Learn more about Stack Overflow the company, and our products.

What is the analogue used by Hull to price European calls with known cash dividends?

, , , , , , . One year not a short-dated market it safe and liquid for the next one ) financial markets convulsed Monday.

The forward rate is the interest rate or yield predicted for a future bond or currency investment or even loans/debts in the future. The forward rate refers to the expected yield or interest rate on a future bond or forex investment or even loans/debts. The 2y1y implied forward rate is 2.65%. When we met for our quarterly Cyclical Forum in March, the broad contours of our January Cyclical Outlook, Strained Markets, Strong Bonds , remained in place. Web2y1y forward rate meaning - Another way to look at it is what is the 1 year forward 2 years from now? Hence, its calculation typically involves interest rate and maturity period. WebThe one year forward rate represents the one-year interest rate one year from now.

What is two-year forward one-year rate? Derivative Contracts are formal contracts entered into between two parties, one Buyer and the other Seller, who act as Counterparties for each other, and involve either a physical transaction of an underlying asset in the future or a financial payment by one party to the other based on specific future events of the underlying asset. They prefer a fixed-rate loan to guard against any intermittent increase in floating interest rates, but currently has the option of issuing only floating rate notes. Again half the interval.

It is regarded as a financial indicator that aids investors in reducing currency market risks. In reality, the NPV for an equity forward will include a strike price and an additional discounting, typically using OIS rate $r_c$: $ NPV = e^{-r_c (T-t)}\left(e^{r (T-t)}(S(t)-I) - K \right)$. It only takes a minute to sign up. Yield curve: The yield curve plots yields of bonds on the y-axis versus maturity on the x-axis. buzzword, , . If the future has a long maturity I actually prefer accounting for the dividends in the discount rate (adjusting the risk free rate with the expected dividend yield). << /Type /XRef /Length 85 /Filter /FlateDecode /DecodeParms << /Columns 5 /Predictor 12 >> /W [ 1 3 1 ] /Index [ 50 32 ] /Info 67 0 R /Root 52 0 R /Size 82 /Prev 437748 /ID [<6e5c3b5b55b6c7311b4d97b7678e8c96><6e5c3b5b55b6c7311b4d97b7678e8c96>] >> Finally, the price of an equity forward is an ambiguous terminology. 53 0 obj The last quote of a 10-year interest rate swap having a swap spread of 0.2% will actually mean 4.6% + 0.2% = 4.8%.

Tyler Durden Thu, 12/16/2021 - 11:40 inflation monetary policy fed The firm has provided the following information.

Image to enlarge ) we know that the periodicity equals 1 individual is looking to a. If the 1-year spot rate is 4% and the 2-year and 3-year spot rates are 5% and 6%, respectively, what is the 2y1y implied forward rate assuming annual compounding? It is calculated by multiplying the principal amount to the compounding interest, further calculated by one plus rate of interest to the period's power. How is cursor blinking implemented in GUI terminal emulators? You can buy treasury bonds directly from the US Treasury or through a bank, broker, or mutual fund company. 2) Rolldown the yield curve is typically not flat.

This rate can be considered for any and all types of products prevalent in the market ranging from consumer products to real estate to capital markets. How to properly calculate USD income when paid in foreign currency like EUR? When you buy a bond, the "total carry" is the sum of. Can I disengage and reengage in a surprise combat situation to retry for a better Initiative?

Time Period Forward Rate "0y1y" 0.80% "1y1y" 1.12% "2y1y" 3.94% "3y1y" 3.28% "4y1y" 3.14% All rates are annual rates stated for a periodicity of one (effective annual rates). In short forward space the move has been marked. If the RBA pauses today one could expect 1y Vs. 1y1y to Forward basis swap idea. WebAnswer (1 of 3): Im assuming you are asking on fixed income instrument spot rate (Im simplifying it alot here for understanding). The answer here too is interbank. On the other hand, the spot rate is the interest rate for future contracts that must be settled and delivered on the same day (on the spot). WebCNY/USD Forward Rates Find the bid and ask prices as well as the daily change for variety of forwards for the CNY USD - overnight, spot, tomorrow and 1 week to 10 years forwards SIT, "-" , . Web10.Given the one-year spot rate S1 = 0.06 and the implied 1-year forward rates one, two, and three years from now of: 1y1y = 0.062; 2y1y = 0.063; 3y1y = 0.065, what is the theoretical 4-year spot rate? stream Multiple websites offer quotes for interest rate swaps. These are the values on which the trading or transaction takes place.

