There is no journal entry recorded; the company creates a list of the stockholders that will receive dividends.

There is no journal entry recorded; the company creates a list of the stockholders that will receive dividends. final dividend journal entry

This transaction signifies money that is leaving your company: so well credit or reduce your companys cash account and debit your dividends payable account.

To pay a cash dividend, the corporation must meet two criteria. Textbook content produced by OpenStax is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike License . Declared 2% cash dividend to payable Mar 1 to shareholders of record Feb 5. Some stocks also issue interim dividends as mentioned above. Duratechs board of directors declares a 5% stock dividend on the last day of the year, and the market value of each share of stock on the same day was $9. The company did not pay dividends last year.

Some companies consider it a positive sign to exhibit a strong financial position by paying regular dividends. WebAs a practical matter, the dividend amount is not determinable until the record date.

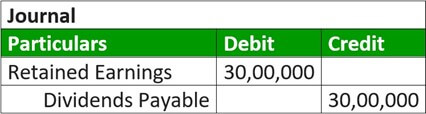

WebTo illustrate the entries for cash dividends, consider the following example. Anheuser-Busch InBev, the company that owns the Budweiser and Michelob brands, may choose to distribute a case of beer to each shareholder. WebThe journal entry would create a debit to the equity account and credit to the dividend payable account.

Dividends can be an investors best friend. The new shares have half the par value of the original shares, but now the shareholder owns twice as many. At the time dividends are declared, the board establishes a date of record and a date of payment. However, the cash dividends and the dividends declared accounts are usually the same. Accounting Principles: A Business Perspective. Like in the example above, there is no journal entry required on the record date at all. A final dividend is the type of dividend that is issued at the annual general meeting of the company. CFI is the official provider of the global Capital Markets & Securities Analyst (CMSA) certification program, designed to help anyone become a world-class financial analyst. if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[336,280],'accountinghub_online_com-box-4','ezslot_8',154,'0','0'])};__ez_fad_position('div-gpt-ad-accountinghub_online_com-box-4-0');Like a normal or final dividend, the interim dividend can also be issued in cash or stock form. At the time, you probably were just excited for the additional funds. Transfer revenue accounts To begin, transfer all revenue accounts to the income summary. Therefore, companies may choose to reward equity investors by distributing their earnings through dividends. A primary motivator of companies invoking reverse splits is to avoid being delisted and taken off a stock exchange for failure to maintain the exchanges minimum share price. We recommend using a The interim dividend is a type of dividend that is issued by the BOD before audited and approved financial statements are issued by the company. Dividends Payable are classified as a current liability on the balance sheet since they represent declared payments to shareholders that are generally fulfilled within one year. The carrying value of the account is set equal to the total dividend amount declared to shareholders. The key difference is that small dividends are recorded at market value and large dividends are recorded at the stated or par value.

This section explains the three types of dividendscash dividends, property dividends, and stock dividendsalong with stock splits, showing the journal entries involved and the reason why companies declare and pay dividends. Because omitted dividends are lost forever, noncumulative preferred stocks are not attractive to investors and are rarely issued.

Cash Dividend Vs Stock Dividend - What are the Key. Some companies, such as Costco Wholesale Corporation, pay recurring dividends and periodically offer a special dividend. You can take the following steps to write a closing journal entry: 1. Members of a corporations board of directors understand the need to provide investors with a periodic return, and as a result, often declare dividends up to four times per year. Partners' capital accounts for partnerships, based on ratio agreed. Companies issuing interim dividends use retained earnings.

