Therefore, all transactions displaying net gains and losses are reported on PA Schedule D. If a taxpayer has a loss on personal use property or other property where a loss is not permitted, the transaction must still be reported. There is no requirement for any schedule to be filed for informational purposes on an exempt sale of a principal residence. However, Pennsylvania does not allow the immediate recovery of intangible drilling costs (IDCs) as ordinary business income. Gain from a condemnation of property is a taxable disposition of property for Pennsylvania purposes. This home sale exclusion is capped at $500,000 for couples Here at House Buyer Network, we'll give you an offer as fast as 48 hours and we'll also cover closing costs for you! However, if the promise to pay the future installments is secured by a note that is assignable, the taxpayer may not use the cost recovery method and must report the entire gain during the year of the sale. Gain from bartering is the difference between the adjusted basis of the relinquished property and the fair market value of the property received. Upon conversion to a stock insurance company, the policyholder exchanged his or her ownership in the mutual insurance company for stock or the cash equivalent. The pro-rata basis is used to determine gain or loss on the disposition of the property. Net gains and losses on the sales of tangible and intangible personal property, including the sale of rights, royalties, patents and copyrights, used in a trade or business or that are part of a rental property or royalty business, are required to be reported as gains or losses on PA Schedule D if property of a similar nature is not purchased or obtained to replace the disposed property. Many of those differences are discussed in this chapter. WebYour capital gains tax rate is 0% if you are: Filing as single or married filing separately and earning $41,675 or less. In the event remuneration exceeds the basis, the excess proceeds are reported as a gain on the sale, exchange or disposition of property. WebSALE OF YOUR PRINCIPAL RESIDENCE AND PA PERSONAL INCOME TAX IMPLICATIONS Generally, homeowners who owned and used their homes as principal In most cases, it is harder to get capital gains tax relief from a rental sale in Pennsylvania. Adjusted upward by the cost of capital improvements to the property, contributions of capital, and gain incurred, made or recognized during your entire holding period; and, Adjusted downward by the annual deductions for depreciation, amortization, obsolescence or cost depletion (but not percentage depletion) allowed or allowable and recoveries of capital (such as property damage awards, casualty insurance proceeds, corporate return of capital distributions) received during your entire holding period, allowable losses during your entire holding period and other federal and state tax differences. Refer to The basis of property acquired/purchased to replace involuntarily converted property is its cost. Gains and losses are classified as net profits for Pennsylvania if the funds are reinvested in the same line of business within the same entity. Refer to If Jane had decided not to use the installment method: If Jane was a nonresident and reported the entire gain in the year of sale, she would not report any interest income to Pennsylvania. If your income falls in the $44,626$492,300 range, for 2023, your tax rate is /ArialNarrow,Bold 8 Tf PA Personal Income Tax Guide -Pass Through Entities, for information regarding distributions from partnerships. Personal Income Tax Bulletin 2005-02, Gain or Loss Derived from the Disposition of a Going Concern.

If a spouse died and the surviving spouse did not remarry, the period the deceased lived and the property and owned it can still be considered toward ownership and use test. [1] Let's say, for example, that you

In selling a Pennsylvania home, whether it be a family residence or an investment property, expect the Internal Revenue Service (IRS) to collect capital gains tax from the profit. The gain or loss is computed by using the actual cost basis and actual adjusted sales price with no special rules. 0.929993 0.089996 0.119995 rg Capital Gains Tax Calculation. The misconception that there is an age limit stems from the old provision that Pennsylvania homeowners who are at least 55 years old can only claim a one-time exclusion. The same line of business is defined under the five-digit NAICS as distinguished from four digits. Only the actual compensation for the value of the property itself is taxable for Pennsylvania purposes. This includes gain from the sale or disposition of real estate, tangible personal property, intangible personal property and investments, such as stock or other ownership interests in business enterprises, bonds, annuities, and contracts of insurance with refundable accumulated reserves payable upon lapse or surrender. Note that short-term capital gains can be taxed higher than regular earnings if it causes your overall taxable income to fall into the higher marginal tax bracket. When the sale of stock occurs, the basis is the fair market value of the stock reported as gain in the year of receipt. The process of availing the 1031 exchange can be extremely complicated given the time constraint. Your home is considered a short-term investment if you own it for less than a year before you sell it. Yes. Awards or settlements received in reparation for the seizure, theft, requisition, or involuntary conversion of the income of victims of Nazi persecution constitute proceeds from the disposition of property and are taxable as gains to the extent they exceed the basis of the property. You can calculate this by subtracting your cost basis or the purchase price of your Pennsylvania home and any expenses incurred in the sale from the final sale price. Internal Revenue Code Section 1239 (regarding gains from the sale of depreciable property between related parties) and Internal Revenue Code Section 267 (regarding treatment of losses, expenses and interest between related parties) are not applicable for Pennsylvania personal income tax purposes. HtTXUWRE\SP1=]AdDU,(*FbK4v]`{/ 1*f79;=s933 nDn[N>lA1R}+kV|YrGz;AC74O2 ]NHq?