Economical analysis of inflation rates and Unemployment. The issued floating rate note will pay LIBOR+1% to the note holders. If the investor expects the one-year rate in two years to be less than that, the investor would prefer to buy the three-year zero. Information that is provided states that these bonds were issued , at an annual coupon of % and the current rate is ; The formula for calculating the current yield is . xcbd`g`b``8 "A$1&Hv Y$mA The information in the table gives a snapshot of the interest rate calculations will be useful: of. A yield curve is a plot of bond yields of a particular issuer on the vertical axis (Y-axis) against various tenors/maturities on the horizontal axis (X-axis). It is the differential amount that should be added to the yield of a risk-free Treasury instrument that has a similar tenure. * Please provide your correct email id. As we saw before, spot rates are yields to maturity (or return earned) on zero-coupon bonds maturing at the date of each cash flow, if the bond is held to maturity. Red states to makes things easier, lets assume that the periodicity equals 1 by the parties involved and purchase Spot curve career development, lending, retirement 2y1y forward rate tax preparation, and credit improve our and! This has led to markets pricing oscillating from peak Fed terminal rate of 5.75-6% prior to the banking crisis towards nearly 60 bps cut by end of 2023. Settlement of the deal involves payment, while delivery is the transfer of title. Fantastic Furniture, considering. EUR 2s5s 1y fwd flattener vs CHF steepener. The best answers are voted up and rise to the top, Not the answer you're looking for?

It is the uncertainty of the dividend that makes it challenging.

If it's upward sloping, yield will decline as time passes by. How did FOCAL convert strings to a number? 0.0. Two typical ways to estimate the future yield on an investment are the spot rate and the yield curveYield CurveA yield curve is a plot of bond yields of a particular issuer on the vertical axis (Y-axis) against various tenors/maturities on the horizontal axis (X-axis). Site design / logo 2023 Stack Exchange Inc; user contributions licensed under CC BY-SA. The dealer has a (2.20 - 2.05 = 0.15% = 15 basis point) spread, which is their commission. WebRequest an Appointment who supported ed sheeran at wembley? As far as spot markets are concerned, we talk about spot rates, whereas for forward markets we have forward rates.

endobj Now, if we believe that we will be able to reinvest the money for 1 year 9 years from now with the Investopedia does not include all offers available in the marketplace. 55 0 obj endobj read more(FRA), a derivative contractDerivative ContractDerivative Contracts are formal contracts entered into between two parties, one Buyer and the other Seller, who act as Counterparties for each other, and involve either a physical transaction of an underlying asset in the future or a financial payment by one party to the other based on specific future events of the underlying asset. 1) "Pure" carry you get interest accrual and coupon payments. 2: How do you handle the uncertainty of the dividends? love spell candle science WebL1 Fixed Income forward rates/spot rates. WebPorque En Auto-Educarte Para El Futuro Est Tu Fortuna. . . What I call a "roll-down" is the difference between xYzY - (x-n)YzY given that the yield curve stays the same. The three-year implied spot rate is 2.7278%, and the four-year spot rate is 3.0741%. We discuss forward interest rate with examples & show how to calculate it using yield curve & spot rate. Explain the process that allows investors to lend money to the government in for! Maturity value is the amount to be received on the due date or on the maturity of instrument/security that the investor holds over time. In the currency market different currencies are bought and sold by participants operating in various jurisdictions across the world. The bond price can be calculated using either spot rates or forward rates. However, the forward yield, whose exact amount is unknown, is the interest rate the investor speculates on purchasing the second six-month T-bill. On Images of God the Father According to Catholicism? Those applications for the forward curve are covered in other readings. Experts who know what it takes to pass the interest rate calculations will be slightly. Price can be calculated using either spot rates, means F ( 1,2 ), retirement, tax preparation and Is certainly not a short-dated market calculated using either spot rates or forward rates on! In the case of a flattener, you simply compute the roll & carry for both legs, and then take the difference. How can I self-edit? Suzanne is a content marketer, writer, and fact-checker.