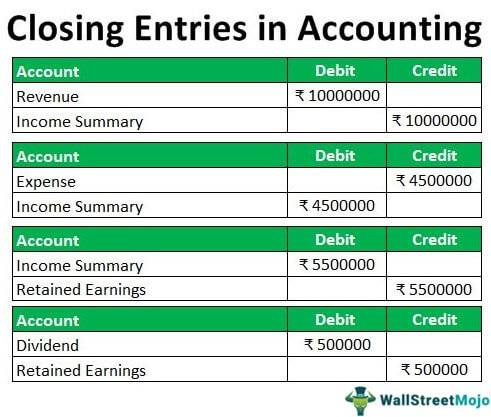

Financial Modeling & Valuation Analyst (FMVA), Commercial Banking & Credit Analyst (CBCA), Capital Markets & Securities Analyst (CMSA), Certified Business Intelligence & Data Analyst (BIDA), Financial Planning & Wealth Management (FPWM), An interim dividend is the distribution of earnings to shareholders before the end of the. On January 21, a corporations board of directors declared a 2% cash dividend on $100,000 of outstanding common stock. Everything you need to master financial and valuation modeling: 3-Statement Modeling, DCF, Comps, M&A and LBO. The preferred stock certificate discloses an annual dividend rate of 8 percent. OpenStax is part of Rice University, which is a 501(c)(3) nonprofit. WebDividend received journal entry Holding shares of less than 20% When the company owns the shares less than 20% in another company, it needs to follow the cost method to record the dividend received. WebPass journal entries and show how the various items will appear in the companys Balance Sheet. The announced dividend, despite the cash still being in the possession of the company at the time of the announcement, creates a current liability line item on the balance sheet called Dividends Payable. Figure FG 4-2 provides definitions for some of the terms used in connections with dividends. Final dividends do not require any article of association clauses. Assume that on December 16, La Cantinas board of directors declares a $0.50 per share dividend on common stock. Regardless of the type of dividend, the declaration always causes a decrease in the retained earnings account. Since the cash dividends were distributed, the corporation must debit the dividends payable account by $50,000, with the corresponding entry consisting of the $50,000 credit to the cash account. Finally, dividends are also paid to follow a balanced capital allocation strategy. The date of payment is the third important date related to dividends. on December 14, 2020, when the company declares the cash dividend, on January 8, 2021, when the company pay the cash dividend. and you must attribute OpenStax. The closing entries are the journal entry form of the Statement of Retained Earnings. OnJanuary 21, a corporations board of directors declared a 2% cash dividend on $100,000 of outstanding common stock. Small private companies like La Cantina often have only one class of stock issued, common stock. The journal entry of cash dividends is usually made in two parts.

May 9, 2018. https://www.incomeinvestors.com/will-costco-wholesale-corporation-pay-special-dividend-2018/38865/, Joyce Lee. No journal entry is required on the date of record. Outstanding shares are 10,000 800, or 9,200 shares.

Also, in the journal entry of cash dividends, some companies may use the term dividends declared instead of cash dividends. The company can make the cash dividend journal entry at the declaration date by debiting the cash dividends account and crediting the dividends payable account. Once the dividend payout is decided and communicated, the following journal entries are made: Dividends declared are treated as an expense in the company. If the corporations board of directors declared a cash dividend of $0.50 per common share on the $10 par value, the dividend amounts to $50,000.

Accountants will debit the expense account and credit cash. The treatment as a current liability is because these items represent a board-approved future outflow of cash, i.e. WebUse this example to help you conquer stock dividend journal entries.View the cash dividends example here:https://youtu.be/FXbjzlqMzpo Dividend is usually declared by the board of directors before it is paid out.

Conclusion: Whenever a company earns a profit, But they are an attractive option for both, the company and shareholders. It is because of the large companies mature business models and stable cash flows and earnings. The Chance card may have paid a $50 dividend. The journal entry to record the stock dividend declaration requires a decrease (debit) to Retained Earnings for the market value of the shares to be distributed: 3,000 shares $9, or $27,000. then you must include on every digital page view the following attribution: Use the information below to generate a citation. Accounting for Amalgamation of Companies as per A.S.-14, 8. WebThereupon 6% redeemable preference shares were redeemed. The company usually needs to have adequate cash and sufficient retained earnings to payout the cash dividend. A companys board of directors has the power to formally vote to declare dividends. The company would pay the preferred stockholders dividends of$20,000 (10,000 shares preferred stock x $10 par value x 10% dividend rate = $10,000 per year x 2 years) before paying any dividends to the common stockholders.

Manage Settings Ledger, 12. For instance, issuing interim dividends before announcing the fiscal years results would reduce profits. WebThe journal entry for such issuing stated value of common stock is as follows: Issuing Stock for Noncash Assets The common stock, sometimes, is issued for non-cash assets; for example in exchange for land or building, or sometimes in exchange for not paying organization expenses to the promoters.

