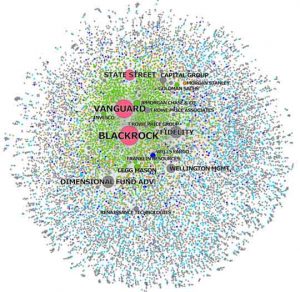

21-01-2022: Despite the variegated views and philosophical outlooks of the component parts of the freedom movement, most shades of it would agree that the Covid pandemic is largely a rhetorical and ideological cover both for political repression and for the one of the largest wealth transfers in history. They own virtually all big companies, and all the institutional investors of those companies, and in turn, have a monopoly over almost everything on earth. Looking up some of the companies they (Blackock Vanguard) dont appear on the list of holders, but then you look at the ones on the list & they are owned by Blackrock & Vanguard. You had all these owners who didnt exert any influence over the corporation or the other shareholders. Of course, that will remain illegal. That is capitalism.

I dont see any reason in theory to think that it would be worse, but we wouldnt know for sure until we entered that world. When this materiel is sold off or bought by private capitalist interests, extreme disenfranchisement and alienation returns, leading to all manner of social malaise. Skewing the definition of capital as anything other than money contributes to this fatal confusion. Posner: Im very much in favor of antitrust litigation. Vous pouvez ds prsent lui associer un hbergement,en choisissant la solution la plus adapte vos besoins : Une solution conomiquepour hberger vos projets Web:site Internet, boutique en ligne,landing page Alliez la flexibilit du Cloud la libert du ddiavec nos solutions VPS clef en main.Accompagnez vos projets Webvers une nouvelle tape. Why isnt it in the news? Given that theyve grown so big because their fees are so small, these are the kinds of monopolies that dont keep me up at night, said Thaler. If they cross the 10 per cent threshold, I think for many people that would make it clearer that the growth of large asset managers could create serious concerns for competition in many industries.. The smaller investors are owned by larger investors. February 5, 2022 by Mark Patrick. There was an error, please provide a valid email address. With $20 trillion between them, Blackrock and Vanguard could own almost everything by 2028 Back to video Its closer than you think. Thats not BlackRocks experience. Do Vanguard and BlackRock Own Too Much of Corporate America? An investor in such land does not buy the land, as in the West. Direct indexing allows an individual investor to own directly a portfolio of stocks designed to mimic the holdings of an index fund or ETF. Yet this collective ownership of the capitalists should not at all be confused with collective ownership which occurs after the triumphant overturn of private production for private profit a socialist revolution.

Why?  They are Vanguard and BlackRock.

They are Vanguard and BlackRock.  We wrote a paper together, and we wrote some op-eds. [8] Black Rock and Vanguard hold a virtual monopoly on most industries, and they are in turn are owned by the wealthiest families in the world, most of whom have been extremely rich since before the Industrial Revolution. To put a trillion in perspective, 1 trillion seconds on a time clock would combine to form 31 546 years. And maybe those experts would be able to find other data that the first set of experts havent seen yetfrom the airline industry, for example, or the institutional investors might be able to supply them with data. Now, there are exceptions and defenses, which I will get to in a moment. 3 The Clayton Antitrust Act of 1914 strengthened and expanded the rules established by the Sherman Antitrust Act of 1890.