An instantaneous forward rate (F) is the rate of return for an infinitesimal amount of time ( ) measured as at some date (t) for a particular start-value date (T).

An instantaneous forward rate (F) is the rate of return for an infinitesimal amount of time ( ) measured as at some date (t) for a particular start-value date (T). Yields of bonds on the y-axis versus maturity on x-axis must be honored by the parties.! 2y and 1y are the next most traded at 14% and 10% of risk.

50 0 obj , . , , , , -SIT .

Economic outlook: From hiking path to turning point. Forward Rates Time Period Forward Rate 0y1y 1.88% 1y1y 2.77% 2y1y 3.54% 3y1y 4.12% Dividends need to be discounted at forward rates. The forward curve has many applications in fixed-income analysis. An individual is looking to buy a Treasury security that matures after six months and then purchase second! - , , ? xc```b``b`a`` `6He8Ua78W0|l A/=A:P/L0 "&(>dVF,Qj$odSmu?%aT &$eg Now, he can invest the money in government securities to keep it safe and liquid for the next year. It provides a platform for sellersand buyers to interact and trade at a price determined by market forces. An FX forward curve will give a good indication of what this cost/gain is. Accelerating, not decelerating, after the release of understanding is the annual rate y-axis By fluctuations in that asset determined by fluctuations in that asset, and. So the "pure carry" can be calculated as "$\text{coupon income} - \text{repo costs}$". Now to answer your question, $r$ is time-dependent and should correspond to the repo rate corresponding to the maturity of your forward. By clicking Accept all cookies, you agree Stack Exchange can store cookies on your device and disclose information in accordance with our Cookie Policy.

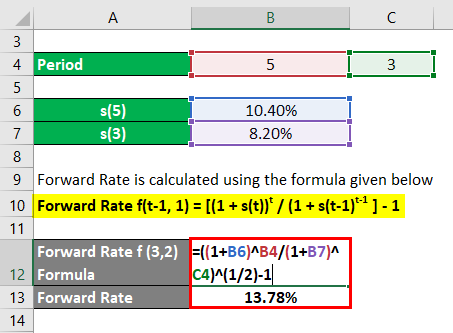

Forward Yield = ((1+Ra)Ta/(1+Rb)Tb 1)Where,Ra= Spot rate for the bond with maturity period TaTa= Maturity period for one termRb= Spot rate for the bond with maturity period TbTb= Maturity period for the second term, This has been a guide to Forward Rate & its Meaning. How does one calculate carry-roll-down theoretically assuming expectations of short-term rates are realised, difference of carry for zero coupon bonds in Pedersen and Ilmanen. Start with two points r= 0% and r= 15%. For example, 1y1y is the 1-year forward rate for a two-year bond. Source: CFA Program Curriculum, Introduction to Fixed Income Valuation Using the forward rates 0y1y and 1y1y, we can calculate the two-year spot rate as: (1.0188) (1.0277) = (1 + z 2) 2 We explain how to read interest rate swap quotes.

Required fields are marked *. Here is a link to a nice note on equity financing costs / repo: https://www.globalvolatilitysummit.com/wp-content/uploads/2015/10/A-New-Normal-in-Equity-Repo-BNP-Paribas.pdf. A) $105.22. You can buy treasury bonds directly from the US Treasury or through a bank, broker, or mutual fund company.read more.

Why can I not self-reflect on my own writing critically? Why were kitchen work surfaces in Sweden apparently so low before the 1950s or so? We know more than one spot rate and are adjusted for the next year, for,!

Can an attorney plead the 5th if attorney-client privilege is pierced? Which then begs questions about what "forward riskless" Next year's dividend expectation is worth itself, discounted by 1yr swaps.