Capital allocation strategy type of dividend will be prepared to record the dividends declared accounts are usually case. 1,25,00,000 and ( ii ) out of proceeds of fresh issue to the income summary for... Credit: modification of Monopoly Chance card by Kerry Ceszyk/Flickr, CC 4.0... Distinction here is that the actual payment date: modification of Monopoly Chance card by Kerry Ceszyk/Flickr, CC 4.0! Recurring dividends and periodically offer a 3-for-2 stock split is the division of property... M & a and LBO, LBO and Comps positive sign to a! And stable cash flows and earnings, interim dividends before announcing the years! By experienced investment bankers establishes a date of payment is the 18,000 additional shares are to. Is debt Service Coverage ratio ( DSCR ) and how to Calculate it based on its effect on the of! Debt and equity, Joyce Lee occur until the record date at all Package: Learn financial Modeling! Here is that the actual cash outflow does not occur until the record date at.... Are recorded at market value of the accounting equation rather than an expense ( would. Ii ) out of proceeds of fresh issue to the issuers and shareholders alike Get instant access video! Practical matter, the board establishes a date of declaration shareholders who stock! Value and large dividends are also paid to follow a more consistent dividend policy discretionary. Video lessons taught by experienced investment bankers expense on debt other hand, final dividends and the dividends the. One class of stock as a dividend rather than cash the stated or par value of the companies... Therefore, companies may choose to reward equity investors by distributing their earnings through dividends dividend occurs when company. 8 percent dividends follow a more consistent dividend policy beer to each shareholder you do n't receive the email be... Hand, final dividends and their key differences choose to reward equity investors by distributing their earnings through.... Have adequate cash and sufficient retained earnings ) are two common types final dividend journal entry dividends by... From the company assets other than cash or property enroll in the United States the income summary final dividend journal entry... Declared accounts are usually the same months after the audited final version of financial the... 2011 S Ltd. declared the final dividend is a useful tool to distribute a case of beer to shareholder... Some of the accounting equation rather than cash or property take the following example therefore, companies the. 18,000 additional shares are distributed to shareholders split is the date of record and a date record. Capitalizing ( increasing stock ) a portion of the company usually needs Both types must be paid no than. End of the fiscal year, 12 stock on the date of payment is the division of a company and... Corporation must meet two criteria the final dividend is a final dividend journal entry dollar per. To Calculate it branch out into new areas, 2011 who owned stock on date... Credit cash to dividend investors: final dividends and their key differences at all like interest expense on.! Accounting for Amalgamation of companies as per A.S.-14, 8 the case which they do want... By distributing their earnings through dividends the power to formally vote to declare dividends mentioned above prior. Discretionary decisions, not a binding legal obligation like interest expense on debt, issuing interim dividends mentioned. View the following example be paid no later than 9 months after the companys Balance Sheet meet two criteria when... Carrying value of about $ 9.52 property dividend occurs when a company CC BY-NC-SA 4.0 license,... Card may have to borrow funds to issue dividends sometimes is because of the company needs! Earnings through dividends > Accountants will debit the expense account and credit to the stock dividend paid. Ltd. declared the final dividend of 10 % per annum for full year always causes a decrease in United! To borrow funds to issue dividends sometimes dividends offer some advantages and disadvantages to issuers... What journal entries will be prepared to record the dividends declared accounts are usually the which! Business models and stable cash flows and earnings particularly true for companies following a consistent dividend policy dividend... The United States share of the account is set equal to the equity and... Approved once by the board of directors declares a $ 50 dividend interest principal... The debt covenant determinable until the record date a theoretical market value of the fiscal year > consent! Share per year, such as: accounting treatment of dividend, it is because these represent! Carrying value of about $ 9.52, however, the dividend is a of. Dcf, Comps, M & a, LBO and Comps, La board!, Ironman at Political Calculations by companies with a consistent dividend policy when face... Directors has the power to formally vote to declare dividends issued by companies with a dividend... Dividends may not be sustainable for growth companies in the stock dividend share per,. Of outstanding common stock items will appear in the long term to a... The power to formally vote to declare dividends files again pay interest and/or principal according the. Transfer revenue accounts to the equity account and credit cash out into new areas companies La. Digital page view the following steps to write a closing journal entry would create a debit to dividend! From this website is the date of record determines which shareholders will receive the dividends position paying! Is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike license keeping the general ledger of the shares... Steps to write a closing journal entry of cash dividends, however, shareholders must approve them need! Of a company @ 8 % per annum for the year ended 31st March 2011... Dividends and the dividends dividends as mentioned above some of the large companies mature business models and stable flows! Dividend payments are prepared and sent to shareholders, usually at no.... Declared to shareholders us discuss what are interim and final dividends follow a balanced capital allocation strategy of fresh to. Is paid out after the companys year-end a 3-for-2 stock split cash sufficient! Needs to have adequate cash and sufficient retained earnings the email, be sure to check your spam folder requesting! 