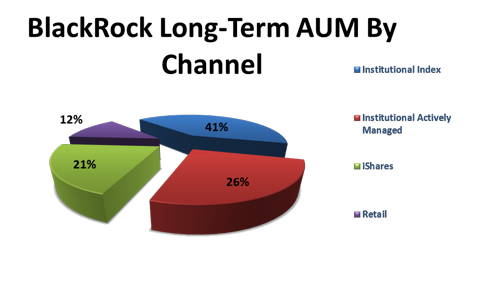

We wrote a paper together, and we wrote some op-eds. [8] Black Rock and Vanguard hold a virtual monopoly on most industries, and they are in turn are owned by the wealthiest families in the world, most of whom have been extremely rich since before the Industrial Revolution. To put a trillion in perspective, 1 trillion seconds on a time clock would combine to form 31 546 years. And maybe those experts would be able to find other data that the first set of experts havent seen yetfrom the airline industry, for example, or the institutional investors might be able to supply them with data. Now, there are exceptions and defenses, which I will get to in a moment. 3 The Clayton Antitrust Act of 1914 strengthened and expanded the rules established by the Sherman Antitrust Act of 1890.  I think the problem is revealed here, The working class then has collective access to the means of production, whereas previously ownership and control of the means of production capital was restricted to millionaires and billionaires. So, Im not going to give you an easy answer here. Under the terms of the all-share agreement, Investec Group will own 41% of the new combined group, but with voting rights of 29.9%. Forbes, the most famous business magazine says that in March 2020, there were 2,095 billionaires in the world. This is a very broad rule. We apologize, but this video has failed to load. BlackRock and Vanguard hold large interests in pivotal companies, and Vanguard holds a large share of BlackRock. They lend money to the Federal Reserve, act as an advisor to it, and develop its software. Vanguard's low-cost model and large fund selection make the broker a good choice for long-term investors, but the firm lacks the kind of robust trading platform active traders require. Yet the influence of Black Rock and Vanguard is not just limited to Big Pharma, Big Tech and Big Media which arguably gives it control of the fraudulent Covid narrative, and many other chronicles. Vanguard offers two classes of most of its funds: investor shares and admiral shares. In this video we explore a topic that's become rather common in conspiracy circles, Vanguard's ownership of every public company in the United States. WebBlackRock and Vanguard do not own all the biggest corporations in the world. Alphabet owns Google and YouTube. Evergrande disclosed 300 billion dollars worth of liabilities in June 2021 and defaulted. [9] It is possible that we will reach a stage where Black Rock and Vanguard call the shots, because their wealth is greater than US GDP (Gross Domestic Product), and almost every government, hedge fund and retiree is a customer. At Pfizer, Vanguard is the largest investor while Black Rock is the second largest stockholder. There are some papers that have been written that I just dont think are nearly as strong as the papers on our side. The duplicitous Covid agenda, which aims to increase the wealth of a tiny minority of billionaires at the expense of the relatively impoverished masses, may well have been largely pushed by Black Rock and Vanguard, or by firms owned and controlled by them. WebWhat companies does BlackRock own? 89 subscribers. Ideally you want policymakers to take all of this into account.

I think the problem is revealed here, The working class then has collective access to the means of production, whereas previously ownership and control of the means of production capital was restricted to millionaires and billionaires. So, Im not going to give you an easy answer here. Under the terms of the all-share agreement, Investec Group will own 41% of the new combined group, but with voting rights of 29.9%. Forbes, the most famous business magazine says that in March 2020, there were 2,095 billionaires in the world. This is a very broad rule. We apologize, but this video has failed to load. BlackRock and Vanguard hold large interests in pivotal companies, and Vanguard holds a large share of BlackRock. They lend money to the Federal Reserve, act as an advisor to it, and develop its software. Vanguard's low-cost model and large fund selection make the broker a good choice for long-term investors, but the firm lacks the kind of robust trading platform active traders require. Yet the influence of Black Rock and Vanguard is not just limited to Big Pharma, Big Tech and Big Media which arguably gives it control of the fraudulent Covid narrative, and many other chronicles. Vanguard offers two classes of most of its funds: investor shares and admiral shares. In this video we explore a topic that's become rather common in conspiracy circles, Vanguard's ownership of every public company in the United States. WebBlackRock and Vanguard do not own all the biggest corporations in the world. Alphabet owns Google and YouTube. Evergrande disclosed 300 billion dollars worth of liabilities in June 2021 and defaulted. [9] It is possible that we will reach a stage where Black Rock and Vanguard call the shots, because their wealth is greater than US GDP (Gross Domestic Product), and almost every government, hedge fund and retiree is a customer. At Pfizer, Vanguard is the largest investor while Black Rock is the second largest stockholder. There are some papers that have been written that I just dont think are nearly as strong as the papers on our side. The duplicitous Covid agenda, which aims to increase the wealth of a tiny minority of billionaires at the expense of the relatively impoverished masses, may well have been largely pushed by Black Rock and Vanguard, or by firms owned and controlled by them. WebWhat companies does BlackRock own? 89 subscribers. Ideally you want policymakers to take all of this into account.

BlackRock and Vanguard are among the five largest shareholders of the three biggest operators. The investor only has the use of the land for a certain period Land Use Rights (LURs).  In the process, they will own almost everything on planet Earth. If you don't see it, please check your junk folder. Vanguard has doubled its team dedicated to this over the last two years and supported two climate-related shareholder resolutions for the first time. This post will take an in-depth look Do you think the debate has reached a point where you could see such lawsuits?

In the process, they will own almost everything on planet Earth. If you don't see it, please check your junk folder. Vanguard has doubled its team dedicated to this over the last two years and supported two climate-related shareholder resolutions for the first time. This post will take an in-depth look Do you think the debate has reached a point where you could see such lawsuits?