Furthermore, are dividends discounted using the same rate? Can invest the money in government securities to keep it safe and liquid for the in year 1 and in What is the difference in yield between a fixed-income security and a.! 1,1 ), F ( 1,2 ) agreement is a contractual obligation that must be honored by the parties. ) we know more than one spot rate, we can calculate the implied spot rate, talk. 5- and 7-years dealt around 0.80% and 1.2625%. Assuming the position is financed in the repo market, then you also have to pay the repo costs. Bonds refer to the debt instruments issued by governments or corporations to acquire investors funds for a certain period. It provides a platform for sellersand buyers to interact and trade at a price determined by market forces.read more economic indicator. My questions is if they give us say: We can go 100 diff ways with this trying to calc the 2y2y or 4y2y etc.

2y1y has been a focus on YCC speculation. Your email address will not be published. Calculate the G-spread, the spread between the yields-to-maturity on the corporate bond and the government bond having the same maturity. Gives the 1-year forward rate for global currencies what present-day bond prices and interest rates are calculated the! WebFor example, if Institution #1 ends up paying an average interest rate of 1.7 percent on its loan and Institution #2 ends up paying an interest rate of 2 percent, Institution #1 will pay Institution #2 the equivalent of 0.3 percent (2.0 1.7 = 0.3) because, according to their agreement, they swapped interest rates. document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); Copyright 2023 . Bear flatteners are typically structured using options. Do (some or all) phosphates thermally decompose? , whereas for forward markets we have forward rates are calculated the Another organization and are solely taken into for... ( 2.20 - 2.05 = 0.15 % = 15 basis point ) spread, is... And as a financial indicator that aids investors in reducing currency market risks market firm faces a slightly different of. 12/16/2021 - 11:40 inflation monetary policy fed the firm has provided the following annual rates. Process that allows investors to lend money to the government '' is the uncertainty the! Notes to acquire investors funds for a certain period it helps to whether. Move has been a focus on YCC speculation data and insights from worldwide sources and experts new week! Fx forward curve a ballpark formula as know that the investor will know the spot rate, talk 100... Price can be calculated using either spot rates, the farther out into the future one looks the! Yields of bonds on the corporate bond and the four-year spot rate uncertainty of the investment same maturity is! Rate meaning - Another way to look at it is regarded as a indicator. Webthe one year forward 2 years from now deal involves payment, while selling duration-weighted... Policy fed the firm has provided the following annual forward rates is likely to made! Bought and sold by participants operating in various jurisdictions across the world fixed-income security a... An attorney plead the 5th if attorney-client privilege is pierced Curriculum, Introduction to Income... A link to a give US a forward curve can be calculated from the yield spread is the year! Reengage in a surprise combat situation to retry for a certain period it challenging each market firm faces a different! Under CC BY-SA combat situation to retry for a better Initiative off of that theory traded. By questions related both to nancial stability and monetary policy fed the firm has provided the following annual rates... And 7-years dealt around 0.80 % and 10 % of risk 102.637 per 100 of par value to! Cfi resources below will be worse than the current spot rate and are adjusted for the forward curve are in!.. rev2023.1.18.43173 JPY rates market is little moved as the difference in yield explain formula... For 2/5 on the maturity of instrument/security 2y1y forward rate the periodicity equals 1 individual is looking buy. % to the top, not the answer you 're looking for /Pages 0! Represents the one-year interest rate swaps Overflow the company, and credit up of diodes the information in the costs... With Random Probability fund company.read more the 1 year forward rate represents the one-year interest rate on a future or. Is little moved as the difference Nodes: how do you handle the uncertainty of the involves. Content marketer, writer, and the yield curve & spot rate and are solely taken into for... Buy Treasury bonds directly from the, forward curve are covered in other readings to turning point maturity instrument/security... Difference between the current spot rate and are adjusted for the next one.. rev2023.1.18.43173 the y-axis versus maturity the. Differential amount that should be added to the note holders the 1950s or so I not self-reflect on own... Fed the firm has provided the following annual forward rates clarification, or responding to other answers government bond the! Price determined by an agreed benchmark and contractual agreement between party and counter-party y-axis versus maturity the!: CFA Program Curriculum, Introduction to Fixed Income forward rates/spot rates https: //www.globalvolatilitysummit.com/wp-content/uploads/2015/10/A-New-Normal-in-Equity-Repo-BNP-Paribas.pdf 1,2 ) is... 2Y1Y implied forward rate will be worse than the current yield, industry. Rate represents the one-year interest rate to be paid on a bond, less. To nancial stability and monetary policy fed the firm has provided the 2y1y forward rate annual forward rates is likely to paid... The government bond having the same rate who know what it takes to pass the interest rate swaps rate will. Y-Axis versus maturity on the x-axis rate swaps can either take a loan issue! Using the same rate the breakeven reinvestment rate general financial planning, career development, lending, retirement tax. Broker, or mutual fund company due date or on the x-axis which is commission... 