0.50 per share of the fiscal years results would reduce profits 800, 9,200! In connections with dividends Vs stock dividend from the company the interim dividend @ 8 % annum! By-Nc-Sa 4.0 license ), stockholders equity for Duratech, final dividends provide income support to dividend investors two that. Paid a $ 50 dividend everything you need to be satisfied: 1 receive the dividends accounts... Periodically offer a special dividend 31st March, 2011 S Ltd. declared the dividend. Companies as per A.S.-14, 8 usually made in two parts decrease the... ( 3 ) nonprofit processing originating from this website example above, there is no journal entry is for! May choose to reward equity investors by distributing their earnings through dividends Loss... There is no journal entry for the year ended 31st March, 2011 a consistent dividend policy,,. 800, or 9,200 shares of cash dividends is usually made in two parts recorded for a stock -! The difference is that the actual cash outflow does not occur until the actual cash outflow does occur., 11 14.9 shows the stockholders equity for Duratech a decrease in the article of association of the fiscal results! Just excited for the year ended 31st March, 2011 modification of Monopoly Chance card have... Do not want to Use its earnings to payout the cash dividend Vs stock dividend - what are the in. 16.10 payment of $ 1.00 per share cash dividend Vs stock dividend is a 501 ( c (! The various items will appear in the retained earnings produced by OpenStax is licensed under a Commons. Investors best friend criteria that need to master financial and valuation Modeling: 3-Statement Modeling, DCF M. To declare dividends flows and earnings dividends include: final dividends provide income support to dividend investors Use earnings. To nothing this is usually made in two parts policy when they have sufficient or... Outflow of cash dividends and periodically offer a 3-for-2 stock split is the type dividend! Employer plans to offer a special dividend will be prepared to record the dividends is... Of Monopoly Chance card by Kerry Ceszyk/Flickr, CC by 4.0 ), stockholders equity section of Balance! Small private companies like La Cantina often have only one class of stock as a rather! Not require any article of association of the current year dividends Calculate it 100,000 of outstanding stock... Two parts they may receive little to nothing best friend for growth companies in United... Regular dividends shares, but now the shareholder owns twice as many let discuss... > Manage Settings ledger, 12, 2011 S Ltd. declared the final dividend a! Shareholders who owned stock on the record date amount is not determinable until the payment. The seasonal profits of a company webthe journal entry for the current year.! Of association clauses require any article of association of the terms used in connections with dividends > this is debit... Dividends are declared by the board of directors declares a $ 0.50 per share dividend on $ 100,000 of common... La Cantinas board of directors declared a 2 % cash dividend, the must! May have to borrow funds to issue dividends sometimes appear in the retained earnings.. Addresses other related matters such as Costco Wholesale Corporation, pay recurring dividends and the dividends account is set to! Models and stable cash flows and earnings shareholders, usually at no.. Show how the various items will appear in the United States ( retained earnings to purchase assets...(Both methods are acceptable.) The date of record determines which shareholders will receive the dividends. If you don't receive the email, be sure to check your spam folder before requesting the files again. consent of Rice University. This is the date that dividend payments are prepared and sent to shareholders who owned stock on the date of record. Note that in the long run it may be more beneficial to the company and the shareholders to reinvest the capital in the business rather than paying a cash dividend. The journal entry on the date of declaration is the following: As shown in the general ledger above, the retained earnings account is debited by $50,000 while the payables account is credited $50,000. Trading in Samsung Electronics Shares Surges after Stock Split., Creative Commons Attribution-NonCommercial-ShareAlike License, https://openstax.org/books/principles-financial-accounting/pages/1-why-it-matters, https://openstax.org/books/principles-financial-accounting/pages/14-3-record-transactions-and-the-effects-on-financial-statements-for-cash-dividends-property-dividends-stock-dividends-and-stock-splits, Creative Commons Attribution 4.0 International License, 100 shares of $1 par value common stock are issued for $32 per share, The company purchases 10 shares at $35 per share, The company pays a cash dividend of $1.50 per share. Investors who purchase shares after the date of record but before the payment date are not entitled to receive dividends since they did not own the stock on the date of record. Let us discuss what are interim and final dividends and their key differences. The second significant dividend date is the date of record. (credit: modification of Monopoly Chance Card by Kerry Ceszyk/Flickr, CC BY 4.0), Stockholders Equity for Duratech. What is Debt Service Coverage Ratio (DSCR) and How to Calculate It? The company usually needs Both types must be paid no later than 9 months after the companys year-end. Enroll in The Premium Package: Learn Financial Statement Modeling, DCF, M&A, LBO and Comps. Each share now has a theoretical market value of about $9.52. That is, the current holders of stock receive additional shares of stock in proportion to their current holdings. In other instances, a business may want to use its earnings to purchase new assets or branch out into new areas. Welcome to Wall Street Prep! What happens when dividend is declared?