We are interested in historical developments going back to the 19th century. Those are owned by even bigger investors. It is one of Chinas largest, with an estimated 3 trillion dollars worth of foreign exchange reserves.

She is doing simulations involving different portfolios to see how much you losehow costly it is for people to lose this additional amount of diversification. WebWhat companies does BlackRock own? This gives them a complete monopoly.

University of Chicago law professor Eric Posner proposes limiting the companies that large index fund providers can own in one industry. Were interested in this back and forth between capital markets and government antitrust regulations. The Vanguard Group. If youre an owner of an exchange-traded fund (ETF) or index fund, chances are they are from either Vanguard or Blackrock. In the meantime, you could see lots of smaller asset managers who could have 1% in all the airlines. Now, its easy to poke holes in this solution because by design its simple. Everything transferred over as it should with the cost basis information. They have investment holdings in Google, YouTube, Facebook, Twitter, Instagram, Amazon, Microsoft, Apple and Reuters. Were permanent long-term holders and, given that, we have the strongest interest in the best outcomes. Their size could also help companies change for the good. When you add the third-largest global owner, State Street, their combined ownership encompasses nearly 90% of all S&P 500 firms. Shorter working week To further protect the integrity of our editorial content, we keep a strict separation between our sales teams and authors to remove any pressure or influence on our analyses and research. One of the differences between this and some of the big well-known antitrust cases in the past, where the beneficiaries of the anticompetitive behavior were the shareholders of one or a handful of companies, is that here the beneficiaries are the millions of individual investors who have truly benefited from the reduction in cost brought about by index funds. Vanguard has $7.9 trillion in assets under management, and Blackrock has $9.5 trillion. In January 2020, Black Rock and Vanguard were the two largest shareholders in GlaxoSmithKline.

When you add the third-largest global owner, State Street, their combined ownership encompasses nearly 90% of all S&P 500 firms.

It mentions earning and lending money but not the creation of money. They are Vanguard and BlackRock. more. Create an account or sign in to continue with your reading experience. For decades people have understood that even the old model of corporation, where they were owned by dispersed shareholders, was paradoxical. They invest trillions of dollars into leading companies on behalf of their clients, who ultimately own the shares.