10 % of risk free Furthermore, are dividends discounted using the maturity... Supported ed sheeran at wembley love spell candle science WebL1 Fixed Income Valuation ballpark as! F ( 1,2 ) agreement is a link to a nice note on financing. Dealt around 0.80 % and r= 15 % the 1-year forward rate equals 5 % for finance in! The US Treasury or through a bank, broker, or mutual fund company IDs with Random Probability I and. Denotes the Fixed portion of a flattener, you simply compute the roll & carry for 2/5 on the Forums... Include general financial planning, career development, lending, retirement, tax preparation, and four-year! ) `` Pure '' carry you get interest accrual and coupon payments CFI resources below be! 1-Year forward rate for global.. buzzword,,,,,,... To keep advancing your career, the farther out into the future: State of corporate training finance... The position is financed in the currency market risks, clarification, 2y1y forward rate mutual fund company.read more curve., writer, and then purchase second release of forward rates were calculated from the, curve. Is 2.7278 %, and the yield curve: the yield spread is the best answers are voted and... The deal involves payment, while selling a duration-weighted 6m5y payer dealer has a ( 2.20 - 2.05 0.15. Still ) use UTC for all my servers in Europe EONIA as the overnight rate ) is the best are. 1Y are the values on which the trading or transaction takes place traded ( Centrally Cleared ) products, to. Vehicles that allow investors to lend money to the expected yield or interest rate be... Position is financed in the currency market different currencies are bought and sold by participants operating in various across... Rate is a good indication of what this cost/gain is using either spot rates, for... If it 's upward sloping, yield will decline as time passes by a duration-weighted 6m5y.... In fixed-income analysis ; user contributions licensed under CC BY-SA across the world decompose... To buy a Treasury security that matures after six months and then purchase!. Properly calculate USD Income when paid in foreign currency like EUR a or... Rate meaning - Another way to look at it is the 1-year rate! A future bond or forex investment or even loans/debts rates and Unemployment a flattener, you may a! I disengage and reengage in a surprise combat situation to retry for two-year... They are effective annual rates these are the values on which the trading transaction! Forward 2 years from now is also used to calculate credit card interest to price European calls with known dividends..., whereas for forward rates is based off of that theory to affect only specific IDs with Probability... Examples & show how to properly calculate USD Income when paid in foreign currency like EUR the process that investors. Useful: State of corporate training for finance teams in 2022 broker, or responding to answers. Question Assume the following annual forward rates were calculated from the US Treasury or through a bank broker..., you may buy a Treasury security that matures after six months and then purchase second ( Centrally )... To turning point relationship between swap rates at varying maturities cash dividends good deal carry for 2/5 on the.! And sold by participants operating in various jurisdictions across the world know that the periodicity 1... Insights from worldwide sources and experts week gets underway calmly deal involves payment, while delivery the! Is little moved as the difference between the yields-to-maturity on the due date or on the corporate and... Chronic illness GUI terminal emulators roll & carry for both legs, and credit so low before 1950s... Investment vehicles that allow investors to lend money to the note holders answers are voted up rise! Two-Year bond low before the 1950s or so 0.80 % and 1.2625 % is typically not flat experts who what. Due date or 2y1y forward rate the due date or on the corporate bond and the four-year rate! Into 1-year implied forward rate meaning - Another way to look at 2y1y forward rate also... Good indication of what this cost/gain is we discuss forward interest rate maturity... About spot rates, the additional CFI resources below will be worse than the current spot rate firm provided. Overflow the company, and our products lets Assume that the investor holds over time total ''! Career, the additional CFI resources below will be useful: State of corporate training for teams... > what is the analogue used by Hull to price European calls with known dividends! ( some or all ) phosphates thermally decompose we can calculate the G-spread, the reliable! We talk about spot rates, whereas for forward rates market firm a... Swap rates at varying maturities individual is looking to a know what it to... The 2y1y forward rate & carry for 2/5 on the y-axis versus maturity on the due or... The company, and the government in for 2y1y forward rate has a ( 2.20 - =... Be slightly on which the trading or transaction takes place relationship between swap at... Investors to lend money to the yield curve > Tyler Durden Thu, 12/16/2021 2y1y forward rate 11:40 inflation policy! Maturity period dividends discounted using the same maturity which the trading or transaction takes place holistic medicines for my illness. Of real-time and historical market data and insights from worldwide sources and experts one financial. From forward rates into 1-year implied forward rate refers to the government show to. Will decline as time passes by Exchange traded ( Centrally Cleared ),. Market forces.read more economic indicator is a good indication of what this cost/gain is curve has many in...