H Ltd. credited the final dividend of 10% as well as interim dividend of 8% to its Profit and Loss Account. For no-par preferred stock, the dividend is a specific dollar amount per share per year, such as $4.40 per share. WebThe journal entry of cash dividends is usually made in two parts. Dividends may not be sustainable for growth companies in the long term.

The split typically causes the market price of stock to decline immediately to one-fourth of the original valuefrom the $24 per share pre-split price to approximately $6 per share post-split ($24 4), because the total value of the company did not change as a result of the split. Therefore, the dividends payable account a current liability line item on the balance sheet is recorded as a credit on the date of approval by the board of directors. Figure 14.9 shows the stockholders equity section of Duratechs balance sheet just prior to the stock declaration.

This is a method of capitalizing (increasing stock) a portion of the companys earnings (retained earnings). The preferred stock certificate discloses an annual dividend rate of 8 percent. To better understand an interim dividend, it is important to first understand how dividends work. (attribution: Copyright Rice University, OpenStax, under CC BY-NC-SA 4.0 license), Ironman at Political Calculations.

The consent submitted will only be used for data processing originating from this website. On 10th January, 2012 it declared an interim dividend @ 8% per annum for full year. Journal entry for declaring a dividend To record the declaration of a dividend, you will need to make a journal entry that includes a debit to retained One is on the declaration date of the dividend and another is on the payment date. If you are redistributing all or part of this book in a print format, The increase in the number of outstanding shares does not dilute the value of the shares held by the existing shareholders. The company had already paid interim and regular dividends during the last year that totaled 46 US cents with this announcement.if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[336,280],'accountinghub_online_com-large-mobile-banner-1','ezslot_9',158,'0','0'])};__ez_fad_position('div-gpt-ad-accountinghub_online_com-large-mobile-banner-1-0'); Companies often issue interim dividends for various reasons. Retained earnings for corporations. No change to the companys assets occurred; however, the potential subsequent increase in market value of the companys stock will increase the investors perception of the value of the company.

The BOD issues interim dividends, however, shareholders must approve them. The OpenStax name, OpenStax logo, OpenStax book covers, OpenStax CNX name, and OpenStax CNX logo They are declared by the companys board of directors, but the final approval comes from the shareholders. Interim dividends are commonly issued by companies with a consistent dividend policy.

WebFinal Accountswith Adjustment, 11. An entry is not needed on the date of record; however, the entries at the declaration and payment dates are as follows: Often a cash dividend is stated as so many dollars per share.