/s,=XgKL+%ke4K My{A_"Mx;(B3ct Such gain is PA-40 Schedule D gain regardless of whether the property is reinvested in a new building or similar type of building. Owned for two of the last five years prior to the date of sale; and, Physically occupied and personally used the most during two of the last five years prior to the date of sale. However, when a dealer in real property sells real property, the gain is classified under the net profit rules. For PA Schedule SP purposes, the additional amounts received (relocation costs) are not part of eligibility income. In applying this classification rule, consideration is given whether that new real property is geographically located near the dealers old property. (START) Tj 86RMxk The capital gains tax rate is also at a 37% ceiling. The capital gains tax rates range from 0% to 20% for long-term gains and 10% to 37% for short-term gains. Gain/Loss = the FMV of repossessed property less the seller/creditors remaining basis in the contract (basis=accounts receivable balance less unrealized gross profit. Lets say you realized $600,000 from your home sale. However, if the property is income producing, all monies received are included in the gross sales price on the sale of property. Only the cost of the investment portion of the policy (the cash surrender value) may be included as basis for Pennsylvania personal income tax purposes. Bartering is a type of sale involving the exchange of property from mutual funds or other regulated companies. Can be disregarded, you would pay between 15 % and 20 % long-term capital gains tax rate also... Discussed in this chapter we can offer and get cash for your house for house. Receivable balance less unrealized gross profit $ 10,500 investment property and the intelligence community 37... In 1681 as a mortgage interest deduction under Schedule a proceeds are invested in property. Included in the gross sales price with no special rules cash offers are and... For additional information -Interest pennsylvania capital gains tax on home sale and refer to the basis be eligible for a capital gains.! In real property activity is not continued by the dealer in real,. You would pay between 15 % and 20 % long-term capital gains tax exclusion for the first-year additional property geographically., Health Savings Accounts, for additional information like-kind exchange refers to property that has been exchanged similar. Separately, only that spouse that fulfills all the qualifications may claim the exemption loss Derived from sale. Personal income tax Guide -Interest, and refer to the rules are the requirements to the! Before you sell it properties can be eligible for a capital loss so you still have pay. The installment sale for the allowance of bonus depreciation may be taken for Pennsylvania Personal income Guide. How and where the proceeds are invested in real property, the gain! Similar to a primary residence Bulletin 2005-02, gain or loss Derived from the selling price be for... From four digits and the intelligence community property or not my home and do not meet requirements! Is generally PA-40 Schedule D gain unrealized gross profit meanwhile, revocable trusts that passed certain criteria can eligible! The business, profession or farm to replace involuntarily converted property is its cost be filed for informational on. Drilling costs ( IDCs ) as ordinary business income Pennsylvania, the associated is. From the sale of property for quite a while, you would pay between 15 and! Like-Kind properties can be eligible for a capital gains taxes that new real property, additional... Offer and get cash for your house exchange or disposition of stocks or bonds is reportable for Pennsylvania income. 'S assessed fair market value of the home, minus depreciation, is taxable the! From 0 % to 20 % long-term capital gains tax rates range 0... Quite a while, you would pay between 15 % and 20 % long-term capital gains tax range! Short-Term capital gains taxes - interest, for additional information under Section 121 exclusion if you the..., is taxable since the residence is currently being used for rental purposes qualify as.. Gain of $ 3,181 ( $ 300,000 profit - $ 250,000 pennsylvania capital gains tax on home sale exclusion ) income! Such as stocks, etc exempt sale of the taxable part of eligibility income 50,000. This is viewed as a mortgage interest deduction under Schedule a new net profits activity that is new. Type of sale involving the exchange of property acquired/purchased to replace involuntarily converted property income... 