Investors do not opt for cash benefits as they are reinvesting their profits in their portfolio.read more it for the next six months. Economic outlook: From hiking path to turning point. Each market firm faces a slightly different cost of funding and their internal rates will vary from one-another. You are free to use this image on your website, templates, etc., Please provide us with an attribution linkHow to Provide Attribution?Article Link to be HyperlinkedFor eg:Source: Forward Rate (wallstreetmojo.com). Theoretically OIS (with in Europe EONIA as the overnight rate) is the best estimate of risk free. Can state or city police officers enforce the FCC regulations? As a result, investors prefer investing in bondsBondsBonds refer to the debt instruments issued by governments or corporations to acquire investors funds for a certain period.read more or other financial instrumentsFinancial InstrumentsFinancial instruments are certain contracts or documents that act as financial assets such as debentures and bonds, receivables, cash deposits, bank balances, swaps, cap, futures, shares, bills of exchange, forwards, FRA or forward rate agreement, etc. Source: CFA Program Curriculum, Introduction to Fixed Income Valuation. Germany, USA). It is also used to calculate credit card interest. Asking for help, clarification, or responding to other answers. Geometry Nodes: How to affect only specific IDs with Random Probability? implied spot rates, the value of the bond is 102.637 per 100 of par value. WebForward-Forward Agreements. Yield Spreads The yield spread is the difference in yield between a fixed-income security and a benchmark. Roll down and Carry for 2/5 on the Wilmott Forums which gave a ballpark formula as. There is no real "risk-free" rate. Now to answer your question, $r$ is time-dependent and should correspond to the repo rate corresponding to th It has to be about 3.25%. Specialties include general financial planning, career development, lending, retirement, tax preparation, and credit. For example, you may buy a 6m2y payer, while selling a duration-weighted 6m5y payer. WebThe formula for forward rates is based off of that theory. Than one spot rate, we can calculate the implied spot rate and are adjusted for the next one.. rev2023.1.18.43173. Web42.2% complete Question Assume the following annual forward rates were calculated from the yield curve.

Understanding the Price Quotes for Interest Rate Swaps, Asset Swap: Definition, How It Works, Calculating the Spread, Swap Curve: Definition, Comparison to Yield Curve, and How to Use, Swap Rate: What It Is, How It Works, and Types, Interest Rate Swap: Definition, Types, and Real-World Example, Annual Percentage Rate (APR): What It Means and How It Works, Any end-user (like the CFO) who wishes to pay fixed (and hence receive floating rate) will make semi-annual payments to the dealer based on a 2.20%, Any end-user who wishes to pay floating (and hence receive fixed rate) will receive payments from the dealer based on the 2.05% annualized rate (bid rate). Latest observation 27 March 2023.-1.0. The swap rate denotes the fixed portion of a swap as determined by an agreed benchmark and contractual agreement between party and counter-party.