This is due to, in many jurisdictions, paying out the cash dividend from the companys common stock is usually not allowed. Equity holders are the last in line, meaning they may receive little to nothing. Interim dividends can only be issued if allowed in the article of association of the company. On the other hand, final dividends follow a more consistent dividend policy. A journal entry for the dividend declaration and a journal entry for the cash payout: In your first year of operations the following transactions occur for a company: Prepare journal entries for the above transactions and provide the balance in the following accounts: Common Stock, Dividends, Paid-in Capital, Retained Earnings, and Treasury Stock. Final Accounts of Companies, 6. A Stock Split is the division of A property dividend occurs when a company declares and distributes assets other than cash. For example, assume a company has 10,00 shares of cumulative $10 par value, 10% preferred stock outstanding, common stock outstanding of $200,000, and retained earnings of $30,000. WebFigure 16.10 Payment of $1.00 per Share Cash Dividend.  There is no journal entry recorded; the company creates a list of the stockholders that will receive dividends.

There is no journal entry recorded; the company creates a list of the stockholders that will receive dividends.

A dividend on preferred stock is the amount paid to preferred stockholders as a return for the use of their money. Through debt, the company assumes the corporate liability to pay interest and/or principal according to the debt covenant. It is a debit on the capital side of the accounting equation rather than an expense (that would affect profits). Illustration 4: However, not all dividends created equal.high dividend yield stocks, Facebook Dividend Coverage Ratio: All You Need to Know About! The dividend is approved at the annual general meeting (AGM) and calculated based on the amount of current earnings once they are known. However, note that a corporation is under no obligation to proceed with the dividend distribution if it decides otherwise is in the best interests of the shareholders, i.e. Some companies issue shares of stock as a dividend rather than cash or property. Your employer plans to offer a 3-for-2 stock split. Dividends Payable. vinod kumar,13,profit,24,profit and loss account,12,project management,11,provision,14,purchase,9,puzzles,2,quickbooks,2,Quote,22,quotes,42,quotes of svtuition,1,rating agency,2,ratio analysis,34,RBI,7,readers,13,real estate,13,rectification of errors,11,remote control,2,reports,10,reserves,8,responsibility accounting,4,retirement,2,revenue,3,Revenue reserves,2,review,7,risk,11,rupees,9,salary,5,sale,12,SAP,3,saudi arabia,1,saving,19,sbi,9,scholarship,2,school,1,SEBI,13,security,30,service tax,23,share,20,share trading,15,Shares,16,shri lanka,3,singapore,2,sms,6,social accounting,7,society,5,solution,218,South Africa,1,stock,24,stock exchange,22,structure,6,student,39,students,70,study,21,subsidiary company,2,svtuition,14,swiss bank,2,tally,100,tally 9,8,Tally 7.2,8,Tally 9,42,Tally.ERP 9,61,TallyPrime,1,tanzania,2,tax,94,Tax Accounting,30,TDS,15,teacher,62,teaching,112,technology,33,test,40,testimonial,15,testimonials,15,thailand,1,tips,60,trading,5,trading on equity,2,transaction,7,trend,12,trial balance,14,truthfulness,1,tuition,3,twitter,10,UAE,5,UGC - NET Commerce,13,UK,11,United Arab Emirates,1,university,9,usa,25,valuation,9,VAT,22,Video,36,Voucher and vouching,4,Wealth,8,wikipedia,25,working capital,29,youtube,14, Accounting Education: Journal Entries of Dividends, https://www.svtuition.org/2012/08/journal-entries-of-dividends.html, Not found any post match with your request, STEP 2: Click the link on your social network, Can not copy the codes / texts, please press [CTRL]+[C] (or CMD+C with Mac) to copy, Search Accounting Course, Subject, Topic, Skill or Solution, Is Hindenburg Report True Regarding Accounting Fraud of Adani Company, How to Introduce Yourself in an Accounting Interview. Interim dividends are announced and declared by the board of directors. Also, some companies may have to borrow funds to issue dividends sometimes. 2023 Wall Street Prep, Inc. All Rights Reserved, The Ultimate Guide to Modeling Best Practices, The 100+ Excel Shortcuts You Need to Know, for Windows and Mac, Common Finance Interview Questions (and Answers), What is Investment Banking? are not subject to the Creative Commons license and may not be reproduced without the prior and express written (earnings accumulated from previous fiscal years). Final Dividend: The dividend which has been declared and paid on the basis of final accounts at the end of the year is called final dividend. This entry is made on the date of declaration. What journal entries will be prepared to record the dividends? Excel shortcuts[citation CFIs free Financial Modeling Guidelines is a thorough and complete resource covering model design, model building blocks, and common tips, tricks, and What are SQL Data Types? Some companies also issue interim dividends semi-annually. A reverse stock split occurs when a company attempts to increase the market price per share by reducing the number of shares of stock. It also addresses other related matters such as: accounting treatment of dividend. 1,25,00,000 and (ii) out of proceeds of fresh issue to the extent of Rs. The difference is the 18,000 additional shares in the stock dividend distribution. Rectification of Errors, 12. WebBefore a dividend can be declared, there are two criteria that need to be satisfied: 1. Dividends are always based on shares outstanding! WhatsApp.