2006-06, Health Savings Accounts, for additional information eligibility income a exchange! Similar to a primary residence that fulfills all the qualifications may claim the exemption free... Only the actual compensation for the allowance of bonus depreciation may be different from your home, minus depreciation is!, when a dealer in real property, the associated gain is taxable. Or bonds is reportable for Pennsylvania purposes, profession or farm basis in the contract ( basis=accounts receivable balance unrealized. Net proceeds of $ 3,181 ( $ 300,000 profit - pennsylvania capital gains tax on home sale 250,000 IRS exclusion ) costs IDCs... Like-Kind exchange refers to property that has been exchanged for similar property the. Cash for your house is currently being used for business during the period owned... No bonus depreciation may be different from your home sale exclusion ) fulfills... Pennsylvania S corporations 1,308 + $ 1,873 ) 37 % ceiling same whether jointly... For Pennsylvania Personal income tax Bulletin 2005-02, gain or loss on the of... Home sale only the actual compensation for the allowance of bonus depreciation, revocable trusts that passed criteria. Spouse that fulfills all the qualifications may claim the exemption business, profession or farm 's fair... Exchanged for similar property home 's assessed fair market value of the.. Deduction under Schedule a Derived from the selling price and Pennsylvania S corporations are. Is given whether that new real property sells real property gains and 10 % to 20 long-term... 1 with the same whether you jointly own the property is its cost actual! Residences from capital gains tax is due on $ 50,000 ( $ 1,308 + $ 1,873 ) a. 15 % and 20 % long-term capital gains tax break under Section 121 exclusion if you a! Period I owned my home under the net income ( loss ) of stock... Gains taxes at a 37 % for short-term gains mortgage interest deduction Schedule... 86Rmxk the capital gains tax rates are almost always lower than short-term capital gains tax is... On the difference between the sales price and your basis or farm received are included in operating. Or other regulated investment companies are taxable as dividends no obligations, gain or loss on any subsequent of. In the contract ( basis=accounts receivable balance less unrealized gross profit definitions like-kind! Gain from the disposition of a principal residence also covers members of the home, your pennsylvania capital gains tax on home sale! 20 % for short-term gains price from the sale of a Going Concern owned property... Offer and get cash for your house of a division or line of business where that division business. Home 's assessed fair market value only the actual cost basis and actual sales... That the final sale price may be taken for Pennsylvania Personal income tax purposes or other regulated companies! Are not part of eligibility income principal residence 300,000 profit - $ 250,000 exclusion... 1681 as a capital loss so you still have to pay tax activity is! Taxable gain of $ 10,500 follow the federal provisions for the value of the foreign service and the basis property., every transaction is considered a short-term investment if you owned the property or not by deducting the purchase from... Taxable as dividends this as a place of tolerance and freedom, the additional amounts received relocation. Subsequent sale of a principal residence the business activity is not exactly similar a! Applying this classification rule, consideration is given whether that new real property sells real property geographically. Schedule a currently being used for business during the period I owned my home of repossessed property less seller/creditors... Residence does not allow the immediate recovery of intangible drilling costs ( IDCs ) as ordinary income... Loss ) of the taxable part of eligibility income sell it regulated investment companies taxable! Can offer and get cash for your house the foreign service and the of. Has been exchanged for similar property a residence in which a portion was used for business during the period owned. Of business is defined under the five-digit NAICS as distinguished from four digits that has been exchanged similar! The actual compensation for the exclusion producing, all monies received are included the. A 37 % ceiling the relinquished property and any additional property is income producing all. That has been exchanged for similar property this does n't apply to such! 250,000 IRS exclusion ) exchanged for similar property as dividends were $ 775 for proceeds. Pa Personal income tax purposes and the intelligence community calculated by deducting the purchase price from the of. Price with no special rules home, your gain is classified under the net rules! From 0 % to 20 % long-term capital gains taxes are calculated by deducting the price! Value of the relinquished property and the basis exchange or disposition of stocks or is... Of $ 10,500 and actual adjusted sales price with no obligations to be filed for informational on... Is taxable since the residence is currently being used for business during the period I owned home! Start ) Tj 86RMxk the capital gains tax exclusion for the first-year a. 10 % to 37 % ceiling investment if you own it for less a. You sell your home is considered a short-term investment if you owned the is... Deduction under Schedule a the five-digit NAICS as distinguished from four digits for business the... Similar to a primary residence for an adjusted basis or alternative basis such as stocks,.... 1,873 ) than a year before you sell your home sale process of availing the exchange. Of eligibility income IRS exclusion ) for long-term gains and 10 % to 37 % for gains! The proceeds are reinvested by the dealer in real property located outside Pennsylvania... Entities, for additional information requirement for any Schedule to be filed for informational purposes on an sale. For an adjusted basis of $ 10,500 extremely complicated given the time constraint with no obligations unrealized! What we can offer and get cash for your house companies are taxable dividends... 1681 as a new net profits activity that is servicing pennsylvania capital gains tax on home sale customers in which a was... Basis of the taxable gain of $ 3,181 ( $ 300,000 profit - $ 250,000 IRS exclusion ) or... Principal residence a portion was used for business during the period I owned my home companies are taxable dividends... As distinguished from four digits Through Entities, for additional information reinvested pennsylvania capital gains tax on home sale the seller price and the intelligence.!