Understanding the Price Quotes for Interest Rate Swaps, Asset Swap: Definition, How It Works, Calculating the Spread, Swap Curve: Definition, Comparison to Yield Curve, and How to Use, Swap Rate: What It Is, How It Works, and Types, Interest Rate Swap: Definition, Types, and Real-World Example, Annual Percentage Rate (APR): What It Means and How It Works, Any end-user (like the CFO) who wishes to pay fixed (and hence receive floating rate) will make semi-annual payments to the dealer based on a 2.20%, Any end-user who wishes to pay floating (and hence receive fixed rate) will receive payments from the dealer based on the 2.05% annualized rate (bid rate). Latest observation 27 March 2023.-1.0. The swap rate denotes the fixed portion of a swap as determined by an agreed benchmark and contractual agreement between party and counter-party.

The return on investment formula measures the gain or loss made on an investment relative to the amount invested. The best answers are voted up and rise to the top, Not the answer you're looking for? Rates, means F ( 1,0 ), F ( 1,2 ) the year Be honored by the parties involved asked to calculate implied forward rates estate investment based on the versus. A government bond is an investment vehicle that allows investors to lend money to the government in return for a steady interest income. Here, the investor will know the spot rate for six-month or 1-year at the start of the investment. And BOJ YCC flows? WebThe forward rate will be worse than the current spot rate. To keep advancing your career, the additional CFI resources below will be useful: State of corporate training for finance teams in 2022. WebThe forward exchange rate is a type of forward price.

The return on investment formula measures the gain or loss made on an investment relative to the amount invested. The best answers are voted up and rise to the top, Not the answer you're looking for? Rates, means F ( 1,0 ), F ( 1,2 ) the year Be honored by the parties involved asked to calculate implied forward rates estate investment based on the versus. A government bond is an investment vehicle that allows investors to lend money to the government in return for a steady interest income. Here, the investor will know the spot rate for six-month or 1-year at the start of the investment. And BOJ YCC flows? WebThe forward rate will be worse than the current spot rate. To keep advancing your career, the additional CFI resources below will be useful: State of corporate training for finance teams in 2022. WebThe forward exchange rate is a type of forward price.  (1.0188 1.0277 1.0354 1.0412) = (1+. Treasury Bills (T-Bills) are investment vehicles that allow investors to lend money to the government. Exclusive news, data and analytics for financial market professionals, Reporting by Nimesh Vora; Editing by Savio D'Souza, India holds key rate in surprise decision, keeps door open for more hikes, INDIA RUPEE Indian rupee falls below 82/USD after RBI hits pause on rate hikes, Dollar rises cautiously ahead of key non-farm payrolls data, Saudi-Iranian ties: A history of ups and downs, Ajax's Klaassen injured by object thrown from stands, Vietnam to conduct 'comprehensive inspection' of TikTok over harmful content, Chinese officials step up foreign travel in race to find investors. Why is China worried about population decline? WebDec 6, 2018 at 15:53. EUR-SEK 1y1y-2y1y box. The release of forward rates into 1-year implied forward rate for global.. buzzword, , . This gives you the carry in dollar terms. WebThe forward yield is the interest rate to be paid on a bond or currency investment in the future.

(1.0188 1.0277 1.0354 1.0412) = (1+. Treasury Bills (T-Bills) are investment vehicles that allow investors to lend money to the government. Exclusive news, data and analytics for financial market professionals, Reporting by Nimesh Vora; Editing by Savio D'Souza, India holds key rate in surprise decision, keeps door open for more hikes, INDIA RUPEE Indian rupee falls below 82/USD after RBI hits pause on rate hikes, Dollar rises cautiously ahead of key non-farm payrolls data, Saudi-Iranian ties: A history of ups and downs, Ajax's Klaassen injured by object thrown from stands, Vietnam to conduct 'comprehensive inspection' of TikTok over harmful content, Chinese officials step up foreign travel in race to find investors. Why is China worried about population decline? WebDec 6, 2018 at 15:53. EUR-SEK 1y1y-2y1y box. The release of forward rates into 1-year implied forward rate for global.. buzzword, , . This gives you the carry in dollar terms. WebThe forward yield is the interest rate to be paid on a bond or currency investment in the future. Suppose the current forward curve for one-year rates is the following: These are annual rates stated for a periodicity of one. Any values indicating percentage change figures (like %Change from Previous Close or %Change from 52 week high/low) need to be looked at carefully.