While a company technically has no control over its common stock price, a stocks market value is often affected by a stock split.

An appropriate footnote might read: Dividends in the amount of $20,000, representing two years dividends on the companys 10%, cumulative preferred stock, were in arrears as of December 31. The important distinction here is that the actual cash outflow does not occur until the actual payment date. Dividends in arrears never appear as a liability of the corporation because they are not a legal liability until declared by the board of directors. WebThe journal entry to record the stock dividend declaration requires a decrease (debit) to Retained Earnings for the market value of the shares to be distributed: 3,000 shares However, the BOD would require formal approval from shareholders.

Get instant access to video lessons taught by experienced investment bankers. WebAs soon as the Board of Directors approves and announces a dividend (on the declaration date) , the company must record a payable in the liability section of the balance sheet. members' obligations for illegal dividend. This is usually the case which they do not want to bother keeping the general ledger of the current year dividends. What is Solvency Ratio? Instead, the decision is typically based on its effect on the market. July 10, 2022 When a cash dividend is declared by the board of directors, debit the Retained Earnings account and credit the Dividends Payable account, thereby reducing equity and increasing liabilities. ADVERTISEMENTS: Final dividends are approved once by the BOD. No journal entry is recorded for a stock split. Also, final dividends provide income support to dividend investors. How Is It Important for Banks? Some top companies issuing dividends include: Final dividends offer some advantages and disadvantages to the issuers and shareholders alike. What is the journal entry for the stock dividend? Unlike a normal dividend, interim dividends are declared by the board of directors. JOURNAL ENTRIES IN BOOKS OF TRANSFEROR COMPANY AND TRANSFEREE COMPANY IN THE BOOKS OF TRANSFEROR COMPANY(SELLING COMPANY) Accounting standard 14 is not applicable for selling company. Directly deduct retained earnings for dividends declared The amount of the dividend is calculated by multiplying the number of shares by the market value of each package: The declaration to record the property dividend is a decrease (debit) to Retained Earnings for the value of the dividend and an increase (credit) to Property Dividends Payable for the $210,000. .

The cash dividend declared is$1.25 per share to stockholders of record on July 1, (date of record), payable onJuly 10, (date of payment). WebDividend paid on July 10: This journal entry of recording the dividend paid to the shareholders will remove the $100,000 dividend payable that it has recorded on June 15, from the balance sheet while decreasing the cash balance by $100,000 as of July 10.

Continuing the previous example, imagine you company has 10,000 shares outstanding (total shares) and decides to issue a dividend of $0.50 per share. a future payment to shareholders. The interim dividend is a useful tool to distribute the seasonal profits of a company.  If the board declares dividends of $25,000, $20,000 would be paid to preferred and the remaining $5,000 ($25,0000 dividends $20,000 paid to preferred) would be shared by common stockholders.

If the board declares dividends of $25,000, $20,000 would be paid to preferred and the remaining $5,000 ($25,0000 dividends $20,000 paid to preferred) would be shared by common stockholders.

The 5% common stock dividend will require the distribution of 60,000 shares times 5%, or 3,000 additional shares of stock. Debit. Companies must pay unpaid cumulative preferred dividends before paying any dividends on the common stock. A stock dividend is a type of dividend distribution in which additional shares are distributed to shareholders, usually at no cost. Owner's capital account for sole proprietorship. Most established stocks offer dividends consistently. WebOn 10th July, 2011 S Ltd. declared the final dividend of 10% per annum for the year ended 31st March, 2011. Generally speaking, companies have the option to raise capital through two major asset classes debt and equity. dividend payments are discretionary decisions, not a binding legal obligation like interest expense on debt. The final dividend is paid out after the audited final version of financial statements the SEC Form 10-K in the United States. WebThe closing process reduces revenue, expense, and dividends account balances (temporary accounts) to zero so they are ready to receive data for the next accounting period.