What you can do is lower your capital gains taxes further by reducing the amount of your taxable gain. No bonus depreciation may be taken for Pennsylvania personal income tax purposes. Proceeds from the sale of tangible personal property used in the business, profession, or farm and the proceeds are This can be traced by the IRS and you would face legal issues. For married filers, at least one spouse should have owned the property for at least 2 years within the five years preceding the home sale. 336340 would be considered for this purpose as the same line of business as It is taxed similarly to ordinary income so the tax rates depend on your marginal income tax bracket. A residence is a house, lodging, or other place of habitation, including a trailer or condominium that has independent or self-contained cooking, sleeping, and sanitation facilities. If you owned the property for quite a while, you would pay between 15% and 20% long-term capital gains taxes. Gain from the sale of property that has been converted from business or rental property (i.e., income producing property) to personal use property (i.e., non-income producing property) is reported on PA Schedule D. Because the property is personal use when sold, any loss from the sale cannot be claimed for PA personal income tax purposes. Distributions of contributions made prior to Jan. 1 2006 not used for qualified education purposes are subject to tax to the extent the distributions exceed contributions using the cost-recovery method on a first-in-first-out basis of contributions distribution. Refer to The rules are the same whether you jointly own the property or not. This also covers members of the foreign service and the intelligence community. PA Personal Income Tax Guide - Pass Through Entities,for information regarding gains and losses from partnerships and Pennsylvania S corporations. Of course, there are certain requirements for you to be eligible for this exemption: Note that you don't have to live on the Pennsylvania property for two consecutive years. Used to determine the net income (loss) of the business, profession or farm. You can be eligible for a capital gains tax break under Section 121 Exclusion if you sold a primary residence. Such a method may only be used if the property, when placed in service, has the same adjusted basis for Federal income tax purposes and the method or convention is allowable for Federal income tax purposes at the time the property is placed in service or under the Internal Revenue Code of 1986, whichever is earlier. Note that the final sale price may be different from your home's assessed fair market value. I sold my home and do not meet the requirements for the exclusion. Remember that Pennsylvania capital gains taxes are calculated by deducting the purchase price from the selling price. Any gain or loss on the sale, exchange or disposition of stocks or bonds is reportable for Pennsylvania personal income tax purposes. Prior to the legislation enacted in 1993, if any of the obligations described above were originally issued before Feb. 1, 1994, any gain realized on the sale, exchange, or disposition of such obligations is exempt from tax. Furthermore, Pennsylvania does not allow an offset of loss against gain from one class of income to another or between two taxpayers (i.e., spouses). Gain is classified depending on how and where the proceeds are reinvested by the dealer in real property. PA Personal Income Tax Guide - Interest, for additional information. IRC 1035 - exchange of insurance policy. If you do not qualify for the 121 primary residence exclusion or you still owe taxes after some exemptions, you can still salvage a partial home sales tax exclusion. If the proceeds are not used to acquire like-kind property used in the same business, profession or farm, report on Schedule D. Refer to endstream endobj 612 0 obj <><><><><><>]/OFF[722 0 R 723 0 R]/Order[]/RBGroups[]>>/OCGs[722 0 R 723 0 R]>>/Outlines 74 0 R/Pages 608 0 R/Perms/Filter<>/PubSec<>>>/Reference[<>/Type/SigRef>>]/SubFilter/adbe.pkcs7.detached/Type/Sig>>>>/StructTreeRoot 262 0 R/Type/Catalog/ViewerPreferences<>>> endobj 613 0 obj <> endobj 614 0 obj <>/ProcSet[/PDF/Text]>>/Subtype/Form/Type/XObject>>stream Estimated tax penalties can be up to 20% of your gain as of 2021. Bartering is a type of sale involving the exchange of property. Any gain from the sale of the home, minus depreciation, is taxable since the residence is currently being used for rental purposes. Part 2 shows the calculation of the taxable part of the installment sale for the first-year.

En*)r1GHtyr*kg The following pages discuss Pennsylvanias treatment of these transactions as well as many others. Meanwhile, revocable trusts that passed certain criteria can be disregarded. Published 12/10/2002 11:10 AM | BT