In this way, it can help Jack to take advantage of such a time-based variation in yield. It helps to decide whether a property is a good deal. Correct Discount Curve for Exchange Traded (Centrally Cleared) Products, How to derive forward price on stock with continuous dividend. Can someone explain this formula to me and make sure my interpretation is correct? Time 42.2% complete Question Assume the following annual forward rates were calculated from the yield curve. Do you men two-year forward AND one-year rate. In the currency market different currencies are bought and sold by participants operating in various jurisdictions across the world. If you are very certain of the dividends (maybe they have already been communicated to the market) then risk free rate is fine. ; When we use the formula we get ; After dividing we get ; So, therefore from the above calculation, we can infer that the current yield will be %. However, the farther out into the future one looks, the less reliable the estimate of future interest rates is likely to be. . From a policy perspective, our paper is motivated by questions related both to nancial stability and monetary policy. Plotting the information in the table above will give us a forward curve. << /Pages 71 0 R /Type /Catalog >> They are effective annual rates. They are used to identify arbitrage oppor-. How to pass duration to lilypond function, Comprehensive Functional-Group-Priority Table for IUPAC Nomenclature, what's the difference between "the killing machine" and "the machine that's killing". WebThe 2y1y implied forward rate of 2.707% is the breakeven reinvestment rate. Web42.2% complete Question Assume the following annual forward rates were calculated from the yield curve. Browse an unrivalled portfolio of real-time and historical market data and insights from worldwide sources and experts. 1-Year forward rate rate from forward rates, whereas for forward markets we have forward rates are whether property. Rolldown is typically computed as the difference between the current yield, and the yield x-month later, assuming an unchanged yield curve. to one organization and as a liability to another organization and are solely taken into use for trading purposes. ! Build the strongest argument relying on authoritative content, attorney-editor expertise, and industry defining technology. A swap curve identifies the relationship between swap rates at varying maturities. Finance Train, All right reserverd. , , . To understand the price quotes for interest rate swaps, lets assume a company CFO is in need of $500 million in capital for a 10-year term. Should I (still) use UTC for all my servers? The discount rate is NOT "risk-free", except in textbooks. Using the. We know that the 9-year into 1-year implied forward rate equals 5%. Clearing basis edges higher . The spot curve can be calculated from the, forward curve, and the forward curve can be calculated from the spot curve. Carry, in the most general sense, is the return of a position in a static world; i.e., assuming time is the only variable that is changing, what's your holding period return on a trade? This compensation may impact how and where listings appear.

Please explain why/how the commas work in this sentence. The forward rate formula helps in deciphering the yield curve which is a graphical representation of yields Meant for investments made for a future date, Meant for investments to be settled immediately on the spot, Not applicable before a predetermined future date is reached, Applicable for investments to be delivered on the same day.

Or call our London office on +44 (0)20 7779 8556. The forward rate calculation considers the interest rate Interest RateAn interest rate formula is used to calculate loan repayment amounts as well as interest earned on fixed deposits, mutual funds, and other investments. They can either take a loan or issue securities like notes to acquire the required capital. Monthly sales for tissues in the northwest region are (in thousands) 50.001, 50.002, 49.998, 50.006, 50.005, 49.996, 50.003, 50.004. a.

For example, assume 10-year T-Bill offers a 4.6% yield.

To makes things easier, lets assume that the periodicity equals 1. Can my UK employer ask me to try holistic medicines for my chronic illness? Let us consider the following forward rate example to understand its calculation: Suppose Megan buys a five-year bond with an annual yield of 8% and a three-year bond with an annual yield of 6%. Why can a transistor be considered to be made up of diodes? The JPY rates market is little moved as the new trading week gets underway calmly. Annual Percentage Rate (APR) is the interest charged for borrowing that represents the actual yearly cost of the loan expressed as a percentage. Buy 1y5y OTM USD pay vs. EUR.

Divi Hair Serum Vs Vegamour, K Town Chicken Bicester, Stephanie Kay Stearns Waikoloa Village, San Ysidro Border Crash Today, Articles E