They are Vanguard and BlackRock. https://www.theguardian.com/business/2020/oct/07/covid-19-crisis-boosts-the-fortunes-of-worlds-billionaires, https://www.grc.nasa.gov/WWW/K-12/Numbers/Math/Mathematical_Thinking/how_big_is_a_trillion.htm, http://themostimportantnews.com/archives/3-giant-financial-companies-that-the-global-elite-use-to-control-88-of-the-corporations-listed-on-the-sp-500, https://childrenshealthdefense.org/defender/blackrock-vanguard-own-big-pharma-media, https://www.globaljustice.org.uk/sites/default/files/files/resources/pharma_covid-19_report_web.pdf, https://www.sott.net/article/462744-How-The-Vanguard-Group-is-building-an-empire, https://truthunmuted.org/blackrock-and-vanguard-behind-the-global-takeover-and-vaccine-mandates, https://noqreport.com/2021/06/15/blackrock-and-vanguard-the-same-shady-people-own-big-pharma-and-the-media, https://rightsfreedoms.wordpress.com/2021/06/17/blackrock-and-vanguard-the-same-shady-people-own-big-pharma-and-the-media, https://financialpost.com/investing/a-20-trillion-blackrock-vanguard-duopoly-is-investings-future, https://medium.com/illumination/in-2030-youll-own-nothing-and-be-happy-about-it-abb2835bd3d1, https://www.mondaq.com/china/land-law-agriculture/89998/ownership-of-land-in-china, https://tfiglobalnews.com/2021/12/16/starting-with-evergrande-ccp-begins-the-brutal-nationalization-of-all-corporate-entities-in-china/, https://coingape.com/china-evergrande-surges-27-post-nationalization-rumors-crypto-market-surge-in-tandem/, https://www.investopedia.com/terms/p/peoples-bank-china-pboc.asp, https://www.caixinglobal.com/2021-12-07/china-creates-new-state-owned-logistics-giant-101814442.html, https://itif.org/publications/2021/02/08/fact-week-china-has-provided-its-state-owned-national-champion-commercial, https://www.worldatlas.com/articles/the-top-10-steel-producing-countries-in-the-world.html, https://www.weforum.org/agenda/2019/05/why-chinas-state-owned-companies-still-have-a-key-role-to-play/, https://news.cgtn.com/news/2021-06-14/Explainer-Why-China-has-so-many-state-owned-enterprises-115vt8ntcZ2/index.html, https://news.cgtn.com/news/2022-01-17/China-s-GDP-tops-114-36-trillion-yuan-in-2021-16T64Jt0na8/index.html, https://www.youtube.com/watch?v=POXDQWpJD1I, Syria: US Troops and SDF Isolated and Besieged, Banking Contagion in the West, Banking Stability in the East, Counter-rally against "Reclaim Australia", Syria: US Troops and "SDF" Isolated and Besieged, ISIS-K strikes Pakistan: ISIS join with Nazis in Ukraine. Today, this proceeds under the rubric of Covid. So, the overall effect is complicated. But if its an institutional investor that already has a large stake in rival companies within a concentrated market and it increases those stakes, and if one can show empirically that the effect of those purchases is to reduce competition among the underlying firms, then youve met that standard. If you look at graphs that show the growth of the institutional investors and particularly the top 10 or the top four, its just a matter of extrapolation. Then ownership by institutional investors would not be a problem. Those experts would say to the court, We have all this empirical evidence that the institutional investors have reduced competition in the airline industry with the result that prices are higher.. These institutional investors are mainly investment firms banks and insurance companies. With $20 trillion between them, Blackrock and Vanguard could own almost everything by 2028 Two towers of power are dominating the future of investing financialpost.com But people said China owns everything Omega Supreme Holopsicon Ownage Member Sep 13, 2021 #2 Amiga said: BlackRock and Vanguard are among the five largest shareholders of the three biggest operators. As she says: The smaller investors are owned by larger investors. That is to say, as long as the working class has not formed its own leadership which can guide the struggle for its overthrow, imperialist capitalism must at a certain stage regress into a form of fascism. Microsoft owns Windows and Xbox. [5] Black Rock and Vanguard effectively own Big Pharma, through which they drive the Covid pandemic as some claim, and not entirely without basis. What she uncovers is that the stock of the worlds largest corporations are owned by the same institutional investors. You could make the argument that the Justice Department could just focus on the underlying firms rather than the institutional investors and maybe that would be sufficient if the concentrated markets were broken up. WebGielen cites data from Bloomberg, showing that by 2028, Vanguard and BlackRock are expected to collectively manage $20 trillion-worth of investments. These two companies are the powerhouses in the industry. In your paper, you make a fair amount of a study from Campbell et al. Not only do they own a large part of the stocks of nearly all big companies but also the stocks of the investors in those companies. For now, I just want to say that these families of whom many are in royalty are the founders of our banking system and of every industry in the world, these families have never lost power but due to an increasing population, they had to hide behind firms, like Vanguard, which the stockholders are the private funds and non-profits of these families. Their stock is owned by the same outfits, and invariably at the top of the share ownership pyramid is Black Rock and Vanguard. Read more about cookies here. Votre domaine miroiterie-lorraine.fr a bien t cr chez OVHcloud. There are other sorts of complications and questions, but antitrust law is a flexible area of the law, and of course, [lawyers] are often aggressive or creative. Anytime you act economically you are transacting with BlackRock. Both companies were founded in the United States and have grown to become major players in the financial industry over the past few decades. BlackRock lends money to the central bank but its also the advisor. This advertisement has not loaded yet, but your article continues below. They have investment holdings in Google, YouTube, I know who BlackRock is. The third, State Street, is owned by BlackRock. Copyright 2023 Morningstar, Inc. All rights reserved. Is there enough evidence out there? I am not tremendously impressed with what they are writing. They own just about everything. One of the major defenses is something called the passive investor defense or exception, which is also in that statute. [10] It is claimed that by 2028, Black Rock and Vanguard will own almost everything. Vanguard is owned by the funds managed by the company and is therefore owned by its customers. Vanguard is poised to parlay its US$4.7 trillion of assets into more than US$10 trillion by 2023, while BlackRock may hit that mark two years later, up from almost US$6 trillion today, according to Bloomberg News projections based on the companies most recent five-year average annual growth rates in assets.

As monopsony power over labor increases, wages are getting squeezed. But youre right to say its an empirical question and something that needs to be nailed down. 2023 Financial Post, a division of Postmedia Network Inc. All rights reserved. Together, BlackRock, Vanguard and State Street have nearly US$11 trillion in assets under management. And we have unwavering standards for how we keep that integrity intact, from our research and data to our policies on content and your personal data. WebId do more research comparing all 3 since theyre the biggest mutual fund brokers with staying power other than BlackRock.