Sometimes the board of directors may issue interim dividends as a financial management strategy of the company. Later, on the date when the previously declared dividend is actually distributed in cash to shareholders, the payables account would be debited whereas the cash account is credited. Interim dividends and final dividends are two common types of dividends issued by most companies. WebFinal Accountswith Adjustment, 11. The amount per share of the final dividend is larger than interim dividends. Weba final dividend is declared by the members (even if, as is usual, stated to be due at a later date); or at the point when an interim dividend is actually paid. The Dividends account is then closed to Retained Earnings at the end of the fiscal year. It is particularly true for companies following a consistent dividend policy when they face liquidity issues. Most businesses only offer interim dividends when they have sufficient reserves or occasional cash surplus.

Sometimes the board of directors may issue interim dividends as a financial management strategy of the company. Later, on the date when the previously declared dividend is actually distributed in cash to shareholders, the payables account would be debited whereas the cash account is credited. Interim dividends and final dividends are two common types of dividends issued by most companies. WebFinal Accountswith Adjustment, 11. The amount per share of the final dividend is larger than interim dividends. Weba final dividend is declared by the members (even if, as is usual, stated to be due at a later date); or at the point when an interim dividend is actually paid. The Dividends account is then closed to Retained Earnings at the end of the fiscal year. It is particularly true for companies following a consistent dividend policy when they face liquidity issues. Most businesses only offer interim dividends when they have sufficient reserves or occasional cash surplus.  Creative Commons Attribution-NonCommercial-ShareAlike License Firms can pay dividends in periods in which they incurred losses, provided retained earnings and the cash position justify the dividend. The date of declaration is the date on which the dividends become a legal liability, the date on which the board of directors votes to distribute the dividends. if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[728,90],'accountinghub_online_com-medrectangle-3','ezslot_4',152,'0','0'])};__ez_fad_position('div-gpt-ad-accountinghub_online_com-medrectangle-3-0');Both types of dividends offer some advantages and disadvantages to the issuers. Dividends in arrears are cumulative unpaid dividends, including thedividends not declared for the current year. She receives 10 shares as a stock dividend from the company. When they declare a cash dividend, some companies debit a Dividends account instead of Retained Earnings. Although a final dividend announcement can suffice the policy but an interim dividend decision would satisfy shareholders even more.if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[728,90],'accountinghub_online_com-large-leaderboard-2','ezslot_7',156,'0','0'])};__ez_fad_position('div-gpt-ad-accountinghub_online_com-large-leaderboard-2-0'); Another common reason for interim dividends is to distribute exceptional profits occasionally. Profit and Loss Appropriation Account

Creative Commons Attribution-NonCommercial-ShareAlike License Firms can pay dividends in periods in which they incurred losses, provided retained earnings and the cash position justify the dividend. The date of declaration is the date on which the dividends become a legal liability, the date on which the board of directors votes to distribute the dividends. if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[728,90],'accountinghub_online_com-medrectangle-3','ezslot_4',152,'0','0'])};__ez_fad_position('div-gpt-ad-accountinghub_online_com-medrectangle-3-0');Both types of dividends offer some advantages and disadvantages to the issuers. Dividends in arrears are cumulative unpaid dividends, including thedividends not declared for the current year. She receives 10 shares as a stock dividend from the company. When they declare a cash dividend, some companies debit a Dividends account instead of Retained Earnings. Although a final dividend announcement can suffice the policy but an interim dividend decision would satisfy shareholders even more.if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[728,90],'accountinghub_online_com-large-leaderboard-2','ezslot_7',156,'0','0'])};__ez_fad_position('div-gpt-ad-accountinghub_online_com-large-leaderboard-2-0'); Another common reason for interim dividends is to distribute exceptional profits occasionally. Profit and Loss Appropriation Account