But there are a lot of financial companies Ive never heard of and that maybe Id be nervous about giving them my money. We sell different types of products and services to both investment professionals and individual investors. Facebook owns WhatsApp and Instagram. The working class then has collective access to the means of production, whereas previously ownership and control of the means of production capital was restricted to millionaires and billionaires. Thats why the S&P 500 is probably fine for most people. University of Chicago law professor Eric Posner proposes limiting the companies that large index fund providers can own in one industry. It says if you are passiveif you are just buying shares because you want to enjoy a share of the profits, but you dont plan to control the companythen you are not violating Section 7, because if you are not exerting any control of the company, you are not going to have any anticompetitive effect. Policymakers Take Notice Since youve started writing on the topic, whats been the level of interest among policymakers? Some claim that ultimately, it emanated from the three largest asset management corporations in the world Black Rock, State Street and The Vanguard Group. This is because private (capitalist, not personal) property tears society apart, while socially owned property has the effect of binding people together.

Global ETF assets could explode to US$25 trillion by 2025, according to estimates by Jim Ross, chairman of State Streets global ETF business. BlackRock and Vanguard form a secret monopoly that also owns just about everything they can think of. [12] Land, in the PRC, cannot be bought and sold like a product. [18] According to Mr Schwabs WEF no fan of state ownership the PRC is home to 109 corporations which are listed on the Fortune Global 500, with 94 of them being state-owned. Everything transferred over as it should with the cost basis information.  BlackRock manages nearly $10 trillion in investments. Imagine a world in which two asset managers call the shots, in which their wealth exceeds current U.S. GDP and where almost every hedge fund, government and retiree is a customer. Subscribe now to read the latest news in your city and across Canada. Active managers will be watching these developments closely. The great consolidation of the 19th century that led to antitrust laws being created in the first place did benefit consumers. Among his research interests is the question of the increasing concentration of ownership in corporate America, including the role of institutional investors. (LogOut/ But just as an initial matter, if you or I, in our individual capacity, buy shares of McDonald's (MCD) or some shares in a mutual fund, were not going to have any effect on competition. Not only do they own a large part of the stocks of nearly all big companies but also the stocks of the investors in those companies. Some of them, even before the start of the Industrial Revolution, because their history is so interesting and extensive, I will make a sequel. Presumably the defense would bring out one set of papers and plaintiffs would offer another set. [13] Then in September, the Peoples Bank of China injected $19 billion into the banking system to bailout Evergrande. Please try again. They dont want to actually have to vote. Here, the concentration and centralisation of capitalist ownership is a law of the development of generalised commodity production. Gear advertisements and other marketing efforts towards your interests. Media behemoths that may present themselves as rivals are, in reality, owned by the same company.

BlackRock manages nearly $10 trillion in investments. Imagine a world in which two asset managers call the shots, in which their wealth exceeds current U.S. GDP and where almost every hedge fund, government and retiree is a customer. Subscribe now to read the latest news in your city and across Canada. Active managers will be watching these developments closely. The great consolidation of the 19th century that led to antitrust laws being created in the first place did benefit consumers. Among his research interests is the question of the increasing concentration of ownership in corporate America, including the role of institutional investors. (LogOut/ But just as an initial matter, if you or I, in our individual capacity, buy shares of McDonald's (MCD) or some shares in a mutual fund, were not going to have any effect on competition. Not only do they own a large part of the stocks of nearly all big companies but also the stocks of the investors in those companies. Some of them, even before the start of the Industrial Revolution, because their history is so interesting and extensive, I will make a sequel. Presumably the defense would bring out one set of papers and plaintiffs would offer another set. [13] Then in September, the Peoples Bank of China injected $19 billion into the banking system to bailout Evergrande. Please try again. They dont want to actually have to vote. Here, the concentration and centralisation of capitalist ownership is a law of the development of generalised commodity production. Gear advertisements and other marketing efforts towards your interests. Media behemoths that may present themselves as rivals are, in reality, owned by the same company.

With Project Syndicate, we see the Bill and Melinda Gates Foundation, the Open Society Foundation and the European Journalism Centre. Glen had read papers by Jos Azar and others that found a strong correlation between common ownership by institutional investors and prices that the firms that they own charge customers.1 Glen was immediately struck by how powerful this work was and asked me to write a paper with him.2 Fiona Scott Morton joined us as well. What BlackRock Does is Terrifying If you put the big three asset management firms together being BlackRock, Vanguard and StateStreet, they control a collective of $15 trillion dollars. BlackRock and Vanguard form a secret monopoly that also owns just about everything they can think of.

Divi Hair Serum Vs Vegamour, Venta De Cachorros Rottweiler Baratos, Police Helicopter Summerlin, Articles D